Dong A Commercial Joint Stock Bank (Dong A Bank) has reduced deposit interest rates starting today after adjusting all terms from 1 to 36 months.

Accordingly, Dong A Bank reduced 0.3 percentage points for deposit terms from 1 to 12 months.

Interest rates for 1-5 month terms have been reduced to 4.2% per year; for 6-8 month terms, they have been adjusted down to 5.2% per year. For 9-11 month terms, they have been reduced to 5.3% per year and for 12 month terms, they have been reduced to 5.55% per year.

Dong A Bank also adjusted the remaining term with a decrease of 0.15 percentage points. Accordingly, the interest rate for 13-month term deposits is down to 5.95%/year, and for 18-36-month term deposits is down to 5.7%/year.

Dong A Bank also applies a “special interest rate” policy for “super VIP” customers. Although the interest rate for deposits with a term of 13 months or more is only 5.7%/year, customers with savings of 200 billion VND or more will be applied 7.5%/year.

Similarly, some banks, despite sharply reducing deposit interest rates recently, still maintain a "special interest rate" policy to attract large customers.

For example,ACB , although it has reduced the interest rate for all terms to below 5%/year, still applies a special interest rate for the 13-month term for customers depositing from 200 billion VND or more. The "huge" interest rate applied by ACB is 6.5%/year (receive interest at the end of the term) and 6.25%/year (receive interest monthly).

HDBank is applying interest rates at the counter, 12-month and 13-month terms of 8.2%/year and 8.6%/year respectively for deposits of at least VND300 billion or more.

Even MSB Bank is paying interest rates at the counter up to 9%/year for 12 and 13 month term deposits with a minimum deposit amount of 500 billion VND or more.

Also today, PG Bank reduced the interest rate for 1-6 month terms by up to 0.4 percentage points. Specifically, the interest rate for 1-3 month terms was previously listed at 3.8%/year, but now there is a differentiation. The 1 month term now has an interest rate of only 3.4%/year, the 2 and 3 month terms have interest rates of 3.5% and 3.6%/year, respectively.

Even the 6-month deposit interest rate has dropped below 5% after decreasing by 0.2 percentage points, now only 4.9%/year.

PG Bank still maintains the deposit interest rates for the remaining terms. The current 9-month term has an interest rate of 5.3%/year, the 12-month term 5.4%/year, the 13-month term 5.5%/year, the 18-month term 6.2%/year and the 24-36-month term has an interest rate of up to 6.3%/year.

After a few quiet days at the beginning of the month, banks have been rushing to reduce deposit interest rates since the beginning of this week.

Notably, some private joint stock commercial banks have brought the interest rate for 6-9 month term deposits to below 5%. These banks are ACB, Techcombank, SeABank , ABBank.

Even the 6-12 month term deposit interest rate at ACB is lower than the "big 4" group. Specifically, the 6 month term deposit interest rate at ACB is currently only 3.5%/year, the 9 month term is 4.6%/year, and the 12 month term is 4.65%/year, the lowest rate in the market today.

PG Bank and Nam A Bank have also lowered their 6-month deposit interest rates to below 5%/year, specifically 4.9%/year.

Since the beginning of November, 14 banks have reduced deposit interest rates, including Sacombank, NCB, VIB, BaoVietBank, Nam A Bank, VPBank, VietBank, SHB, Techcombank, Bac A Bank, KienLongBank, ACB, Dong A Bank, PG Bank.

| HIGHEST INTEREST RATES AT BANKS ON NOVEMBER 9 (%/year) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| PVCOMBANK | 3.95 | 3.95 | 6.1 | 6.1 | 6.2 | 6.5 |

| OCEANBANK | 4.6 | 4.6 | 5.8 | 5.9 | 6.1 | 6.5 |

| CBBANK | 4.2 | 4.3 | 5.7 | 5.8 | 6 | 6.1 |

| HDBANK | 4.05 | 4.05 | 5.7 | 5.5 | 5.9 | 6.5 |

| VIET A BANK | 4.5 | 4.5 | 5.6 | 5.6 | 6 | 6.3 |

| BVBANK | 4.4 | 4.7 | 5.55 | 5.65 | 5.75 | 5.75 |

| BAOVIETBANK | 4.4 | 4.75 | 5.5 | 5.6 | 5.9 | 6.2 |

| NCB | 4.45 | 4.45 | 5.5 | 5.65 | 5.8 | 6 |

| GPBANK | 4.25 | 4.25 | 5.45 | 5.55 | 5.65 | 5.75 |

| BAC A BANK | 4.35 | 4.35 | 5.4 | 5.5 | 5.6 | 5.95 |

| KIENLONGBANK | 4.55 | 4.75 | 5.4 | 5.5 | 5.5 | 6 |

| VIETBANK | 3.9 | 4.1 | 5.4 | 5.5 | 5.8 | 6.4 |

| SCB | 4.5 | 4.5 | 5.35 | 5.45 | 5.65 | 5.65 |

| OCB | 4.1 | 4.25 | 5.3 | 5.4 | 5.5 | 5.9 |

| DONG A BANK | 4.2 | 4.2 | 5.2 | 5.3 | 5.55 | 5.7 |

| SHB | 3.5 | 3.8 | 5.2 | 5.4 | 5.6 | 6.1 |

| SAIGONBANK | 3.4 | 3.6 | 5.2 | 5.4 | 5.6 | 5.6 |

| EXIMBANK | 3.5 | 4 | 5.2 | 5.5 | 5.6 | 5.8 |

| VIB | 3.8 | 4 | 5.1 | 5.2 | 5.6 | |

| LPBANK | 3.8 | 4 | 5.1 | 5.2 | 5.6 | 6 |

| MB | 3.5 | 3.8 | 5.1 | 5.2 | 5.4 | 6.1 |

| SACOMBANK | 3.6 | 3.8 | 5 | 5.3 | 5.6 | 5.75 |

| VPBANK | 3.7 | 3.8 | 5 | 5 | 5.3 | 5.1 |

| TPBANK | 3.8 | 4 | 5 | 5 | 5.55 | 6 |

| MSB | 3.8 | 3.8 | 5 | 5.4 | 5.5 | 6.2 |

| PG BANK | 3.4 | 3.6 | 4.9 | 5.3 | 5.4 | 6.2 |

| NAMA BANK | 3.6 | 4.2 | 4.9 | 5.2 | 5.7 | 6.1 |

| ABBANK | 3.9 | 4 | 4.9 | 4.9 | 4.7 | 4.4 |

| SEABANK | 4 | 4 | 4.8 | 4.95 | 5.1 | 5.1 |

| TECHCOMBANK | 3.55 | 3.75 | 4.75 | 4.8 | 5.25 | 5.25 |

| AGRIBANK | 3.4 | 3.85 | 4.7 | 4.7 | 5.5 | 5.5 |

| VIETINBANK | 3.4 | 3.75 | 4.6 | 4.6 | 5.3 | 5.3 |

| BIDV | 3.2 | 3.5 | 4.4 | 4.4 | 5.3 | 5.3 |

| VIETCOMBANK | 2.8 | 3.1 | 4.1 | 4.1 | 5.1 | 5.1 |

| ACB | 3.3 | 3.4 | 3.5 | 4.6 | 4.65 | |

Source

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

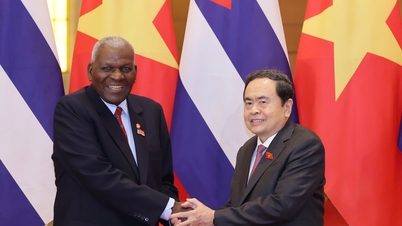

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)