Shopping malls with prime locations are sought after by many tenants.

According to the Real Estate Market Focus Report for the third quarter of 2024 in Ho Chi Minh City by CBRE Company Limited (Vietnam), for three consecutive years from 2020 to 2022, Ho Chi Minh City has not had any new supply of completed commercial centers.

Entering 2024, the market will gradually become more vibrant with 4 new shopping malls opening, including two Vincom shopping malls that will come into operation in the second quarter of 2024, Parc Mall (35,000 m2, District 8) just opened in the third quarter of 2024 and Central Premium Mall (30,000 m2, District 8) expected to be completed in the fourth quarter of 2024, helping the scale of the Ho Chi Minh City retail market by the third quarter of 2024 to reach nearly 1.2 million m2.

Along with the new shopping malls opening, there is the presence of new brands, the brand expands its premises, the average occupancy area is improved, increasing from 93% to 94%.

In the first 9 months of 2024 alone, newly leased retail space was recorded at 87,000 square meters, the highest in the past 3 years.

Newly opened shopping malls are almost 100% filled, leading to the average vacancy rate of the whole market in both central and non-central areas being approximately equal, at only 5-6%.

(Source: CBRE Vietnam).

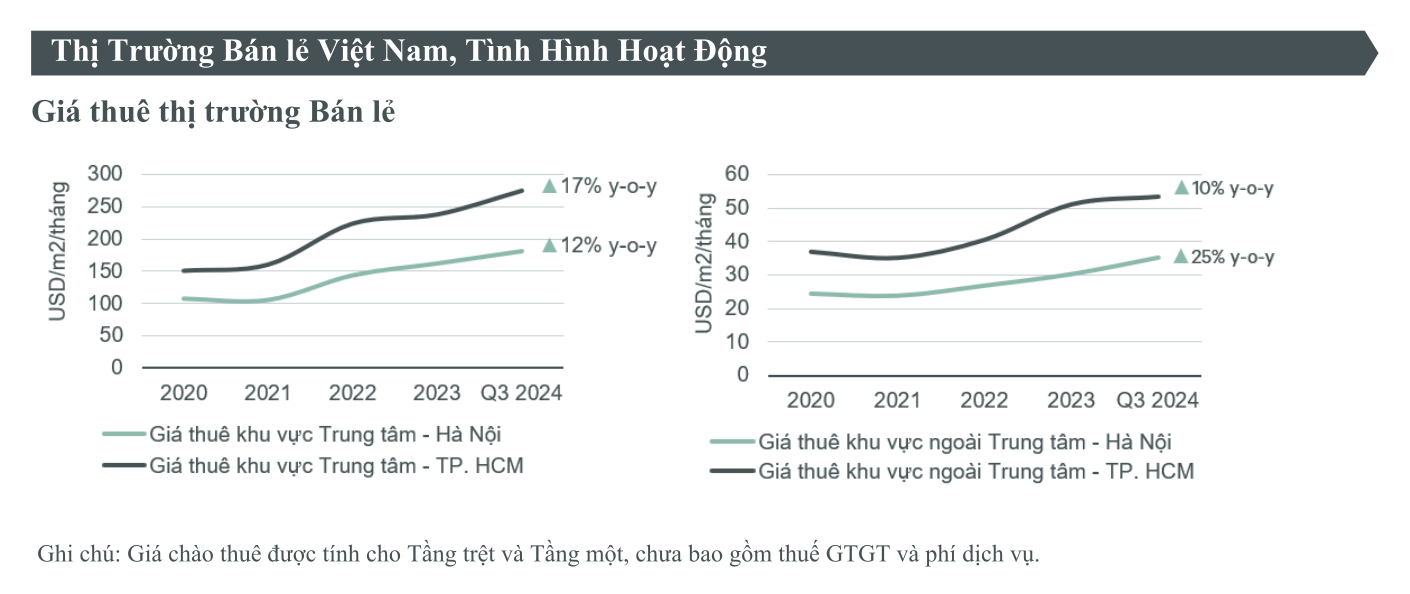

Rental prices in the central area remained almost unchanged due to the lack of vacant space for lease, averaging 274 USD/m2 (6.8 million VND/m2) for the ground floor and first floor.

The average rental price in the non-central area was recorded at 53 USD/m2 (1.3 million VND/m2), down 0.9% compared to the previous quarter because newly opened shopping malls are all located in suburban districts, so the rental price is softer than the general level, but still 10% higher than the same period last year.

Rental prices in Ho Chi Minh City have seen significant increases in recent years, and prime shopping malls are still continuously sought after by many tenants, including both new brands entering the market and existing brands.

Rental prices in Ho Chi Minh City have witnessed significant increases in recent years.

Ms. Pham Ngoc Thien Thanh - Head of Research and Consulting Department of CBRE in Ho Chi Minh City said: "After a long period of silence and being affected by the Covid-19 pandemic, brands have gradually regained confidence and become more confident in expanding their chain of stores."

CBRE statistics on the total number of transactions in the market in the past 3 years, the market recorded expansion mainly from F&B brands (Food and Beverage, accounting for 35%), followed by Fashion & Accessories brands (33%).

The Lifestyle industry ranked 3rd with 13%, and is also gradually growing. This is an industry that tends to develop quite strongly abroad and is gradually spreading in Vietnam, with the business area of each store also getting larger and larger, up to 1,000 m2.

Ready-built warehouse rental prices remain stable

Not only shopping mall leasing activities are developing positively, in the third quarter of 2023, CBRE's report recorded vibrant leasing activities in both warehouses and ready-built factories.

The average warehouse occupancy rate increased 7% quarter-on-quarter to 68%; and the factory occupancy rate increased 3% quarter-on-quarter to 84%.

In the first 9 months of 2024, the Southern tier 1 market leased nearly 420,000 m2 of warehouses and 543,000 m2 of factories, nearly double the same period last year.

The demand for ready-built warehouses in the South comes from manufacturers in the high-tech, electronic components, and logistics sectors, in addition to the expansion of companies in the e-commerce sector.

In the third quarter of 2024, more than 140,000 m2 of warehouses were recorded as completed and it is expected that there will be more than 150,000 m2 of warehouses by the end of 2024, mainly in Long An .

Industrial real estate is gradually attracting the attention of many foreign investors.

Regarding average rental prices, ready-built warehouse rental prices in the Southern market remained stable compared to the previous quarter, reaching 4.6 and 4.9 USD/m2/month, respectively, with growth reaching 2.7% over the same period last year for warehouses and 0.4% for factories.

In the next 3 years, industrial land rental prices are expected to increase by 5-8%/year in the North and 3-7%/year in the South.

Meanwhile, rental prices of ready-built warehouses/factories are forecast to increase slightly by 1-4%/year, with the ready-built factory segment experiencing a higher price increase rate in the next three years.

Ms. Thien Thanh predicted: "With stronger investment in developing transport infrastructure in the Southern region, the industrial real estate market is spreading to new areas such as Tier 2 markets and the Mekong Delta, opening up many opportunities for investors.

The industrial real estate market used to be a traditional market, mainly developed by domestic investors. However, in recent years, we have seen stronger interest and investment from foreign investors, from Singapore, Korea and Thailand."

Source: https://www.nguoiduatin.vn/mat-bang-ban-le-cho-thue-tai-tphcm-lap-dinh-moi-204241009153213648.htm

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)