In November, PNJ of jewelry "queen" Cao Thi Ngoc Dung, achieved net revenue of 3,111 billion VND, up nearly 23% over the same period. Profit after tax increased 31% to 199 billion VND, the highest in 9 months.

In the first 11 months, PNJ recorded revenue of VND29,495 billion. Accumulated profit increased by nearly 6% over the same period, reaching a record VND1,732 billion.

In 2023, PNJ set a target of VND 35,598 billion in revenue and VND 1,937 billion in profit after tax. With the business results after 11 months, PNJ completed 83% of the revenue target and 89% of the yearly profit plan.

Since the beginning of December, domestic gold prices have continuously reached new records. SJC gold prices increased from nearly 74 million VND/tael in early December to 77 million VND/tael after the end of the session on December 23. Many experts predict that gold prices will maintain their upward momentum and may continue to reach new historical milestones. PNJ's revenue and profits will likely continue to increase strongly.

In its analysis at the end of November, SSI Research Securities forecast that although the challenges of the macro economy are expected to ease, it will still take more time for spending to recover. The securities company forecasts that PNJ's gross profit margin will increase from 17.5% in 2022 to 18.4% - 18.2% in 2023 - 2024. Net profit in 2023 - 2024 is estimated at VND 1,850 billion, up 2.6% and VND 2,170 billion, up 17.2% over the same period.

At the end of the trading session on December 22, PNJ shares reached 83,000 VND/share.

Business news

The stock market has a number of other important events of listed companies.

* GVR: On December 22, the Board of Directors of Vietnam Rubber Industry Group adjusted the consolidated business plan for 2023. Of which, adjusted revenue decreased by 12% compared to the original plan to VND 24,243 billion. At the same time, pre-tax profit and after-tax profit decreased by 19% and 21% to VND 3,956 billion and VND 3,363 billion, respectively.

* PTH: Petrolimex Ha Tay Transport and Services Joint Stock Company adjusted its 2023 plan. Pre-tax profit and after-tax profit were adjusted down to VND3.9 billion and nearly VND3.1 billion, respectively, equivalent to about 69% and 68% of the 2023 plan.

*FPT : FPT Corporation announced that it brought in $1 billion in IT service revenue from overseas markets, mainly from three key markets: Japan, the Americas and Asia Pacific. These markets all grew by over 30%. Of which, the Japanese market increased by 54%, driven by the large demand for IT spending in this market, especially spending on digital transformation.

* PLP: Pha Le Plastic Production and Technology JSC announced that it had received a decision from the Hai Phong City Tax Department on administrative fines for tax violations of VND 214 million due to false declarations leading to an increase in the amount of value added tax to be refunded and false declarations leading to a shortage of corporate income tax payable.

* D2D: Industrial Urban Development Corporation No. 2 will spend more than VND125 billion to lease land from Sonadezi Chau Duc Corporation (SZC) in Chau Duc Industrial Park for a period of 35 years.

* DAH: Mr. Pham Huy Thanh successfully purchased 2 million shares of Dong A Hotel Group Corporation on December 18, thereby increasing his ownership ratio from 5 million shares (5.94%) to 7 million shares (8.31%).

* FRT: Dragon Capital fund group has owned more than 11% of shares at FPT Digital Retail JSC after two member funds, Norges Bank and Hanoi Investments Holdings Limited, bought a total of 50,000 shares.

* TDM: Thu Dau Mot Water JSC will pay 2023 cash dividend at a rate of 14%. Expected implementation date is May 15, 2024.

VN-Index

At the end of the trading session on December 22, VN-Index increased by 0.63 points (+0.06%) to 1,103.06 points, HNX-Index decreased by 0.21 points (-0.09%) to 228.27 points, UpCOM-Index decreased by 0.02 points (-0.03%) to 86.14 points.

VNDirect Securities believes that, in the context of many developed markets closing for a few sessions for holidays, the selling pressure of foreign investors on the Vietnamese stock market may cool down. However, this trend may only be temporary, leading to the cautious and reserved psychology of domestic investors that cannot be completely relieved.

In that context, it is unlikely that stock indices will see a strong breakout in the last trading week of 2023. The VN-Index may recover slightly towards the 1,120-1,130 point range next week. Therefore, investors should maintain a moderate stock weight and limit the use of leverage at this time, especially in the context that the mid-term uptrend of the VN-Index has not been established until the VN-Index "convincingly" surpasses the resistance zone around 1,150 points.

KB Securities Vietnam (KBSV) commented that the uptrend is not really convincing when liquidity is still maintained at a low level, differentiation is taking place between industry groups and between stocks in the same industry. Therefore, the index is forecasted to continue to face pressure to shake at the resistance zone near 1,110 (+-5).

Investors are advised to avoid chasing buys in early recoveries, and can consider flexible two-way buying/selling with low proportions at the next support/resistance zones, specifically the lower limit of 1,080 (+-15) and around 1,110 (+-5).

Source: vietnamnet

Source

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

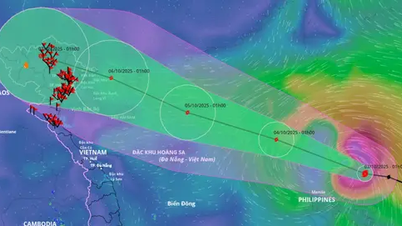

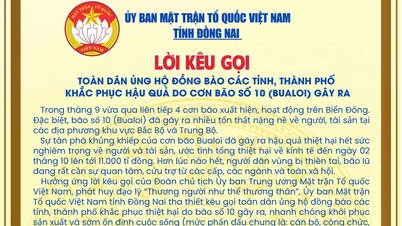

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

Comment (0)