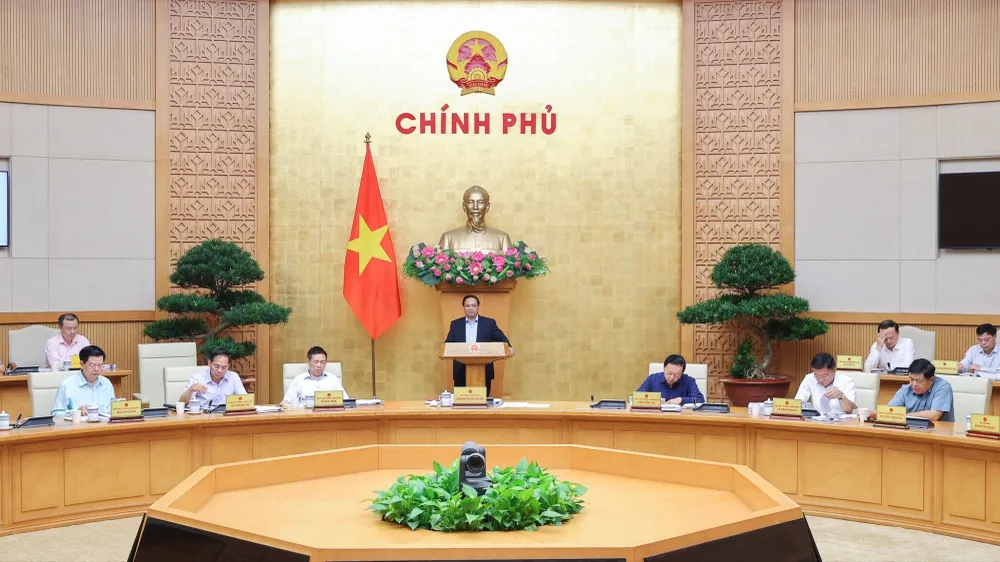

The Government has just issued Resolution 278/NQ-CP on the thematic meeting on law making in September 2025 (first session).

The Government requested ministers to direct drafting agencies to promptly complete draft laws to ensure proper implementation of the provisions of the Law on Promulgation of Legal Documents; and closely coordinate with the National Assembly Committees to ensure quality and progress in submitting them to the National Assembly at the 10th session (October 2025).

In particular, with the draft Law on Personal Income Tax (amended), the Government agrees on the necessity of developing a draft law to continue institutionalizing the Party's guidelines and policies, the State's policies and laws on perfecting the tax policy system in general and the personal income tax policy in particular.

The Ministry of Finance shall preside over and coordinate with relevant ministries and agencies to research and absorb as much as possible the opinions of Government members and the Prime Minister's conclusions, and complete the draft law to ensure requirements.

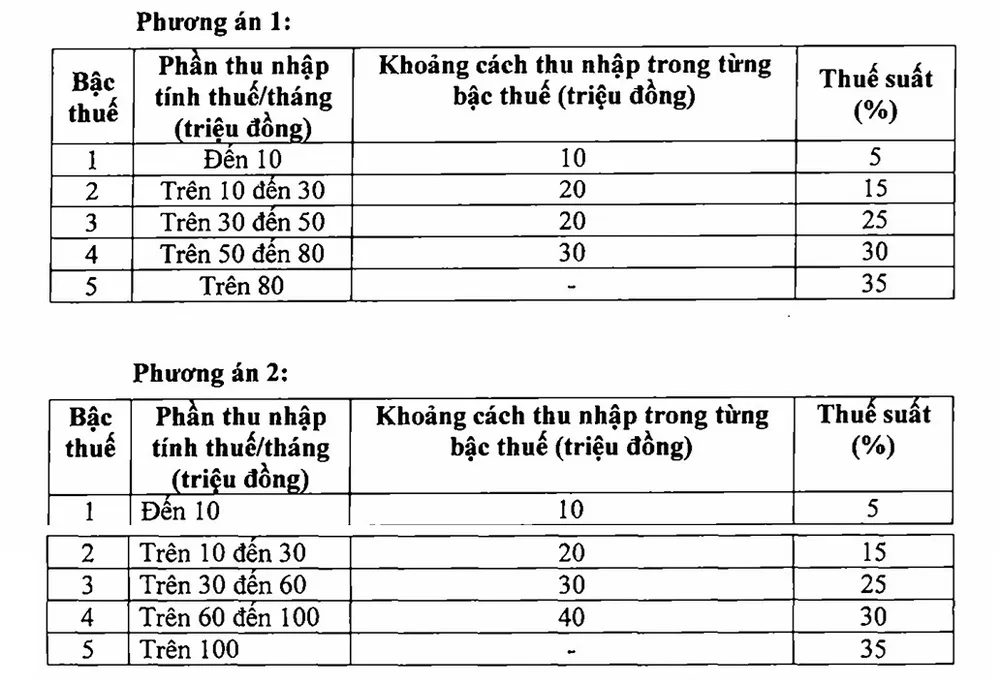

The Government requested to review and add income items (severance pay, allowances, subsidies, living expenses paid by Vietnamese agencies abroad...) to the tax-exempt list; complete regulations on progressive tax tables according to option 2 as reported by the Ministry of Finance; at the same time, carefully assess the impact on the content of regulations on personal income tax on business income, avoid causing major disruption to people's business activities, and effectively implement the policy of eliminating tax collection for business households and business individuals according to Resolution No. 68-NQ/TW of the Politburo on private economic development, Resolution No. 198/2025/QH15 of the National Assembly on a number of special mechanisms and policies for private economic development.

The Government also requested that the draft law clearly stipulate that income from gold trading activities is subject to tax to increase market transparency and limit gold speculation; assign the Ministry of Finance to coordinate with the State Bank to unify this content in the draft law.

Previously, in the latest draft of the revised Personal Income Tax Law, the Ministry of Finance proposed a plan to amend the progressive personal income tax schedule from 7 levels to 5 levels, with the highest tax rate being 35% (according to the current Personal Income Tax Law, the progressive tax schedule applied to income from salaries and wages includes 7 tax levels: 5%, 10%, 15%, 20%, 25%, 30% and 35%).

The Ministry of Finance said that for option 2, basically every individual with taxable income of 50 million VND/month or less will receive a tax reduction equivalent to option 1. For individuals with taxable income of over 50 million VND/month, the reduction will be greater than option 1.

According to the drafting agency, through the consultation process, the majority proposed implementing option 2. There were also opinions suggesting further extension of income levels in each tax bracket, lowering the tax rate for each bracket, or even reducing the ceiling from 35% to 30% or 25%...

Currently in the region, the highest tax rate is usually 35% like in Thailand, Indonesia, Philippines; while China, Korea, Japan, India apply a ceiling rate of 45%...

Adjusting tax rates according to the two options mentioned above, along with increasing family deductions and adding other deductions such as health, education, etc., the tax burden will be significantly reduced, especially for the middle-low income group, who will be exempt from personal income tax. For individuals with higher incomes, the level of tax regulation will also be reduced compared to the current level.

According to the Ministry of Finance's calculations, adjusting the tax schedule according to option 1 would reduce the budget revenue by 7,120 billion VND and according to option 2, the revenue would reduce by 8,740 billion VND. The Ministry of Finance submitted to the Government for implementation according to option 2.

Source: https://www.sggp.org.vn/hoan-thien-du-an-luat-thue-thu-nhap-ca-nhan-sua-doi-trinh-quoc-hoi-vao-thang-10-post812943.html

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)