On the evening of December 13, the market received news that MicroStrategy's MSTR stock would join the Nasdaq 100 Index on December 23, immediately stimulating the price of Bitcoin (BTC) when MicroStrategy is the business holding the largest cryptocurrency in the world .

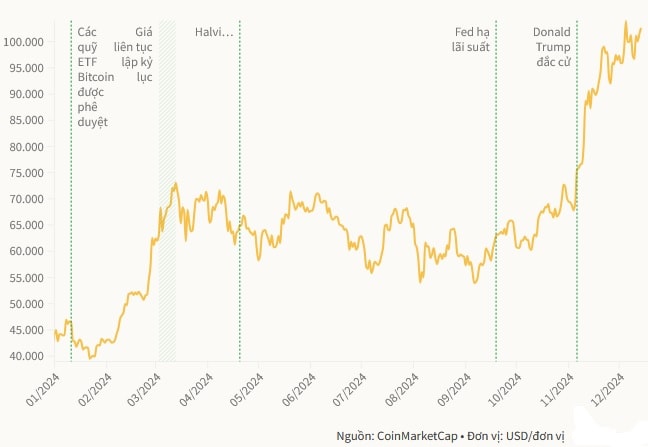

BTC price was pushed up to 100,000 USD per unit on the evening of December 13 but then experienced a slight shake. The increase was almost successfully tested as the clock entered a new day.

Since 0:00 until now, Bitcoin has been above 101,000 USD, at times surpassing 102,600 USD. The above market price has improved by nearly 3% compared to yesterday and is currently not too far from the record of more than 103,900 USD set on December 5.

MicroStrategy has a market capitalization of about $92 billion, making it the 40th largest company in the Nasdaq 100 and likely has a weighting of 0.47%, according to CoinDesk.

Adding MSTR to the index would increase Nasdaq 100’s exposure to BTC, as MicroStrategy owns about $42 billion of the world’s largest cryptocurrency. Conversely, ETFs would automatically buy MSTR shares to balance their portfolios, indirectly helping Bitcoin receive more large investment flows.

"Millions of investors will now have indirect exposure to Bitcoin, and this will further fuel the cryptocurrency market," said James Van Straten, senior analyst at CoinDesk.

Many experts also predict that MicroStrategy could consider joining the S&P 500 next year, although this may be challenging due to the company's software profits. If successful, the event will mark a major step forward for Bitcoin's exposure to major financial institutions.

MicroStrategy started buying BTC in mid-2020, betting the cryptocurrency would help it survive in a period of fierce competition. Today, about 90% of the company's value is tied to its Bitcoin holdings.

However, senior ETF expert James Seyffart warned that MicroStrategy's entry into the Nasdaq 100 index is likely to be short-lived as the company could be reclassified as a financial company in March when its value comes almost entirely from its BTC holdings and not its actual business operations.

Source: https://baohaiduong.vn/gia-bitcoin-lai-vuot-moc-100-000-usd-400426.html

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

Comment (0)