Vietnam has just experienced a year of many high-level diplomatic activities, including upgrading relations with both the US and Japan to the level of “comprehensive strategic partnership”.

After celebrating the 50th anniversary of diplomatic relations and signing an agreement to upgrade the ASEAN-Australia-New Zealand Free Trade Area (AANZFTA) last August, Australia is expected to be Vietnam's next "comprehensive strategic partner".

In fact, the two governments have repeatedly announced their intention to develop the relationship to a new level. This week, Prime Minister Pham Minh Chinh paid an official visit to Australia and attended a special summit to celebrate 50 years of ASEAN-Australia dialogue relations with leaders of other ASEAN countries.

From supplying key raw materials to Vietnam to opening up new areas of cooperation, Australia plays a significant role in Vietnam’s growth story, according to a report recently released by HSBC Global Research.

HSBC's report “Vietnam and Australia: Ready for a new phase” points out that once the two sides become “comprehensive strategic partners”, there are potential directions for bilateral relations waiting ahead.

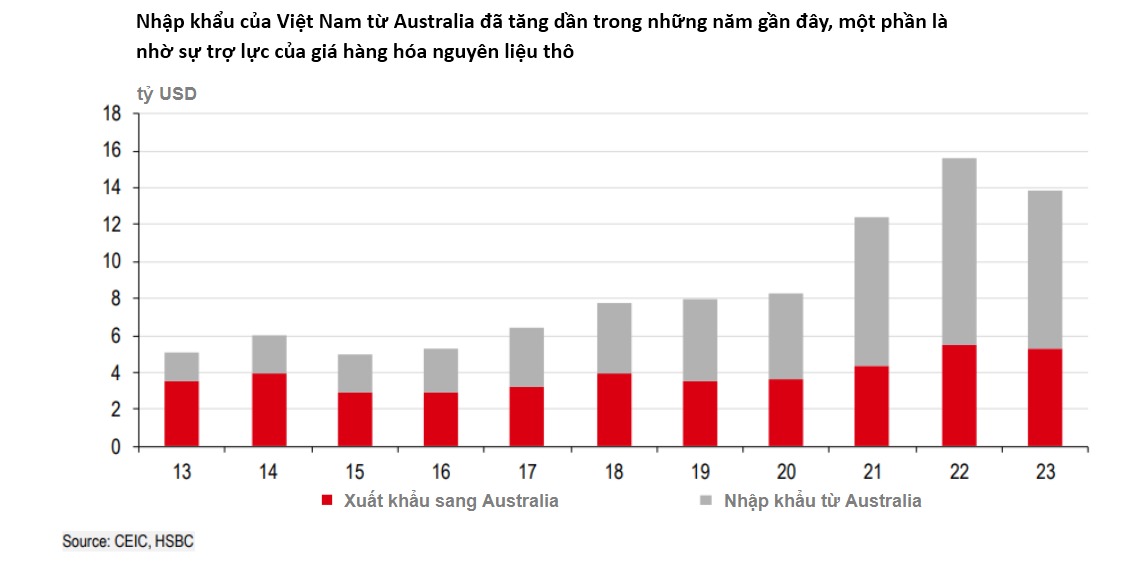

First, bilateral trade between Vietnam and Australia has boomed over the past decade, more than doubling to $13.8 billion in 2023. However, part of the increase in trade since the pandemic has come from rising global raw material prices. Specifically, the two commodities that have increased the most are coal and cotton.

Vietnam is currently Australia's largest single cotton export market, accounting for 40% of the country's total cotton export turnover, double the market share in 2020. Similarly, Australia accounts for nearly 40% of Vietnam's cotton import turnover.

Although in terms of proportion to total exports (15%), Vietnam’s textile and garment industry has seen its market share decline in recent years while electronics has increased to 35%, this is still considered an advantage for Australian cotton exporters.

The trade boom is not limited to manufacturing, however. A huge increase in household discretionary spending has also fueled demand for some Australian exports. In particular, Australian beef exports have boomed thanks to the elimination of many tariffs under the AANZFTA agreement in 2018.

More encouraging is Vietnam’s beef consumption potential. According to OECD-FAO, by 2030, Vietnam’s beef consumption per capita is forecast to be the highest in ASEAN, opening up opportunities for increased trade flows.

On the other hand, Vietnam’s exports to Australia are also increasing. Agricultural products are the leading products, with nuts and seafood accounting for the majority. For example, the majority of cashew nuts imported into Australia come from Vietnam, according to ITC data.

In order to further take advantage of trade agreements between the two countries such as AANFTA, CPTPP and RCEP, HSBC experts pointed out in the report that it is equally important for Vietnam to improve quality control for agricultural exports, especially in the context of Australia's quality standards and regulations being more stringent than those of the US and EU in some areas.

Currently, only four types of fresh fruit have access to the Australian market: mango, dragon fruit, lychee and longan, but that is also a sign that there are still great opportunities to expand the market.

Second, services are also an area worth considering, although the pace is still slow. Last year, ASEAN welcomed 4 million tourists from Australia, but less than 10% of them went to Vietnam. Part of the reason may be related to visas, as Australian visitors to Vietnam are not yet exempt from visas and there are still restrictions on the number of flights.

