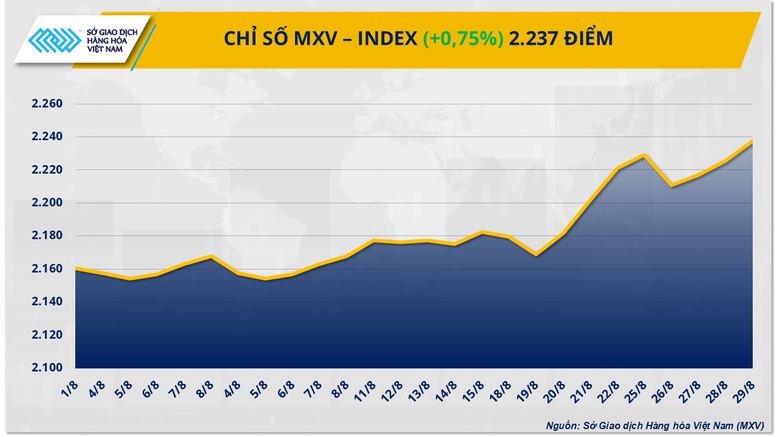

Photo 1: MXV-Index

Silver prices hit a near 14-year high

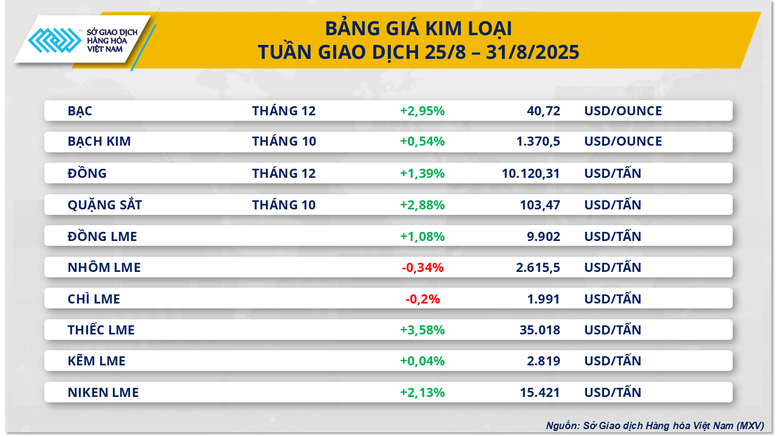

According to MXV, the metal group led the general trend of the whole market last week with overwhelming buying power of 8/10 items. In particular, silver was the focus when the price of December futures contract increased by nearly 3% to 40.72 USD/ounce - the highest level in nearly 14 years, marking the second consecutive week of increase.

First of all, the expectation that the Fed will soon ease monetary policy has significantly impacted the movement of this commodity. The market is now almost certain that the Fed will cut interest rates by 25 basis points at the September meeting, with the probability according to CME FedWatch rising to 87.4% from 84.7% a week ago. Morgan Stanley forecasts that the Fed may continue to cut interest rates in December and maintain the quarterly reduction rate in 2026, bringing interest rates to 2.75 - 3%. Low interest rates will weaken the USD, thereby making assets priced in this currency such as silver cheaper for international investors, stimulating buying power.

In addition, recent economic data showing a weakening US labor market has reinforced expectations of further Fed easing. Unemployment claims remain at a three-year high and non-farm payrolls have fallen sharply, increasing pressure on the Fed to support economic growth.

Moreover, escalating trade and geopolitical tensions have also boosted demand for safe havens. The US’s imposition of a 50% tariff on Indian goods and tougher signals on Russia have sent capital looking to silver, alongside gold, as a hedge against risk.

In addition, the wave of physical silver investment continues to increase, creating additional support for prices. In the US, the accumulated silver volume from 2010-2024 reached 1.5 billion ounces, equivalent to 70% of the value of gold investment, much higher than the world average. In India, demand for silver bars and coins in 2024 increased by 21% thanks to attractive domestic prices.

This impact also spread to the domestic market. Recorded on the morning of September 1, the price of 999 silver in Hanoi reached 1.263-1.296 million VND/tael, and in Ho Chi Minh City it was 1.265-1.302 million VND/tael, both up about 2% compared to a week ago.

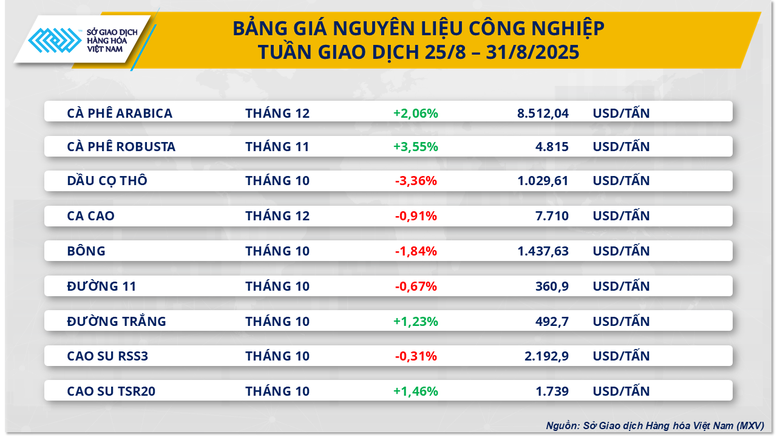

Coffee prices continue to rise sharply due to supply tensions

In the industrial raw material market, the prices of two coffee products continued to increase due to concerns about the production situation in Brazil. Specifically, the price of Arabica coffee increased by more than 2% to 8,512 USD/ton while the price of Robusta coffee increased by more than 3.5% to 4,815 USD/ton.

A new report from Safras & Mercado shows that Brazil’s coffee production in the 2025-2026 crop year will drop sharply to 63.35 million bags, 3.3% lower than the previous forecast. Arabica production will fall sharply to 38.05 million bags, 14% lower than the previous crop year, while Robusta will exceed 25 million bags but not enough to make up for the shortfall. Brazil’s coffee exports are expected to fall 11%, with inventories only equivalent to 5% of demand, making global supplies more fragile and prices remain high.

Regarding the tariff issue, the Brazilian government announced on August 28 that it would consider the possibility of applying the Reciprocity Law to the US, after the US imposed a 50% tax on many Brazilian export products, including coffee. If the US continues to retaliate by raising the tax rate further, the world coffee market is expected to continue to witness strong "price explosions".

Currently, domestic inventories in the US are sufficient for 45-60 days, and importers are beginning to look for alternative sources from other countries. However, the harvests from Colombia and Vietnam are not expected to be harvested and exported until October.

Source: https://baochinhphu.vn/thi-truong-hang-hoa-soi-dong-sac-xanh-102250901100047482.htm

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)