Circular 77/2025 of the Ministry of Finance details securities trading and securities transfer services under Decree 181/2025 of the Government on the Law on Value Added Tax, a number of business services, and securities transfer activities that are not subject to tax. This provision applies to taxpayers performing securities trading and securities transfer services; tax authorities, relevant organizations and individuals.

Specifically, securities trading services not subject to VAT include brokerage; receiving entrusted account management; online trading; lending for purchase and advance payment for sale; trading, online connection, use of terminals; borrowing and lending; custody, clearing, payment of transactions; post-transaction processing and error correction; management of collateral assets, position management; payment of principal, interest, repurchase of government bonds and other types of bonds as prescribed.

Some securities activities and services are not subject to tax.

PHOTO: NGOC THANG

Also includes the fields of securities trading at securities companies; investment, capital contribution, issuance, offering of financial products and secured warrants; and market making transactions. As well as securities underwriting and related services; securities investment consultancy; securities investment fund management, securities investment portfolio management.

In addition, securities transfer activities not subject to VAT include transfers through the trading system of the Stock Exchange; transfers of ownership outside the system of the Stock Exchange; and securities transfers. At the same time, transfers through auctions, bidding, competitive offerings, and book building are also exempt from tax.

Source: https://thanhnien.vn/mot-so-dich-vu-kinh-doanh-hoat-dong-chung-khoan-khong-chiu-thue-185250907094052924.htm

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

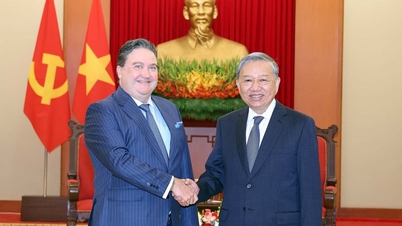

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam chairs the meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/fb2a8712315d4213a16322588c57b975)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Infographics] An Giang tourism makes a spectacular breakthrough](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/30/e472f9f3f91d407ba4b7de460fb0481d)

Comment (0)