Yesterday (December 13), Xinhua News Agency reported that the annual Central Economic Work Conference had just concluded in Beijing. Through the conference, Mr. Xi Jinping, President of China, emphasized the priorities for the country's economic development in 2025.

Stimulating the domestic market

Accordingly, China will adopt a more proactive fiscal policy and run a higher budget deficit as a percentage of GDP, while ensuring a strong fiscal policy continuity to create a greater impact. Mainland policymakers pledged to increase the issuance of ultra-long special treasury bonds and local government special purpose bonds, and optimize the structure of fiscal spending.

China's economy is facing many difficulties.

Before the conference, China's top officials revealed that they would loosen monetary policy by 2025 by adopting a "moderately loose monetary policy." The last time China used the phrase was in July 2010 when the country was dealing with the fallout from the global financial crisis.

The Beijing government’s goal is to stimulate the domestic consumer market. This is emphasized as China is increasingly facing challenges as the trade war with the US is expected to escalate after Donald Trump officially takes office as US president on January 20, 2025.

If the trade war escalates as predicted, China may face even greater difficulties. This is because the country's economy has not yet effectively solved problems such as the sluggish real estate market and declining confidence and income, which have caused consumption to remain low. Therefore, monetary easing and flexible fiscal policy are seen as strategies to strengthen the domestic market.

Bold but effective measures?

In fact, China has been rolling out massive stimulus packages for the past few months. In late September, the country cut mortgage rates for existing homes and reserve requirements by 0.5 percentage points. This plan is expected to benefit 50 million households – equivalent to 150 million people – reducing the average household borrowing cost by about 150 billion yuan per year, aiming to effectively boost consumption and investment.

In addition, the People's Bank of China (PBOC - acting as the central bank) is also considering measures to allow policy and commercial banks to provide loans to qualified companies to buy land. This solution is to revive land resources and reduce financial pressure on real estate enterprises. Previously, the PBOC reduced the 14-day repo rate by another 10 basis points, from 1.95% to 1.85%. Along with that, the PBOC also used this tool to inject 74.5 billion yuan (about 10.6 billion USD) into the economy.

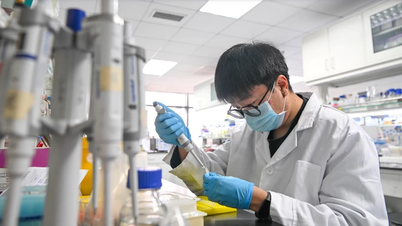

Beijing has also begun to use measures to stimulate investment amid concerns that Washington's sanctions are causing capital to flow out of China. A typical example is the "bold capital" initiative to direct investment to early-stage, technology-focused projects that accept higher risks.

The initiative, which began in Shenzhen in October as part of a plan to promote high-quality development in venture capital, will see Shenzhen commit to a series of government investment funds worth trillions of yuan (nearly $140 billion), develop an industrial fund cluster worth hundreds of billions of yuan, and a seed and angel investment fund cluster worth 10 billion yuan (nearly $1.4 billion) by 2026. Shenzhen aims to "fully tap the potential of private capital and strive to register more than 10,000 private equity and venture capital funds."

However, China’s ambitious action plans are said to be out of step with the reality. Many observers believe that the Chinese economy is actually facing more difficult problems than simply declining consumption or stagnant real estate. The reason is that the long-standing development models are no longer suitable.

In response to the announcement of the new plans, the country's stock market continued to decline yesterday (December 13). Meanwhile, according to an assessment sent to Thanh Nien by S&P Ratings, China's economy will find it difficult to achieve the 5% growth target this year, with growth forecasts for 2025 and 2026 at 4.1% and 3.8%, respectively.

Source: https://thanhnien.vn/kinh-te-trung-quoc-trong-chien-luoc-quay-ve-co-thu-185241213220517188.htm

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Infographic] Key tasks in the 2025-2030 term of Dong Nai province](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/30/59bd43f4437a483099313af036fef0db)

Comment (0)