From a member of a group managing $548 billion in assets

Introduced on its website, Mirae Asset Securities Joint Stock Company (Vietnam) is a member of Mirae Asset Financial Group. This group was established in Korea and is expanding to 17 countries. Total assets under management (as of March 2023) are about 548 billion USD.

Meanwhile, Mirae Asset Securities Joint Stock Company (Vietnam) was established in December 2007 in District 1, Ho Chi Minh City. Initially, this enterprise was called Mirae Asset Securities Joint Stock Company, with a charter capital of 300 billion VND.

In 2015, the State Securities Commission (SSC) approved the share transfer transaction so that Mirae Asset Wealth Management (HK) Limited could own the entire charter capital of the company. At the same time, the SSC approved the conversion of the securities company's business type into a single-member limited liability company. Therefore, Mirae Asset (Vietnam) is one of the first 100% foreign-owned securities companies in Vietnam.

Since 2015, with the support of Mirae Asset Financial Group, Mirae Asset Securities has increased its capital 5 times, bringing its charter capital from VND 300 billion to VND 6,590.5 billion as of November 2021.

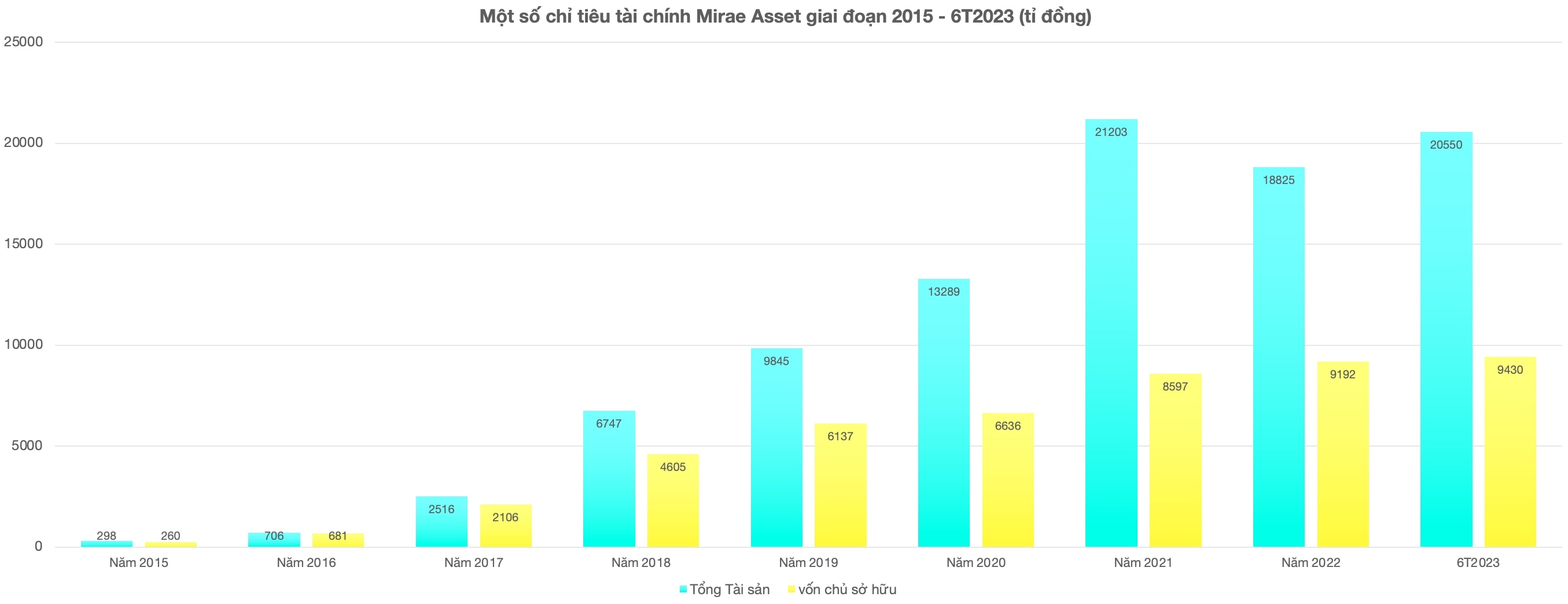

Along with the rapid capital growth, Mirae Asset Securities' assets have also made great leaps since 2015.

Specifically, at the end of 2015, Mirae Asset Securities' total assets reached VND 298 billion. However, one year later, total assets increased to VND 706 billion, equivalent to an increase of 257% after only 12 months. The growth momentum of Mirae Asset Securities' assets remained strong in the following years. According to the financial report for the first 6 months of 2023, as of June 30, 2023, the total assets of this securities company reached more than VND 20,550 billion.

