After yesterday's volatile session with sudden liquidity , green returned to dominate Vietnamese stocks when the indices traded above the reference price for most of the trading session on July 4. VN-Index fluctuated in the 1,380 - 1,390 point range all day today and closed up 5 points (+0.36%) compared to yesterday, while HNX-Index increased more strongly with an amplitude of 0.68%, to 232.51 points. UPCoM index also increased slightly by 0.31%.

This increase was accompanied by a clear differentiation between stock groups. Technology stocks were the bright spot of the session with FPT increasing by more than 3%, ITD increasing by 2.6%, while CMG increased by 1.4%. Banking stocks also increased simultaneously, led by NVB hitting the ceiling,ACB +2.1%. Some other bank stocks such as VCB, VPB, STB, LPB, TCB increased slightly. Steel, food and beverage and retail groups also traded positively. Seafood stocks also turned around after the previous cautious session, with ANV alone increasing by 5.8%.

Meanwhile, securities stocks have differentiated after a period of strong cash flow attraction and steady growth in the previous period. Real estate stocks also recorded mixed movements with sharp declines in some large stocks such as VIC, VHM, DXS. However, VRE, DXG, NVL... have attracted cash flow quite positively.

Green dominated with 447 stocks increasing in price on the three exchanges, while only 273 stocks decreased in price.FPT continued to stand out when it increased by 3.81% to 122,500 VND/share, becoming the stock that contributed the most points to the VN-Index. The stocks that contributed the most points in the session were FPT, VCB, ACB... Meanwhile, in the opposite direction, VIC, VHM, GVR, BCM put pressure on the index. Vingroup shares alone took away 2.23 points from the general index. According to experts from Pinetree, the cash flow in the market "rotated" to pull up large-cap stocks, while the mid-cap group was differentiated. Investors may therefore find it difficult to "make money" at this time.

|

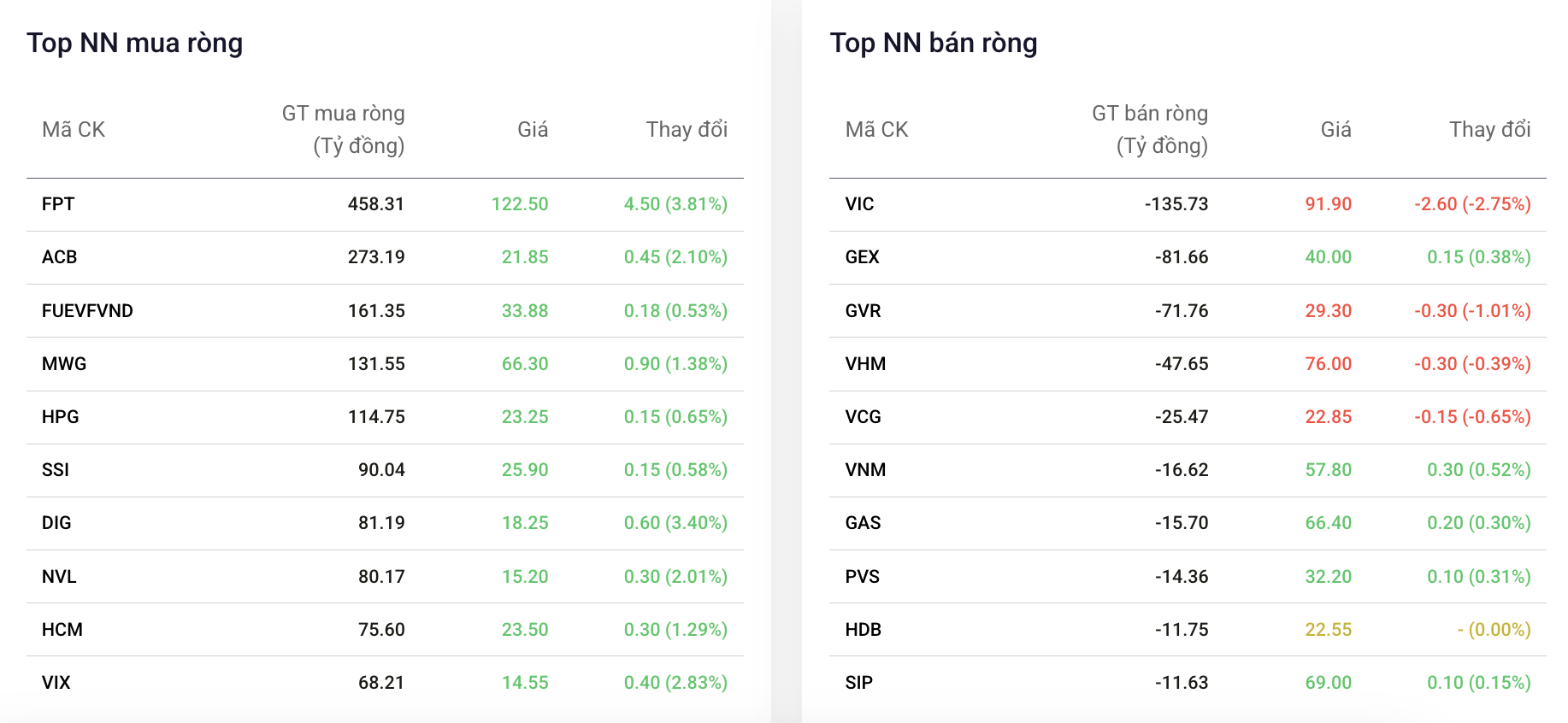

| Top stocks net bought/sold by foreign investors in the session of July 4 - Source: Dstock |

In today's session, the bright spot of the market continued to come from foreign transactions. After yesterday's strong disbursement session, foreign investors continued to net buy 1,849 billion VND across the market . The focus of net buying was FPT ( 458 billion VND ) and ACB ( 273 billion VND ). These are also the two pillars that had the most positive impact on the market today. The stocks that were net bought all closed with an increase in price. On the selling side, VIC was the code that foreign investors sold the most with a value of 135.7 billion VND, followed by GEX, GVR and VHM. However, three consecutive net buying sessions by foreign investors are supporting positive sentiment for domestic investors.

Liquidity on July 4 was lower than yesterday's session but still remained at a high level with the total trading value on HOSE reaching over VND20,800 billion, with matched volume alone reaching nearly 876 million shares. Trading value on HNX and UPCoM reached VND1,539 billion and VND506 billion, respectively.

Source: https://baodautu.vn/khoi-ngoai-manh-tay-giai-ngan-tuan-dau-thang-7-vn-index-tien-gan-moc-1390-diem-d322126.html

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)