Vietnam stock market lacks supporting information; 6 potential stocks at the end of the year; PNJ expected to increase 18% profit; Vietravel shares skyrocket; Dividend payment schedule.

VN-Index quiet when information is "empty"

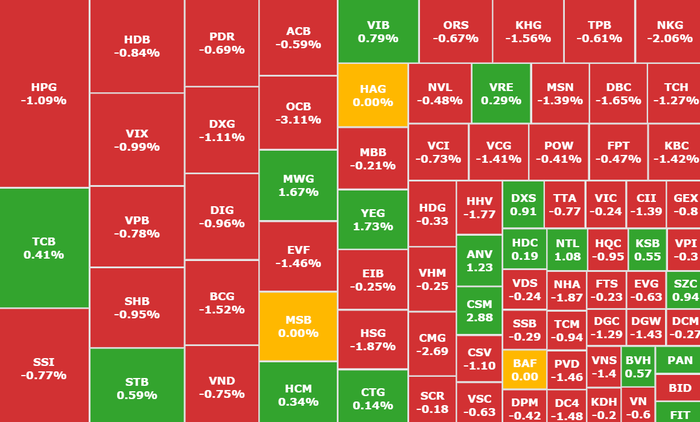

After 3 consecutive weeks of increase, the Vietnamese stock market has been under short-term adjustment pressure in the past week due to weak demand and net selling pressure from foreign investors. The lack of supporting information has made it difficult for investors' psychology to be stable.

VN-Index recorded 4 consecutive sessions of decline at the resistance zone of 1,280 points, down a total of 7.57 points (-0.6%) after 5 sessions, down to 1,262.57 points.

HNX Index decreased slightly by 0.99 points to 227 points; UPCOM also decreased by 0.14 points to 92.54 points.

Liquidity dropped sharply as the market continued to fluctuate, lacking leading stocks. Except for the banking sector which moved in the green, many stocks in the securities, real estate, oil and gas, steel sectors... all fluctuated quietly, sinking in the red.

Many market-leading stock groups are in red under the pressure of "lack of information" from the market.

Foreign investors net sold for the 5th consecutive session with 1,207 billion VND in the whole market. VCB (Vietcombank, HOSE) shares were under the strongest selling pressure with a net selling value of 54 billion VND. Next were a series of other large stocks, including: HPG ( Hoa Phat Steel, HOSE) at 37 billion, VPB (VPBank, HOSE) at 21 billion,...

On the contrary, HDB ( HDBank , HOSE) was the most heavily bought on the floor with a value of 58 billion VND; CTG (VietinBank, HOSE), SSI (SSI Securities, HOSE),... were also net bought by foreign investors with a value of about several tens of billion VND per share.

Commenting on the developments of the new week, experts said that the gloomy cash flow is a notable factor. However, the medium and long-term trend is still relatively positive and investors need to focus on re-evaluating their investment portfolios as well as strategizing the allocation of weight to potential stock sectors.

T&T becomes strategic shareholder, Vietravel shares soar

Going against the market trend, VTR (Vietnam Tourism and Transport Marketing Joint Stock Company - Vietravel, UPCoM) increased for 3 consecutive sessions.

At the end of the weekend session, VTR stock stopped at 22,500 VND/share, up 7.66% compared to the previous session. During the session, there was a time when this stock increased to the ceiling price of nearly 12%.

This development came about thanks to the news that T&T Group became a strategic shareholder of travel airline Vietravel Airlines.

Accordingly, Vietravel Group, T&T Air Transport and Trade Joint Stock Company (T&T Airlines), T&T Super Port and International Logistics Center Company Limited (T&T SuperPort), BVIM Fund Management Joint Stock Company have officially become strategic shareholders of Vietravel Airlines.

According to Mr. Do Quang Hien, Executive Chairman of T&T Group, becoming a strategic shareholder of Vietravel Airlines is an important milestone for T&T Airlines, T&T SuperPort in particular and T&T Group in the new development stage of the enterprise. This cooperation and investment promotes the development of the transportation, aviation and tourism industries; creates a driving force for economic growth...

PNJ 's 2024 profit is expected to increase by 18%

Recently, Phu Nhuan Jewelry Joint Stock Company - PNJ (PNJ, HOSE) has just announced its business results for the first 11 months of 2024. Accordingly, revenue reached VND 35,210 billion, up 19% over the same period last year, and profit after tax was VND 1,876 billion, up 8%.