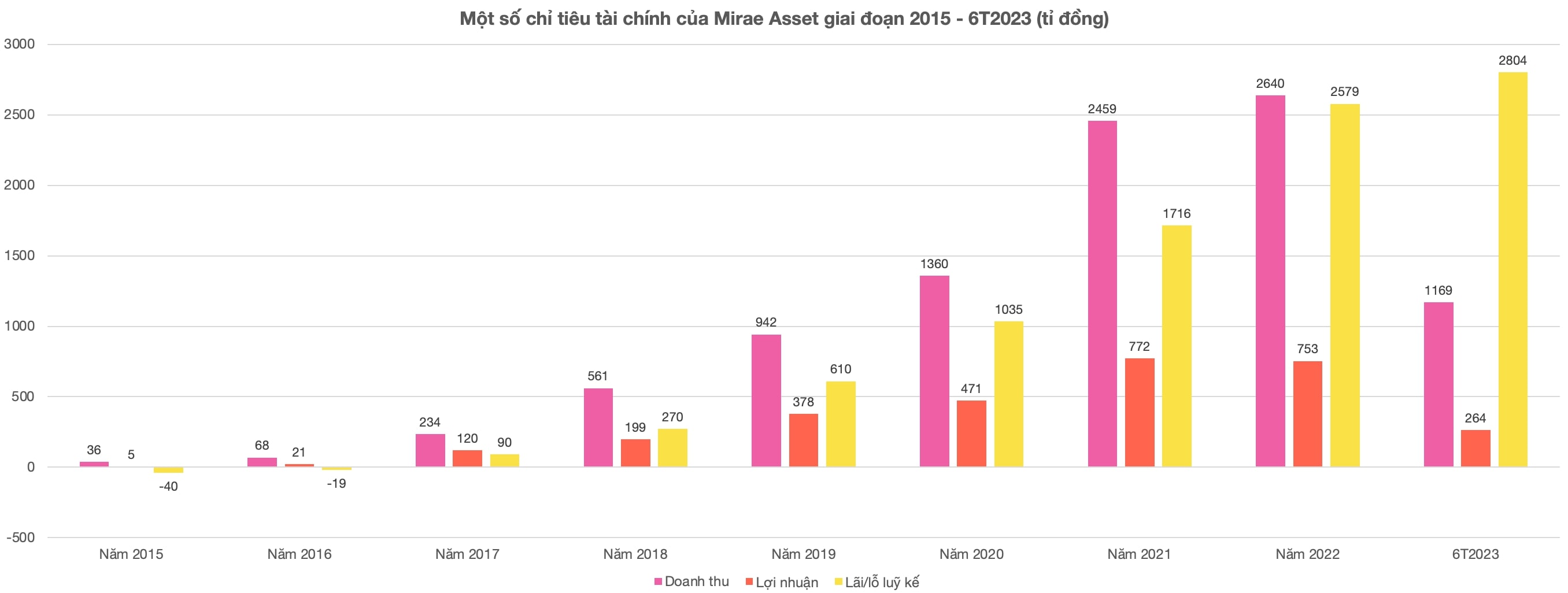

Similarly, Mirae Asset Securities’ revenue and profit also increased by large amounts. At the end of 2015, operating revenue only reached 36 billion VND, profit after tax was nearly 5 billion VND. At that time, the company had accumulated losses of nearly 40 billion VND.

7 years later, by the end of 2022, Mirae Asset Securities' total operating revenue had reached VND 2,640 billion, with after-tax profit reaching nearly VND 753 billion. As of June 30, 2023, undistributed after-tax profit reached VND 2,805 billion.

To fundamental violations that cause loss of trust and affect transparency

These figures show that since being acquired by Mirae Asset Financial Group, Mirae Asset Securities has had significant growth. However, recently, this unit was fined 112.5 million VND by the State Securities Commission for violating regulations on receiving and executing customer trading orders.

Specifically, Mirae Asset received and placed orders for the sale of shares of Lizen Joint Stock Company (code LCG) of Mr. Nguyen Van Nghia from June 8, 2023 to June 16, 2023. However, this unit made a transaction to buy 20,000 LCG shares on June 9. After that, it continued to sell in excess of the customer's registered trading volume.

Speaking with Lao Dong, lawyer Mai Thao - Deputy Director of TAT Law Firm - said that the "wrong" order placed by Mirae Asset Securities caused damage to customers and affected the stock market.

The issue of public concern is that after Mirae Asset is handled for the above violations, what will be the solution for investors to ensure their legitimate rights?

Answering this question, lawyer Mai Thao cited Clause 1, Article 33 of Circular 119/2020/TT-BTC regulating the correction of errors after securities transactions performed by the Vietnam Securities Depository and Clearing Corporation: "The Vietnam Securities Depository and Clearing Corporation shall correct errors after transactions in cases where clearing members are securities companies that mistakenly place or place incorrect customer orders such as: incorrect customer account number, incorrect securities code, incorrect price level, excess orders, mistakenly placing buy orders as sell orders and vice versa, incorrect quantity of securities...".

According to lawyer Phung Lan (Nam Thai International Law Company Limited), when investors discover a mistake by a securities company, they need to immediately report it to the securities company so that they can promptly handle, cancel orders or correct errors after securities transactions.

In case an investor has reason to believe that a securities company intentionally placed a wrong trading order, or intentionally failed to handle a wrong order, causing damage to the investor, or to gain illegal profits, it is necessary to notify the State Securities Commission and relevant authorities, and the police investigation agency to intervene to handle the violation.

"The above incident shows that the state agencies must closely and promptly supervise securities activities. Therefore, securities companies need to be careful when conducting securities transactions, strictly comply with the Securities Law and its guiding documents to avoid violations of the law in the securities field. This will cause customers to lose confidence and more or less affect the transparency and reputation of the Vietnamese securities market," emphasized lawyer Mai Thao.

Source

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)