The Government proposes to keep the 75% tax rate on tobacco for now but add an absolute tax rate (100%) according to the roadmap. For alcohol and beer, the tax rate is proposed to be a percentage rate, increasing according to the roadmap each year.

On the morning of November 22, Deputy Prime Minister Le Thanh Long presented to the National Assembly a summary report on the draft revised Law on Special Consumption Tax.

According to the draft law on tobacco products as prescribed by the Law on Prevention and Control of Tobacco Harms, the tax rate of 75% will be maintained and an absolute tax rate will be added according to the roadmap to increase each year in the period from 2026 to 2030.

The regulation aims to contribute to the goal of reducing the rate of tobacco use among men aged 15 and over to below 36% in the 2026-2030 period according to the National Strategy on Tobacco Harm Prevention and Control and towards achieving the tax ratio on tobacco retail price as recommended by the World Health Organization.

With tobacco, the Government proposed two options.

Option 1: For cigarettes: 2,000 VND/pack (from 2026), 4,000 VND/pack (from 2027), 6,000 VND/pack (from 2028), 8,000 VND/pack (from 2029), 10,000 VND/pack (from 2030).

For cigars: VND 20,000/cigar (from 2026), VND 40,000/cigar (from 2027), VND 60,000/cigar (from 2028), VND 80,000/cigar (from 2029), VND 100,000/cigar (from 2030).

For shredded tobacco, pipe tobacco or other forms used for smoking, inhaling, chewing, smelling, or sucking: VND 20,000/100g or 100ml (from 2026), VND 40,000/100g or 100ml (from 2027), VND 60,000/100g or 100ml (from 2028), VND 80,000/100g or 100ml (from 2029), VND 100,000/100g or 100ml (from 2030).

Option 2: For cigarettes: 5,000 VND/pack (from 2026), 6,000 VND/pack (from 2027), 7,000 VND/pack (from 2028), 8,000 VND/pack (from 2029), 10,000 VND/pack (from 2030).

For cigars: VND 50,000/cigar (from 2026), VND 60,000/cigar (from 2027), VND 70,000/cigar (from 2028), VND 80,000/cigar (from 2029), VND 100,000/cigar (from 2030).

For shredded tobacco, pipe tobacco or other forms used for smoking, inhaling, chewing, smelling, or sucking: VND 50,000/100g or 100ml (from 2026), VND 60,000/100g or 100ml (from 2027), VND 70,000/100g or 100ml (from 2028), VND 80,000/100g or 100ml (from 2029), VND 100,000/100g or 100ml (from 2030).

The government is leaning towards option 2 because the price of cigarettes in Vietnam is getting cheaper compared to income while the burden of medical costs related to diseases caused by cigarettes is very high. In addition, it also helps reduce cigarette consumption, thereby reaching the goal of reducing the rate of tobacco use among men aged 15 and over...

The examining body, the National Assembly's Finance and Budget Committee, also agreed with option 2 to contribute to increasing the effectiveness of the policy in consumer orientation and in line with tax reform trends in other countries.

For alcohol and beer, the draft law stipulates tax rates in percentages that increase year by year in the period 2026-2030 to achieve the target of increasing alcohol and beer prices by at least 10% according to the World Health Organization's tax increase recommendation. The draft law proposes two options.

For alcohol products with an alcohol content of 20 degrees or higher, the Government is leaning towards increasing the tax rate from the current level of 65% to 80%, 85%, 90%, 95%, 100% each year in the period from 2026 to 2030.

For alcohol products under 20 degrees, the Government is leaning towards increasing the tax rate from the current level of 35% to 50%, 55%, 60%, 65%, 70% each year in the period from 2026-2030.

Regarding beer, the Government is leaning towards increasing the tax rate from the current level of 65% to 80%, 85%, 90%, 95%, 100% each year in the period from 2026-2030.

Option 2 would have a stronger effect on reducing affordability of alcohol products, and would have a better impact on reducing alcohol consumption and related harms caused by alcohol abuse.

Presenting the review, the leader of the Finance and Budget Committee said that most opinions agreed with the tax increase as in option 2, some opinions suggested considering calculations and proposing a reasonable increase level to be able to achieve the set goals.

Some people say that setting the tax rate on beer equal to the tax rate on wine over 20 degrees is not really appropriate because the harmful effects of wine or beer depend mainly on the alcohol concentration.

The Government regulates the annual revenue threshold not subject to VAT.

Continue to reduce VAT by 2% until the end of 2024

Without collecting tax on small orders via Shopee, TikTok will lose a large amount of revenue

Property tax should be levied on high-income earners, not necessarily VAT increase

Source: https://vietnamnet.vn/trinh-quoc-hoi-phuong-an-tang-thue-voi-ruou-bia-thuoc-la-2344567.html

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

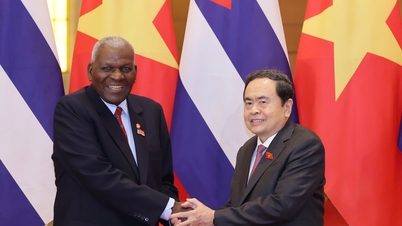

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

Comment (0)