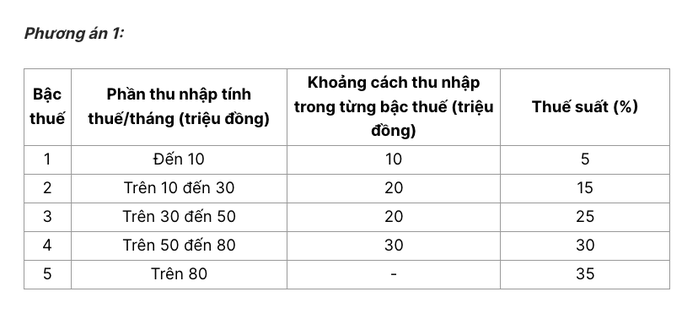

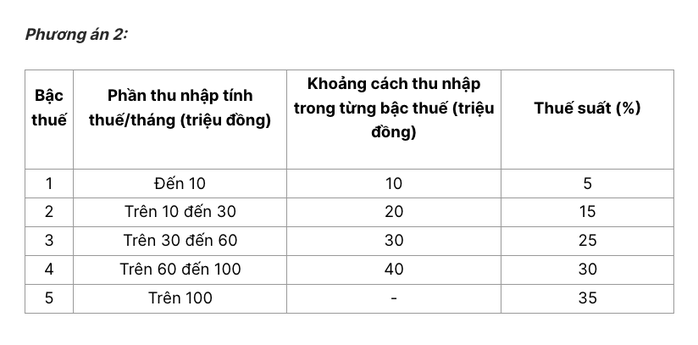

Maintaining the same viewpoint as the previous draft, in this draft, the Ministry of Finance continues to propose two options, reducing the number of levels of the progressive tax schedule from 7 levels to 5. When reducing the number of levels, the tax rate changes between levels, but the lowest level is still 5% and the highest level remains at 35%. The two options for the personal income tax schedule are as follows:

Option 1 as proposed by the Ministry of Finance

Option 2 as proposed by the Ministry of Finance

According to the Ministry of Finance, narrowing the number of tax brackets will contribute to simplifying tax management and collection, facilitating tax declaration and calculation, and be consistent with the trend of personal income tax reform in the world .

Implementing options 1 and 2 meets the goal of reducing tax rates, adjusting taxable income at each rate to an even number. However, the impacts of the two options are different.

For option 1, individuals with taxable income currently at level 1 will not be affected (however, with the adjustment of the family deduction level, individuals with income at level 1 will all receive a tax reduction).

Individuals currently paying taxes from level 2 or higher will receive a tax reduction compared to the current tax rate (for example, individuals with taxable income of 10 million VND/month will receive a reduction of 250,000 VND/month, individuals with taxable income of 30 million VND/month will receive a reduction of 850,000 VND/month, individuals with taxable income of 40 million VND/month will receive a reduction of 750,000 VND/month, individuals with taxable income of 80 million VND will receive a reduction of 650,000 VND/month...).

For option 2, basically every individual with taxable income from 50 million VND/month or less will have their tax reduced equivalent to option 1. For individuals with taxable income over 50 million VND/month, the reduction will be greater than option 1, so the State budget revenue will be reduced more than option 1.

During the consultation process, the majority suggested implementing option 2. The Ministry of Finance said that there were suggestions to further extend the income levels in each tax bracket, lower the tax rate in each bracket, and lower the highest tax rate from 35% to a lower level (30% or 25%)...

Regarding these opinions, through international experience research, some countries in the region are still regulating the highest tax rate at 35% such as Thailand, Indonesia, Philippines; even at a rate higher than 45% such as China, Korea, Japan, India.

Adjusting the tax rate according to the two options mentioned above, along with adjusting the family deduction level and adding other deductions (health, education , etc.), the tax rate has been reduced, supporting taxpayers, especially individuals with average and low incomes who will switch to not having to pay personal income tax.

For individuals with higher income levels, the tax regulation level is also lower than the current one. For example, an individual with one dependent, with income from salary and wages of 20 million VND/month, currently paying personal income tax of 125 thousand VND/month, when implementing family deductions and tax schedule according to option 2, will not have to pay tax.

If the income is 25 million VND/month, the tax payable will decrease from the current 448 thousand VND/month to 34 thousand VND/month (a decrease of about 92%); if the income is 30 million VND/month, the tax payable will decrease from the current 968 thousand VND/month to 258 thousand VND/month (a decrease of about 73%)...

The Ministry of Finance cited the 2024 population living standards survey report of the General Statistics Office, showing that Vietnam's average monthly income per capita in 2024 (at current prices) is 5.4 million VND and the group of households with the highest income (the group of the richest 20% of the population - group 5) has an average income of 11.8 million VND/month/person.

Accordingly, the proposed deduction for taxpayers is 15.5 million VND/month, which is nearly 3 times higher than the average income per capita, and also higher than the average income of the 20% of the population with the highest income.

Tax regulation is also aimed at the group of people with high average income. Accordingly, the 5% tax rate at level 1 applies to taxable income from 0 - 10 million VND/month, equivalent to income from salary and wages of an individual with 1 dependent from 20 - 35 million VND/month; the 15% tax rate at level 2 applies to taxable income from 10 - 30 million VND/month, equivalent to income from salary and wages of an individual with 1 dependent from 35 - 56 million VND/month...

Therefore, the Ministry of Finance submitted to the Government to implement option 2.

Source: https://nld.com.vn/thong-tin-moi-ve-bieu-thue-thu-nhap-ca-nhan-muc-cao-nhat-la-bao-nhieu-196250905100755852.htm

![[Photo] High-ranking delegation of the Russian State Duma visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/c6dfd505d79b460a93752e48882e8f7e)

![[Photo] Joy on the new Phong Chau bridge](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/b00322b29c8043fbb8b6844fdd6c78ea)

![[Photo] The 4th meeting of the Inter-Parliamentary Cooperation Committee between the National Assembly of Vietnam and the State Duma of Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/9f9e84a38675449aa9c08b391e153183)

Comment (0)