ANTD.VN - Hanoi Tax Department recommends that taxpayers, when receiving messages, tax payment notices, penalty decisions, etc., should carefully check the content and not rush to follow the instructions in the messages or notices.

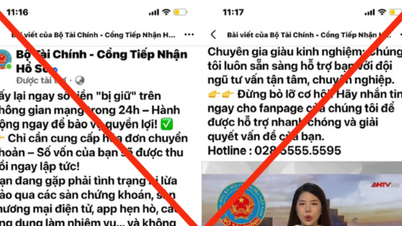

Hanoi Tax Department has just issued a warning about impersonating tax authorities for profit and fraud.

Accordingly, the Hanoi Tax Department said that recently, the appearance of information about a number of subjects impersonating civil servants and state officials, forging notices and impersonating the Tax Authority is tending to increase in level and frequency continuously with the purpose of defrauding and appropriating taxpayers' money.

|

The situation of impersonating tax authorities is increasing (Illustration photo) |

Hanoi Tax Department affirmed that this agency only authorizes the People's Committees of wards, communes and towns to collect non-agricultural land use tax from households and individuals and authorizes Hanoi Post Office to collect tax from business households in the districts: Thanh Tri, Dong Anh, Son Tay, Thanh Oai- Chuong My, Phuc Tho, Phu Xuyen. The authorized collection agency will issue receipts and collection documents according to regulations to taxpayers.

Therefore, the Hanoi Tax Department recommends that taxpayers, when receiving messages, tax payment notices, penalty decisions, etc., should carefully check the content, not rush to reply or follow the instructions in the messages or notices.

To avoid fraud when conducting transactions with tax authorities or performing tax operations, taxpayers can contact the focal point of the Tax Department or Tax Branch in the area for support via the phone number published on the Hanoi Tax Department's website.

In case of receiving messages on social networking platforms and calls with signs of fraud, taxpayers need to save evidence such as messages or call recordings, report to the telecommunications enterprise managing the subscriber to request handling, and at the same time provide available evidence to the competent authorities of the Ministry of Public Security and the nearest tax authority to request handling of the violations of the subjects according to the provisions of law.

Source link

Comment (0)