This result came from jewelry retail revenue increasing by 16%, accounting for 57.1% of total revenue, helping PNJ complete 95% of revenue target and 90% of profit plan for the whole year.

PNJ plans to open more stores next year.

Over the past 11 months, the number of stores at PNJ has increased to 424 nationwide, opening 35 new stores. It is expected that in 2025, this network will continue to expand by 30-35 stores, taking advantage of the opportunity to gain market share from small retail stores that do not meet gold origin regulations.

Based on the above situation, SSI Securities has a positive view on PNJ's prospects, forecasting revenue in 2025 to reach VND 39,000 billion (of which retail revenue will increase by 14%) and net profit to reach VND 2,500 billion, up 18%, thanks to the increased proportion of retail revenue and reduced impact from inventory reduction.

In another development, Ms. Tran Phuong Ngoc Thao, Vice President of PNJ, has just registered to buy 4 million shares to increase her ownership ratio. The transaction is expected to take place from December 18, 2024 to January 16, 2025. If the transaction is successful, she will increase her ownership to more than 11.8 million shares (2.33%), equivalent to 3.51% of charter capital.

List of potential stocks in the second half of the year

Agriseco Securities (AGR) believes that this is the right time to re-disburse after the market hit a short-term bottom in November. Therefore, investors should prioritize choosing leading enterprises with reasonable valuations, expecting positive growth in the fourth quarter and the whole year to build their investment portfolio in December.

Accordingly, the company lists potential stocks for the end of December.

FPT (FPT JSC, HOSE) has long-term prospects from semiconductors and AI when it has officially launched an AI factory with Nvidia to provide AI and Cloud services in Vietnam and Japan. Agriseco expects this to be a long-term driving force for FPT as FPT already has good financial potential and maintains a regular dividend policy (the company is also preparing to pay a 10% cash dividend for 2024 next December).

GMD (Gemadept JSC, HOSE) when increasing capital to expand investment to increase capacity. Recently, GMD issued shares to existing shareholders at a price of VND 29,000/share, to mobilize an additional VND 3,000 billion. This amount will be used to implement the Nam Dinh Vu port project phase 3, expected to be implemented from the end of 2024. In addition, the Gemalink deep-water port project phase 2 will also be implemented from 2025.

HPG (Hoa Phat Group Joint Stock Company, HOSE) achieved an attractive valuation. AGR expects HPG's consumption output to continue to improve with the main driving force from domestic construction steel: Information from the Vietnam Steel Association, HPG's domestic construction steel sales output in October reached more than 378,000 tons, up 65% over the same period. In terms of legal aspects, the Land Law, Housing Law, and Real Estate Business Law will permeate the economy and boost supply, promoting the Government's push to build traffic works to help increase domestic construction steel consumption demand.

AGR assesses the current price as suitable for long-term holding of HPG shares.

KDH (Khang Dien Housing Investment and Trading JSC, HOSE) has medium and long-term prospects thanks to its large land fund. The company owns over 600 hectares of land in the eastern part of Ho Chi Minh City. As of the end of September, inventories reached VND22,450 billion, up 19% compared to the beginning of the year at Tan Tao Residential Area, Emeria, Clarita, Solina, Green Village, Phong Phu 2, Binh Trung Industrial Park projects. These are all projects with potential for price increases, expected to boost long-term growth potential for KDH.

REE (Refrigeration Electrical Engineering Corporation, HOSE) with 2 core business segments received many positive signals. Accordingly, The hydropower segment is the main growth driver in the coming quarters, as electricity demand in 2025 is forecast to be high with a base scenario of electricity growth of 11-12% (according to the Ministry of Industry and Trade). REE's hydropower segment will be mobilized more thanks to the high probability of La Nina occurring in late 2024 and early 2025. In addition, the two Tra Khuc 2 hydropower plants and Duyen Hai wind power plant acquired by REE in 2024 with a total capacity of 78MW are expected to contribute to revenue from 2026.

VCB (Vietcombank, HOSE) achieved its plan to increase capital to support short-term stock prices. The National Assembly approved the policy of investing additional State capital (VND 20,695 billion) to increase VCB's capital to VND 83,591 billion. In addition, VCB's plan to increase capital from the remaining profit after tax, after setting aside funds in 2022 and 2023 according to regulations (estimated at VND 45,900 billion) is expected to be approved soon, thereby creating a positive effect on short-term stock prices.

