In the future, technology and national security will not be separate in a divided world .

|

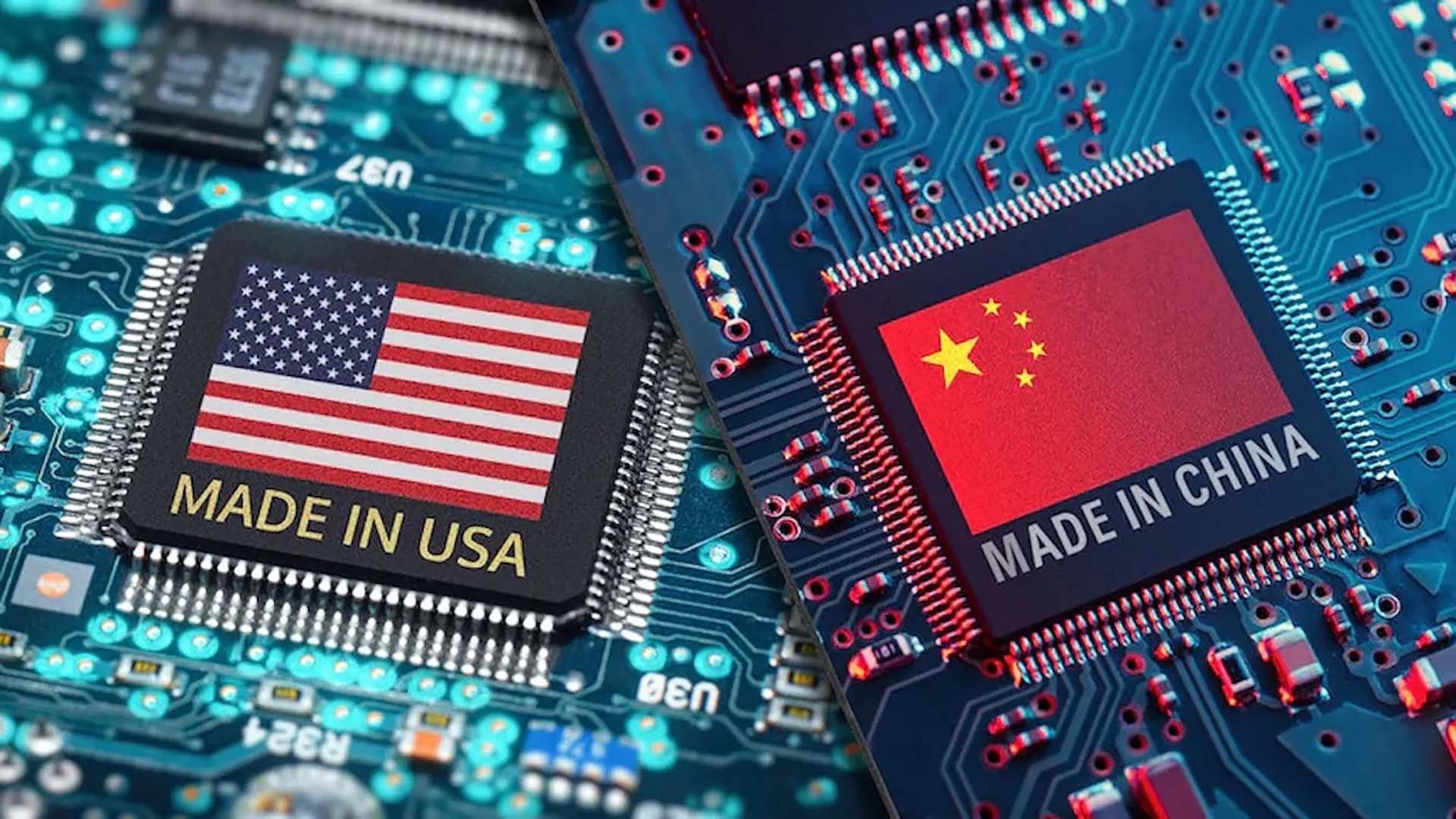

| The competition for dominance in the semiconductor industry between China and the US is becoming increasingly fierce. (Source: pressxpress.org) |

China is seeking to assert itself as the world's leading scientific and technological superpower as part of its comprehensive national security strategy, launched in 2014.

Semiconductors are central to China’s economic security strategy, as they are essential to all civilian and military technology. Semiconductors will help determine whether Beijing achieves its geopolitical and economic goals in the coming decades. Competition between China and the West in this area will continue to intensify in the coming period.

The US increased restrictions

As US President Joe Biden takes office in 2021, there are growing concerns that new Western technologies are making China a formidable military rival, capable of quickly surpassing the US as the leading artificial intelligence (AI) superpower.

Over the past decade, the West has increasingly seen disruptions in supply chains for medical equipment, semiconductors and critical raw materials, and the US has taken drastic steps to limit China’s influence in these areas.

In August 2022, the US enacted the CHIPS Act or Semiconductor Manufacturing Promotion Act, which aims to move some of the overseas microchip production back to the US and increase international competitiveness, reducing dependence on imports and supply disruptions. The CHIPS Act plans to invest $52 billion in US manufacturing development and more than $24 billion in related tax incentives.

