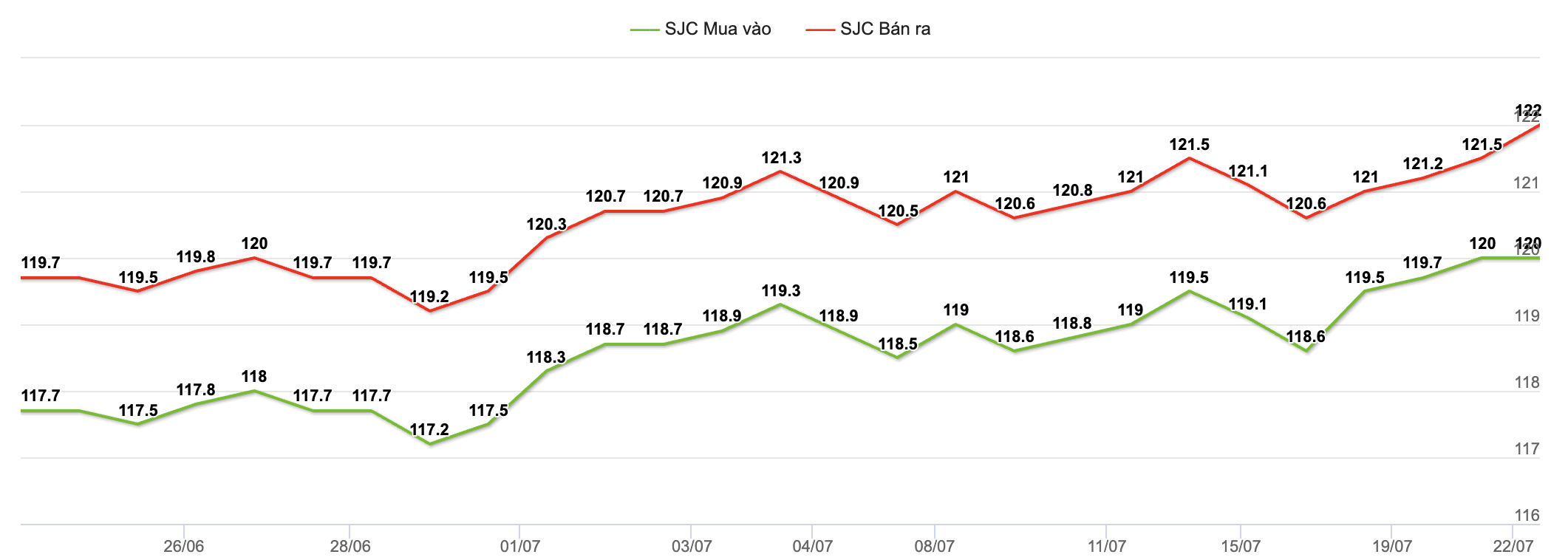

On July 22, the domestic gold price at many gold trading companies was simultaneously raised to 122 million VND/tael for selling. This is also the highest price of SJC gold bars in the past 2 months. The increase of the domestic market is supported by the world market developments in the context that global investors continue to closely monitor geopolitical and monetary developments.

At Saigon Jewelry Company (SJC), the listed price of gold bars is 120 million VND/tael for buying and 122 million VND/tael for selling, an increase of 500,000 VND for selling compared to yesterday. The buying and selling margin has therefore widened, returning to 2 million VND/tael.

|

| SJC gold bar price maintained an upward trend over the past month. |

The price of 999.9 smooth round gold rings at Bao Tin Minh Chau is traded around 116.3 - 119.3 million VND/tael (buy - sell). The price of gold rings varies significantly between gold brands, but the difference between buying and selling is also commonly from 2 - 3 million VND/tael between brands.

Meanwhile, in the international market, the spot gold price this morning slightly adjusted to 3,390.8 USD/ounce after reaching 3,400 USD/ounce last night. The gold futures contract price for August 2024 was recorded at around 3,405 USD/ounce.

In a report published in mid-July 2025, the World Gold Council (WGC) assessed that the weak USD, flat interest rates and an unstable economic and geopolitical environment have strongly boosted investment demand for gold. In the first half of this year alone, gold has increased by 26% in USD terms.

Regarding the outlook for gold prices in the second half of the year, WGC has presented three scenarios. According to the baseline scenario, gold prices will remain flat in the second half of the year, with a maximum increase of 5% assuming current economic and market forecasts are accurate and macroeconomic conditions are stable. In the scenario of a weakening economy, increased stagnant inflationary pressures, escalating geopolitical tensions, and increased demand for gold as a haven, gold prices will increase by 10-15% in the second half of the year.

On the contrary, in the scenario where global conflicts are resolved, gold prices will fall by 12-17%. However, the WGC believes that this possibility is unlikely to happen in the current context. A WGC survey of 73 central banks shows that about 95% believe that countries will continue to increase their gold holdings next year. In particular, domestic gold sources are considered a strategic option to achieve this goal.

The world gold price is hovering near a 5-week high. Another major reason is the cautious sentiment as the August 1 deadline approaches. This is the time when US President Donald Trump can impose a 30% tax on most goods from the European Union (EU) if the two sides do not reach a trade agreement. The EU has now prepared countermeasures in the event of a no-deal scenario.

Regarding monetary policy, investors are waiting for the speech of the Chairman of the US Federal Reserve (Fed) Jerome Powell today to look for signals on the possibility of adjusting interest rates at the meeting next week. Although Mr. Trump continues to pressure the Fed to cut interest rates, traders are still not completely confident in the possibility of a move this month.

In Europe, the European Central Bank (ECB) will hold its regular meeting this week. It is expected that the operating interest rate will remain at 2% at the meeting on July 25, after 8 consecutive cuts. The euro is currently above the 1.16 USD to 1 EUR mark, as investors expect the ECB to continue to monitor developments in tariff policy and exchange rate pressure on growth.

The DXY index, which measures the strength of the USD against a basket of six major currencies, continued to remain below the 98 mark after two consecutive sessions of decline. Thanks to cooling external factors, the central exchange rate announced by the State Bank on the morning of July 22 was 25,179 VND/USD, down 12 VND compared to yesterday.

At Vietcombank, the listed exchange rate is 25,960 VND/USD for buying and 26,320 VND/USD for selling, down 20 VND in both directions compared to yesterday. Thus, the USD selling price at commercial banks has left the high mark of 26,340 VND maintained since last Friday. In the free market, USD is trading around 26,450 VND, still "higher" than the exchange rate on the official market.

Source: https://baodautu.vn/gia-vang-mieng-sjc-cham-moc-122-trieu-dongluong-cao-nhat-2-thang-d338109.html

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

Comment (0)