Comments and recommendations

Mr. Nguyen Chi Hieu, Consultant, Mirae Asset Securities, commented: "The big wind is changing direction, the whole financial world is facing strong movements of the global macro".

Regarding macro information, the US - the world's economic center, is making the market expect a strong interest rate cut when the US Federal Reserve (Fed) sent a clear signal about the possibility of a 25 basis point cut at its December meeting. However, the reality is that the USD has strengthened over the past week. Domestically, the USD/VND exchange rate has cooled down but still maintained a high level around 25,450 over the past week. This is a sign that the exchange rate pressure has not been completely relieved.

Currently, the market is at a particularly attractive valuation zone, opening up opportunities for long-term investors. Corporate profits across the market have grown by nearly 68%. Supportive policies from the State, along with the recovery of cash flow, are the main driving forces for the market to enter a new cycle. This is the time for investors to seize the opportunity, because today's valuation bottom can be a launching pad for strong growth in the future.

The most notable stocks are in the three pillars of the economy, including: Securities with SSI (SSI Securities, HOSE); Banking with CTG (VietinBank, HOSE), TCB (Techcombank, HOSE); Steel with HPG (Hoa Phat Steel, HOSE), NKG (Nam Kim Steel, HOSE).

In addition, there is the industrial park real estate group with KBC (Kinh Bac Urban Area, HOSE) and SZC (Sonadezi Chau Duc, HOSE).

Mr. Hieu noted that the story of the market at this time is not only about numbers, but also about trust. With the economy regaining strength, synchronous support policies and smart money returning, this is the time for investors to look far and act at the right time.

Vietcap Securities VN-Index is expected to maintain the 1,260-point threshold. The uptrend will be reinforced if increased buying activity helps the index surpass the resistance of 1,270 points. However, the upward movement on low liquidity will prolong the sideways phase and reduce the reliability of the inherently positive signal.

SSI Securities commented that low liquidity has reduced the excitement of VN-Index, putting pressure on the ability to maintain the range of 1,264 - 1,276 points. VN-Index is retreating to the short-term support zone of 1,260 points. Technical indicators show that the short-term correction trend is gradually becoming clearer. The index is expected to continue to fluctuate in the range of 1,256 - 1,268 points, with the temporary downward momentum dominating.

Dividend payment schedule this week

According to statistics, there are 20 enterprises that have dividend rights from December 2 to 6, of which 19 enterprises pay in cash and 1 enterprise issues additional shares.

The highest rate is 95%, the lowest is 1%.

1 additional issuer:

Nam Kim Steel JSC (NKG, HOSE), ex-right trading date is December 19, ratio is 50%.

Cash dividend payment schedule

*Ex-dividend date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to buy additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | Education Day | Day TH | Proportion |

|---|---|---|---|---|

| HPP | UPCOM | December 16, 2024 | January 8, 2025 | 10% |

| IDV | HNX | December 16, 2024 | December 30, 2024 | 15% |

| CNC | UPCOM | December 16, 2024 | December 30, 2024 | 20% |

| VSI | HOSE | December 16, 2024 | December 26, 2024 | 10% |

| HPD | UPCOM | December 17, 2024 | January 8, 2025 | 10% |

| BFC | HOSE | December 17, 2024 | December 30, 2024 | 5% |

| S4A | HOSE | December 19, 2024 | January 8, 2025 | 12% |

| GDT | HOSE | December 19, 2024 | December 31, 2024 | 10% |

| MCH | UPCOM | December 19, 2024 | December 30, 2024 | 95% |

| CX8 | HNX | December 19, 2024 | January 9, 2025 | 1% |

| DRC | HOSE | December 19, 2024 | January 10, 2025 | 5% |

| HAM | UPCOM | December 19, 2024 | January 10, 2025 | 10% |

| TIP | HOSE | December 19, 2024 | January 24, 2025 | 13% |

| HC3 | UPCOM | December 19, 2024 | January 3, 2025 | 10% |

| AVC | UPCOM | December 19, 2024 | March 10, 2025 | 5% |

| DM7 | UPCOM | December 19, 2024 | January 3, 2025 | 10% |

| VPD | HOSE | December 20, 2024 | January 22, 2025 | 14% |

| THP | UPCOM | December 20, 2024 | January 21, 2025 | 2% |

| TVT | HOSE | December 20, 2024 | January 16, 2025 | 4% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-16-20-12-co-hoi-giai-ngan-nhom-co-phieu-dau-nganh-20241216091855301.htm

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)