Two months later, the White House announced a series of sanctions and controls aimed at protecting US intellectual property and national security, while making it harder for China to obtain or manufacture advanced chips of 14-16 nanometers or smaller. The US also banned the supply of advanced graphics processors from US-based Nvidia to Russia and China, which are used to build supercomputers. By March 2023, the CHIPS Act had tightened its grip on China, with a ban on investments in China-based chip manufacturing with interconnects smaller than 28 nanometers.

Currently, the US accounts for 10% of the global market share in the semiconductor manufacturing sector, but dominates 39% of the value chain, while Japan, Europe, South Korea and Taiwan (China) hold 53%.

While the United States leads the upstream integrated circuit design process, the Netherlands and Japan have strong positions in midstream integrated circuit manufacturing, as well as packaging and testing. Taiwan (China) produces 92% of the world's most sophisticated chips measuring 3-5 nanometers and 80% measuring 7 nanometers or less.

The United States has also stepped up cooperation and coordinated sanctions with Japan, the Netherlands and many other countries to strengthen export controls on high-performance semiconductor manufacturing equipment. For example, in 2018, Dutch company ASML agreed to supply advanced EUV lithography equipment to China's Semiconductor Manufacturing International Corporation (SMIC). With extreme ultraviolet (EUV) lithography technology, transistors can be created with dimensions of only nanometers (nm). Under pressure from the United States, the Dutch government later withdrew this agreement.

Japan also recently imposed controls on 23 types of chip technology that Japanese companies can export to countries like China. Japanese companies are not as prominent as the Netherlands' ASML or Taiwan's TSMC, but they dominate some stages of the chipmaking process.

However, neither the US nor Japan’s export controls restrict the supply of older-generation chips to China, so Chinese chipmakers can still use old technology equipment that is considered several generations behind rivals Taiwan’s TSMC and South Korea’s Samsung, according to gisreportsonline.com.

China's response

Since 2015, Chinese President Xi Jinping has called for a national strategy to achieve self-reliance by reducing dependence on imports of key Western technologies and components. Beijing’s “Made in China 2015” strategy set a target of increasing chip self-sufficiency from 10% to 70% by 2025. However, this has not happened. According to Topwar.ru, in 2022, the figure was only 16%. The target was later adjusted to 75% by 2030.

Beijing imported record amounts of semiconductors in 2023 from the Netherlands, Singapore, and Taiwan (China) before the US implemented new export restrictions. Last summer, the country added $41 billion to the China Integrated Circuit Industry Investment Fund, launched in 2014 to boost the chip industry.

In total, Beijing is said to have invested around $150 billion in the semiconductor industry, including research and development facilities – more than any other economy since 2015. In 2020, reports suggested that SMIC would need seven years to catch up with Western companies that currently lead the technology. However, SMIC and Huawei are making rapid progress, with advanced 7-nanometer chip production expected by 2023.

In response to US sanctions, China has banned the import of products from US memory chip maker Micron for critical infrastructure and other domestic sectors from May 2023 due to “serious security risks”. In 2022, Micron produced a quarter of the world’s DRAM memory chips, and China accounted for nearly 11% of its sales.

By July 2023, China will restrict exports of two key rare earth metals, gallium and germanium, which are widely used in microelectronics, which are essential for the production of high-tech weapons as well as batteries, displays and many other high-tech products. China currently produces about 80% of the world’s gallium and 60% of its germanium. As a result, China’s export restrictions have significantly limited some foreign manufacturers’ access to these critical materials and increased prices because there are few alternatives.

While these policies seek to improve China’s bargaining power with the United States in the short term, they also reflect China’s efforts to become the world’s largest supplier of many key raw materials and refined products. However, the export cuts could also prompt the United States to accelerate projects to bring manufacturing back to the United States or to shift it to friendly countries.

Since 2023, China has expanded the scope of its Counter-Espionage Law to address as-yet-unspecified “national security threats.” The program requires state-owned companies in the finance, energy, and other sectors to replace foreign software in their information technology systems. These companies include more than 60 of China’s 100 largest listed companies.

In late December 2022, Huawei, one of China’s largest private companies, said it had mastered a method of designing microchips that had previously been monopolized by the West. Huawei’s success opens up the prospect that China could finally begin to produce some of its smallest and most powerful microchips itself, mastering a crucial chipmaking method. While it remains to be seen how far Huawei can defy Western sanctions, China’s ability to overcome bans and restrictions to develop advanced semiconductor manufacturing technology is a headache for the West.

According to gisreportsonline.com, it is only a matter of time before China catches up with the US, even if it faces new sanctions. However, SMIC has been able to purchase spare parts and technical services to maintain its 7-nanometer chip production facility despite the US's increased export controls. Huawei and SMIC are even planning to produce the advanced 5-nanometer ASCEND 920 chip, which will help close the gap with advanced 3-nanometer Western AI chips and potentially 2-nanometer chips.

China's policies aimed at self-sufficiency and separation from the West, along with the increasing sanctions and export controls of the US and its allies, are escalating the global war for the world's most advanced semiconductors and chips. However, this fierce competition is an opportunity for China to break out and become a true "chip power" in the near future.

Source: https://baoquocte.vn/khoa-hoc-cong-nghe-cuoc-dua-chua-hoi-ket-277478.html

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

Comment (0)