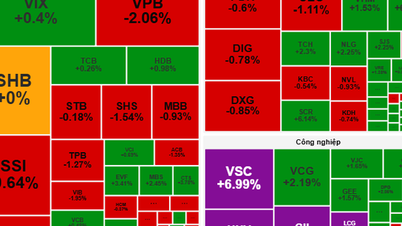

Last week, the Vietnamese stock market did not have a big change in terms of points, but there was a big change in the appetite of speculative money. The VN-Index almost went sideways last week when the group of bank stocks faced short-term profit-taking pressure. The money flow was sucked into the group of bank stocks, causing other groups of stocks to fall into a state where when bank stocks increased, they only increased slightly, and when bank stocks adjusted, they decreased more.

Cash flow appears to be strict in selecting leading stocks, as most trading sessions are strongly active in the banking group and "abandoning" other traditional groups such as securities, steel, real estate, etc.

According to data compiled by DSC Securities Company, the current cash flow is most concentrated in the large-cap group (VN30) and creates a huge gap compared to the cash flow in the remaining two groups: mid-cap (VNMidcap) and small-cap (VNSmallcap). This development may make most investors unhappy, especially those who "missed the wave" of banking, but overall, this is a common manifestation of a sustainable and orderly "wave" of growth.

According to observations, cash flow into the banking group often creates strong and sustainable waves of increase. However, unlike the group of speculative stocks, cash flow is difficult to make waves in the banking group as well as the stocks that stand for a long time because the number of stocks in these groups is quite large, consuming a lot of resources. Therefore, there will be adjustments for this group of stocks to cool down, and cash flow has the opportunity to move to groups of stocks that have not increased or have more attractive valuations.

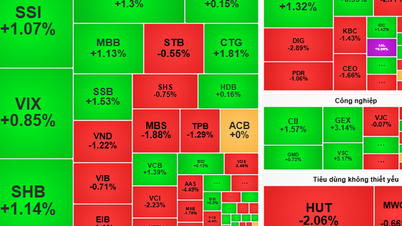

Many experts predict that in the coming sessions, large-cap stocks, especially banks, will still be the support to help VN30 increase points. If it overcomes the resistance at 1,168 points, VN30 will lead VN-Index to extend its increase to the 1,190-1,195 point range. However, the increase next week may experience continuous fluctuations because banking stocks may be under high profit-taking pressure and cash flow may be differentiated among stock groups.

Experts from DSC Securities Company maintain a positive view on the market trend in the first quarter of 2024 and believe that the market still has room to increase. Because up to now, the VN-Index has not increased long enough and much enough like the movement of a standard "wave" of increase, meaning the market has not reached a state of "tense" optimistic psychology to be considered a dangerous zone. Only when the market suddenly appears bad news will the increase be at risk of being broken sooner than expected. In the short term, the slow spread of cash flow accompanied by alternating market fluctuations can keep the VN-Index in the 1,140 - 1,170 point range longer.

From a short-term perspective, experts from SHS Securities Company said the market is moving positively but the increase has slowed down and fluctuated within a narrow range. The VN-Index has also tested the support level of 1,150 points and may continue to fluctuate, and it is not yet possible to determine whether this support test will be successful or not.

With the momentum of movement on a good short-term accumulation platform, experts of SHS Securities Company still expect a successful scenario and the index will enter the expected medium-term accumulation area.

Source

Comment (0)