Mr. Pham Anh Tuan - Director of Payment Department, State Bank of Vietnam

Cross-border payments: An inevitable trend in the digital age

At the workshop "Cross-border payments and online loans: Digital utilities for business and consumption", Mr. Pham Anh Tuan - Director of the Payment Department, State Bank of Vietnam affirmed that cross-border payment connection is an inevitable requirement in the context of integration. To promote, it is necessary to synchronize technical infrastructure, perfect the legal corridor, strengthen inter-sectoral coordination and expand international cooperation.

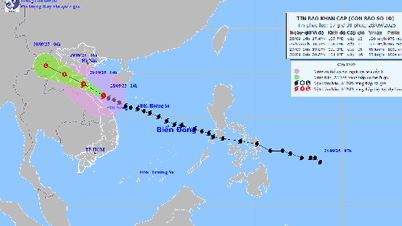

The State Bank of Vietnam has implemented a policy of cross-border QR payments. Vietnamese people traveling to Thailand can pay by QR like domestically, with competitive exchange rates; from September 2025, some units in China will also start accepting QR payments. By 2026, the State Bank of Vietnam plans to complete bilateral payment projects with India, Malaysia, Singapore, etc.

According to Ms. Le Thi Thuy Ha - Director of Digital Lending Project, MBBank , with QR, customers only need a phone connected to the internet to make payments, which is convenient and costs less than international cards. Mr. Nguyen Hoang Long - Deputy General Director of NAPAS, emphasized that the rapid changes in the market are causing traditional payment models to gradually lose their advantages. Cross-border payment connections not only serve tourism, services and digital commerce but also help the domestic payment system become more autonomous, reduce international dependence and enhance the position of Vietnamese currency.

In the opposite direction, stores, even small ones, can also serve international tourists via cross-border QR – fast, safe and convenient.

Mr. Nguyen Hoang Long - Deputy General Director of Vietnam National Payment Joint Stock Company (NAPAS)

Online lending – a driver for financial inclusion

Mr. Pham Anh Tuan said that online lending is an important indicator in the digital banking transformation roadmap, helping customers access capital more conveniently. The State Bank of Vietnam has issued Circular 06/2023/TT-NHNN (amending Circular 39/2016/TT-NHNN), along with Decree 94/2025/ND-CP of the Government , allowing for the first time the implementation of the peer-to-peer lending (P2P lending) model within the framework of controlled testing.

In this context, data security becomes a key requirement. Mr. Tuan emphasized the need to invest in security infrastructure, apply AI monitoring, perfect the legal framework for protecting personal data, share network intelligence information and periodically train employees to build trust among users.

Ms. Le Thi Thuy Ha said that MBBank has achieved many outstanding results: more than 33 million customers opened online accounts using eKYC; 100% of unsecured loans and 90.8% of production and business loans have been disbursed online, with cumulative sales of more than 165 trillion VND in just the first 8 months of 2025. eKYC technology and digital signature help the loan process at MB take only a few minutes from identification to disbursement.

Ms. Nguyen Thi Ngoan - Chief Financial Officer of MISA Group, CEO of JETPAY, analyzed that online loans help small and medium-sized enterprises overcome traditional document barriers, disburse within 24 hours, do not require collateral but are based on digital data. In 2024, the limit will reach 6,721 billion VND, disbursed 8,686 billion VND; by August 2025, this number has increased to 7,634 billion VND and 11,875 billion VND, with a loan success rate 10 times higher than traditional.

Ms. Ngoan recommended that the State Bank of Vietnam soon deploy a P2P sandbox, allowing platforms such as MISA Lending to participate in testing and directly access CIC data for more transparent credit assessment.

Mr. Minh

Source: https://baochinhphu.vn/thanh-toan-truc-tuyen-an-ninh-mang-va-bao-ve-du-lieu-la-dieu-kien-tien-quyet-102250912145525548.htm

![[Photo] General Secretary To Lam receives Chairman of the State Duma of the Russian Federation Vyacheslav Volodin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/3814a68959e848f586178624b6bd66e5)

![[Photo] Prime Minister Pham Minh Chinh meets with Chairman of the State Duma of the Russian Federation Vyacheslav Volodin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/08ca17cb0c46432dbdb94f9eaf73b47a)

![[Photo] President Luong Cuong receives Chairman of the State Duma of the Russian Federation Vyacheslav Volodin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/6bd456e072504df3a468acbf9b7989c8)

![[Photo] President Luong Cuong receives Chairman of the State Duma of the Russian Federation Vyacheslav Volodin](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/29/6bd456e072504df3a468acbf9b7989c8)

Comment (0)