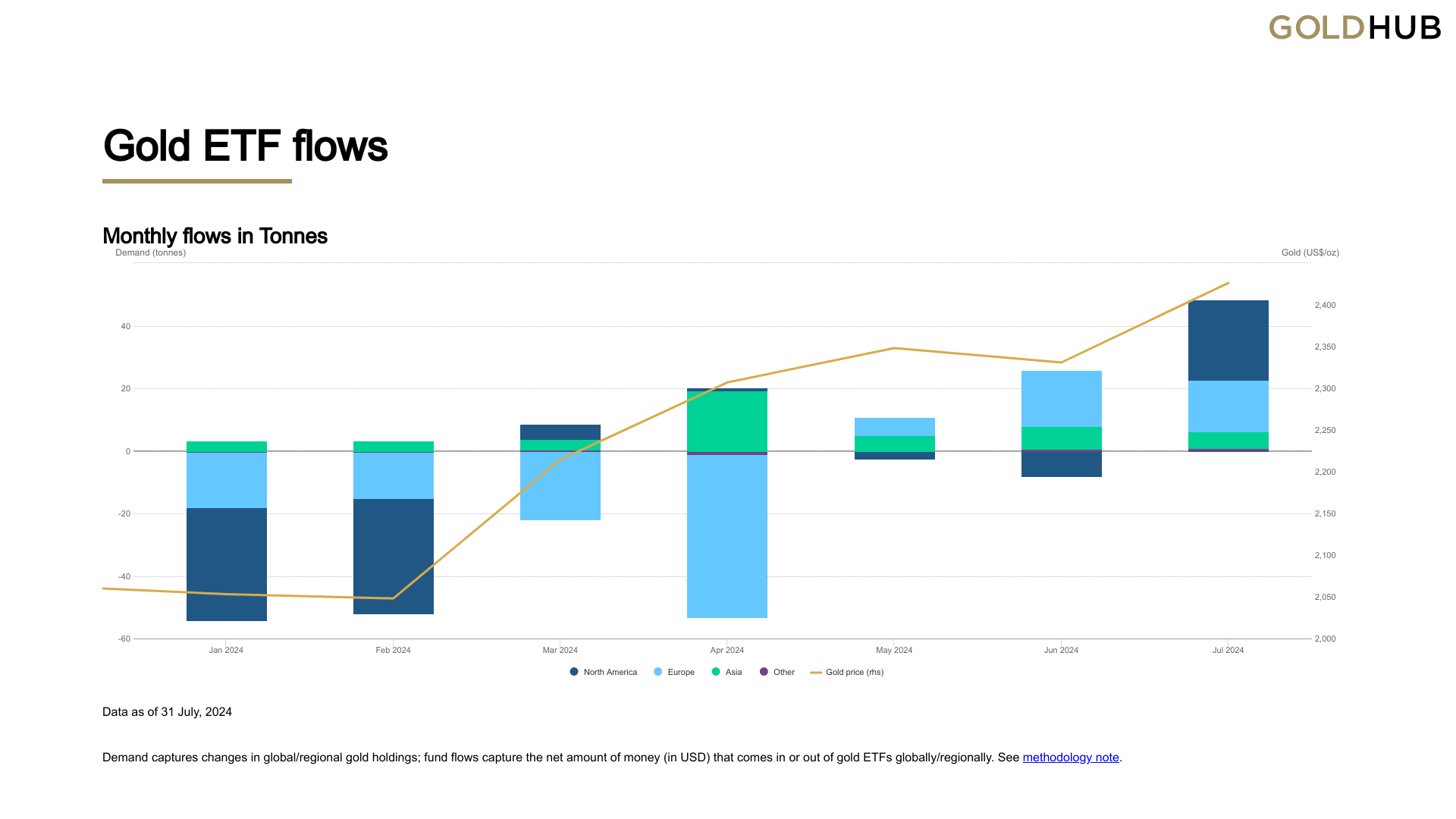

According to the World Gold Council (WGC) Gold ETF Cash Flows report, July saw the largest monthly inflow of gold investment from global gold ETFs since April 2022. All major “sharks” participated in gold investment.

Global gold ETFs recorded their third consecutive month of inflows into gold, adding $3.7 billion to bullion investments in July. Total holdings increased by 48 tonnes to 3,154 tonnes as of the end of July, WGC analysts said.

World gold prices increased by 4% last month, along with additional gold purchases, causing the assets of these funds to increase by 6% to 246 billion USD.

Western gold ETFs were the biggest contributors. The region recorded inflows into gold for three consecutive months, reaching $1.2 billion in July, the strongest since March 2022. British and Swiss funds led the net purchases.

In Europe, government bond yields fell, which made ETFs more interested in gold.

According to WGC, major fluctuations in the race to the White House, including the attempted assassination of Mr. Trump, Mr. Biden's withdrawal from the presidential race, etc., have caused the gold market to "heat up". Demand for safe-haven gold has increased sharply, with gold ETFs witnessing strong cash flows into buying gold in about two days.

Meanwhile, inflation has fallen, the labor market has cooled, the US Federal Reserve (Fed) is likely to cut interest rates as early as September. US Treasury yields have fallen and the US dollar has weakened, pushing gold prices to high levels. At the same time, it has boosted investors' interest in gold ETFs.

Volatility in equities, especially in the second half of July, also supported demand for gold ETFs, WGC analysts said.

Despite high prices, Asian funds remained net buyers of gold for 17 consecutive months, adding $438 million in July, with India topping the list. Chinese and Japanese funds also saw strong purchases as stock markets weakened and domestic gold prices rose.

Recently, some forecasts said that whichever candidate, Mr. Donald Trump or Ms. Kamala Harris, becomes the US president and the owner of the White House, will also increase the injection of money to support the economy . Gold will benefit from this move.

Several major banks in the world still maintain their forecast that gold prices will reach $2,500/ounce this year.

Source: https://vietnamnet.vn/gia-vang-tang-ca-map-van-manh-tay-gom-2312622.html

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

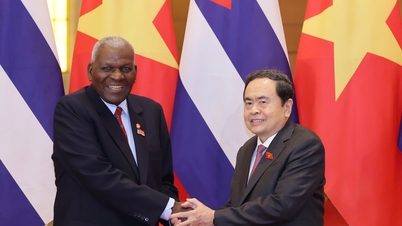

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

Comment (0)