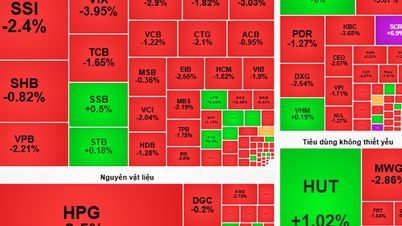

The market fell into a state of "green skin, red heart" when falling stocks overwhelmed rising stocks, but VN-Index still accumulated 1.22 points, up to 1,263.79 points in the trading session on December 16, breaking the streak of four consecutive declines.

The market fell into a state of "green skin, red heart" when falling stocks overwhelmed rising stocks, but VN-Index still accumulated 1.22 points, up to 1,263.79 points in the trading session on December 16, breaking the streak of four consecutive declines.

After four consecutive declines last week, some experts believe that the market is likely to continue its short-term fluctuations in the re-accumulation process. The market is aiming to return to the old peak of 1,300 points in the absence of obvious negative factors from exchange rates and the international market.

Reality also partly proves the above statement when VN-Index, although opening the first session of the week (December 16) in green, the increase amplitude was not too large. Before lunch break, selling pressure increased while demand was weak, causing many groups of stocks such as banks , steel, oil and gas, fertilizers... to start to plummet. From the middle of the afternoon session, demand appeared at low prices, helping the index return to green before closing at 1,263.79 points, up 1.22 points compared to the reference.

The index increased, but the number of stocks that decreased today was up to 214, while the number of stocks that closed in the green was only 158. The large-cap basket was similar when stocks decreased overwhelmingly with 14 stocks, while stocks increased by only 10 stocks.

BID accumulated 0.75% compared to the reference to 46,750 VND, becoming the main driving force for the market in today's session. The remaining driving force came from pillar codes of many other industry groups such as aviation, food, real estate... Specifically, HVN increased 3.21% to 27,350 VND and led the increase in the aviation group, VNM of the food group increased 1.25% to 65,000 VND and VHM of the real estate group increased 0.74% to 40,950 VND.

Industrial real estate stocks also recorded a significant improvement when most closed in the green. Specifically, SIP increased 2.8% to VND84,700, KBC increased 1.8% to VND28,350 and VGC increased 1.6% to VND44,600.

On the other hand, HPG lost 0.74% to VND27,000 and was the main factor holding back the market's increase in today's session. The remaining stocks on the list of stocks negatively affecting the VN-Index are mostly in the large-cap basket. Specifically, GVR decreased 0.64% to VND31,200, MBB decreased 0.62% to VND24,100, GAS decreased 0.44% to VND68,100, BVH decreased 1.69% to VND52,300 and CTG decreased 0.28% to VND36,250.

Trading volume for the entire session today reached 539 million shares, an increase of 60 million units compared to the session at the end of last week. Trading value accordingly increased by VND1,403 billion, to VND12,820 billion.

FPT leads in liquidity with a matched value of about 494 billion VND, followed by HPG with more than 450 billion VND and SSI with more than 379 billion VND. In terms of trading volume, VIX leads with nearly 23.4 million shares successfully matched, followed by DIG with about 16.9 million shares and HPG with more than 16.6 million shares.

Foreign investors extended their net selling streak to the sixth session. Specifically, this group sold more than 43.5 million shares, equivalent to a transaction value of VND1,451 billion, while only disbursing more than VND1,253 billion to buy about 36 million shares. The net selling value accordingly reached about VND198 billion, nearly 7 times higher than the previous session.

Foreign investors today aggressively sold HPG shares with a net value of over VND148 billion, followed by BID with nearly VND62 billion. On the other hand, foreign investors actively disbursed into SSI with a net purchase value of approximately VND80 billion, followed by HDB with about VND73 billion and SIP with over VND66 billion.

Source: https://baodautu.vn/vn-index-ngat-chuoi-giam-diem-4-phien-lien-tiep-d232614.html

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

Comment (0)