At the end of the session on September 3, the entire HoSE floor (HCMC) had 212 stocks increasing in price and 110 stocks decreasing in price.

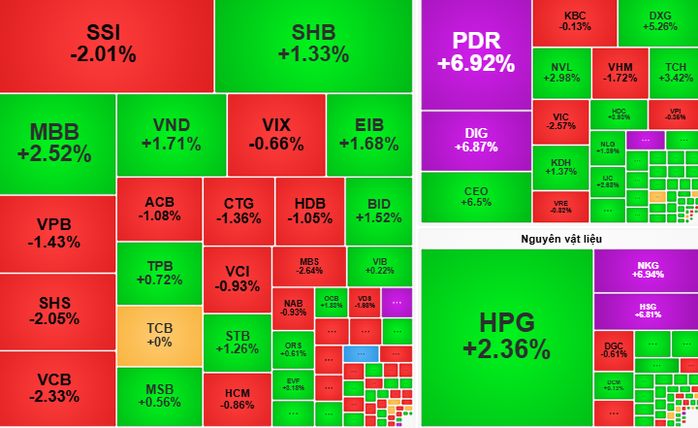

The trading session on September 3rd saw the VN-Index open with a narrow range of fluctuations around the reference level. The VN30 group of stocks, especially codes such as VIC, VHM and the banking group, were under strong correction pressure, pulling the general index down. Meanwhile, some blue-chips such as HPG, MSN and VNM still maintained a significant green color.

The highlight of the morning session on September 3 came from mid-cap stocks, especially those in the real estate, construction and steel sectors, with impressive demand. Codes such as CII, DIG, and NKG recorded ceiling prices, while many other stocks increased by 2-3%.

In the afternoon session, VN-Index continued to struggle in red, with a clear differentiation among blue-chips. Real estate and steel codes continued to be the focus, with PDR, NKG, HSG and DIG all hitting the ceiling, creating a positive highlight. However, net selling pressure from foreign investors was quite strong, reaching a value of VND 2,884.99 billion, focusing on codes such as HPG, VPB andFPT .

At the end of the trading session, VN-Index closed at 1,681 points, down slightly by nearly 1 point. On the entire HoSE floor (HCMC), there were 212 stocks increasing, 110 stocks decreasing and 59 stocks remaining unchanged, showing that active buying cash flow is still active.

According to VCBS Securities Company, the current developments show that VN-Index maintains a sideways trend in the 1670-1690 point range, with a clear differentiation between blue-chips and mid-cap stocks. Cash flow is strongly circulating into sectors such as real estate, banking, public investment, steel and construction.

VCBS recommends that investors take advantage of fluctuations to increase the proportion of stocks that have accumulated well, consolidate the price base or successfully test support. At the same time, investors can "follow" the cash flow, selecting stocks that attract strong demand for surfing.

Rong Viet Securities Company (VDSC) commented that the market is cautious before the resistance zone of 1690-1700 points, but still maintains signs of recovery. Liquidity decreased slightly compared to the previous session, showing that selling pressure is not too great. However, investors need to be wary of risks from supply if net selling pressure from foreign investors increases.

VDSC believes that the market still has a chance to test the resistance zone of 1690-1700 points in the coming sessions, but investors need to closely observe supply and demand developments to assess the possibility of an increase.

Source: https://nld.com.vn/chung-khoan-ngay-4-9-co-hoi-du-theo-co-phieu-thu-hut-dong-tien-196250903171143454.htm

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

Comment (0)