Encouragingly, Vietnam is considering expanding its visa exemption list and introducing new routes, both important initiatives as Australian tourists tend to stay longer and spend more during their holidays.

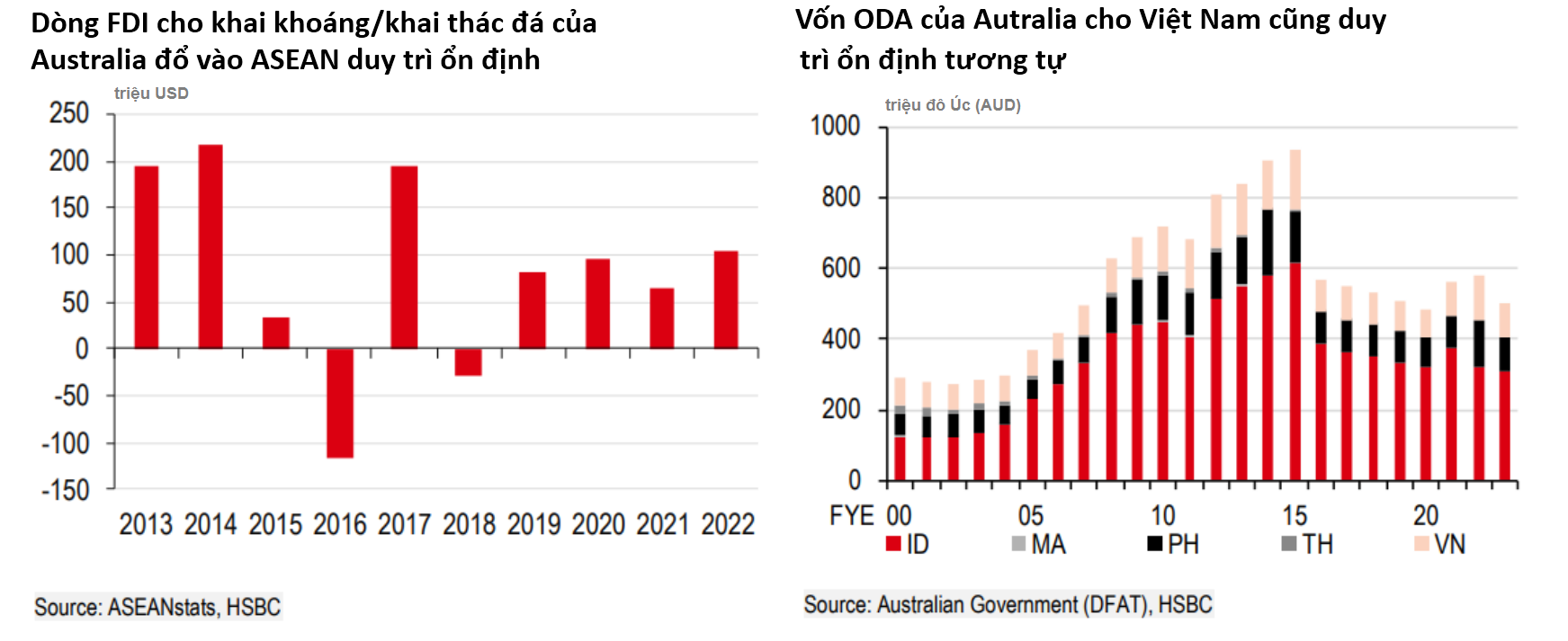

Third, in terms of investment, Vietnam has the world’s second-largest rare earth reserves, which are largely untapped. Australian businesses with expertise in mining and processing are also looking to seize the opportunity, with steady FDI flows into the sector across ASEAN as a whole.

For Vietnam, a prime example is Blackstone Minerals, a company with two major projects in Son La province, including an exploration and exploitation project and a nickel ore deep processing project.

In addition to its critical minerals, Australia’s role as a major energy supplier to Vietnam puts it in a strategic position to help accelerate Vietnam’s energy transition, with the Australian Government committing to provide 105 million Australian dollars (AUD) in support to Vietnam in this area.

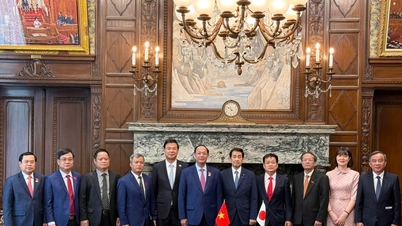

Apart from trade and FDI, other forms of cooperation are equally important, according to the HSBC report. While Indonesia has long been the main recipient of official development assistance (ODA), Vietnam has also seen a steady increase in ODA flows from Australia, the report said.

In the field of human resources, the two sides also have close links. Australia has long established a milestone in education by establishing the first foreign-invested international university in Vietnam (RMIT University) since 2000.

As part of its commitment to Vietnam, the Royal Melbourne Institute of Technology (RMIT) in Vietnam received an additional investment of AU$250 million last year, contributing to the opening of an Innovation Hub to support workforce skills upgrading.

Over the years, Australia has played a role in Vietnam's growth story. In the future, opportunities arising from new demand will be the foundation for a new page in Vietnam-Australia relations, the HSBC report concluded .

Minh Duc

Source

Comment (0)