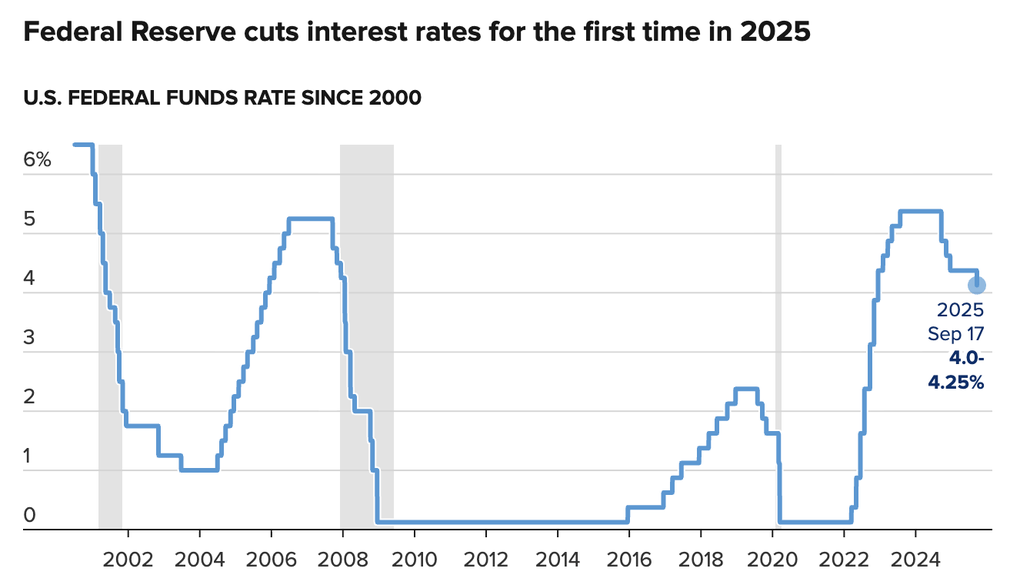

The Fed cut interest rates for the first time this year, by 0.25%, to 4-4.25%. The move was in line with market expectations.

Only new Governor Stephen Miran opposed the policy this time, saying the Fed should cut more aggressively by 0.5%. Meanwhile, two governors, Michelle Bowman and Christopher Waller, voted in favor of a 0.25% cut.

"Recent data suggest that economic activity has slowed in the first half of the year. Job creation has also slowed, the unemployment rate has edged up but remains low. Inflation has accelerated and remains quite elevated," the Fed said in a statement after the meeting.

The agency forecasts another 50 basis point rate cut this year and 25 basis points in 2026 and 2027. The Fed has two more meetings this year, in October and December.

The Federal Open Market Committee (FOMC) said economic activity had "slowed," adding that job creation had slowed, while inflation had risen and remained high.

Slowing job growth and rising inflation have put the Fed's dual goals of price stability and full employment in conflict.

Fed interest rate developments (Photo: CNBC).

Previously, the US Senate had just approved Mr. Stephen Miran to the position of a member of the Fed Board of Governors. Mr. Stephen Miran will temporarily replace Ms. Adriana Kugler - who suddenly resigned last month. President Donald Trump nominated Mr. Miran to this position in August right after Ms. Kugler resigned. Mr. Miran only took nearly 6 weeks to be accepted to the position of Fed Governor, while the normal process can take up to several months.

The Fed has cut rates three times in 2024, while it has not made any adjustments this year. Previously, the market was almost certain that the Fed would cut rates by 25 basis points (0.25%) at its September meeting. Many recent signs point to a weakening labor market. Some Fed officials also said that the impact of import tariffs on inflation may be short-lived.

In a speech late last month, Fed Chairman Jerome Powell hinted at the possibility of a rate cut, noting "rising employment risks." Other Fed officials have expressed similar concerns.

According to the US Department of Labor, on average, the number of new jobs created in the US during the period from June to August was only about 29,000 a month. This figure is only slightly higher than the 15-year low set the previous month.

There are now more job seekers than vacancies. Jobless claims for the week ending September 6 hit a nearly four-year high. In August, the number of people unemployed for more than 26 weeks hit a four-year high.

In addition, US inflation has accelerated in recent months, largely due to President Trump’s tax policies. However, Fed officials increasingly believe that this trend is only temporary.

The Consumer Price Index (CPI) in August increased by 2.9% compared to the same period last year, in line with analysts' forecasts. For many months, consumer inflation figures have been almost in line with forecasts, despite the disruption caused by import taxes.

With the labor market weakening and economic sentiment uncertain, businesses now have less room to raise prices than they did post-pandemic. “Most forecasts suggest that inflation will slow for several more months, with the impact of tariffs tapering off by early 2026,” Board of Governors member Christopher Waller said on August 28 in Miami.

Source: https://dantri.com.vn/kinh-doanh/fed-chinh-thuc-ha-lai-suat-thi-truong-tai-chinh-toan-cau-rung-chuyen-20250917225220125.htm

![[Photo] General Secretary To Lam chairs the meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/fb2a8712315d4213a16322588c57b975)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)