Many customers have difficulty updating biometric features

To ensure safety in electronic transactions, since the morning of July 1, many commercial banks have updated the biometric verification feature for transactions of 10 million VND or more or transactions totaling 20 million VND/day.

Responding to reporters, many people felt that transactions were slow, inconvenient, and encountered many typical errors such as not being able to transact or not being able to register for biometric confirmation.

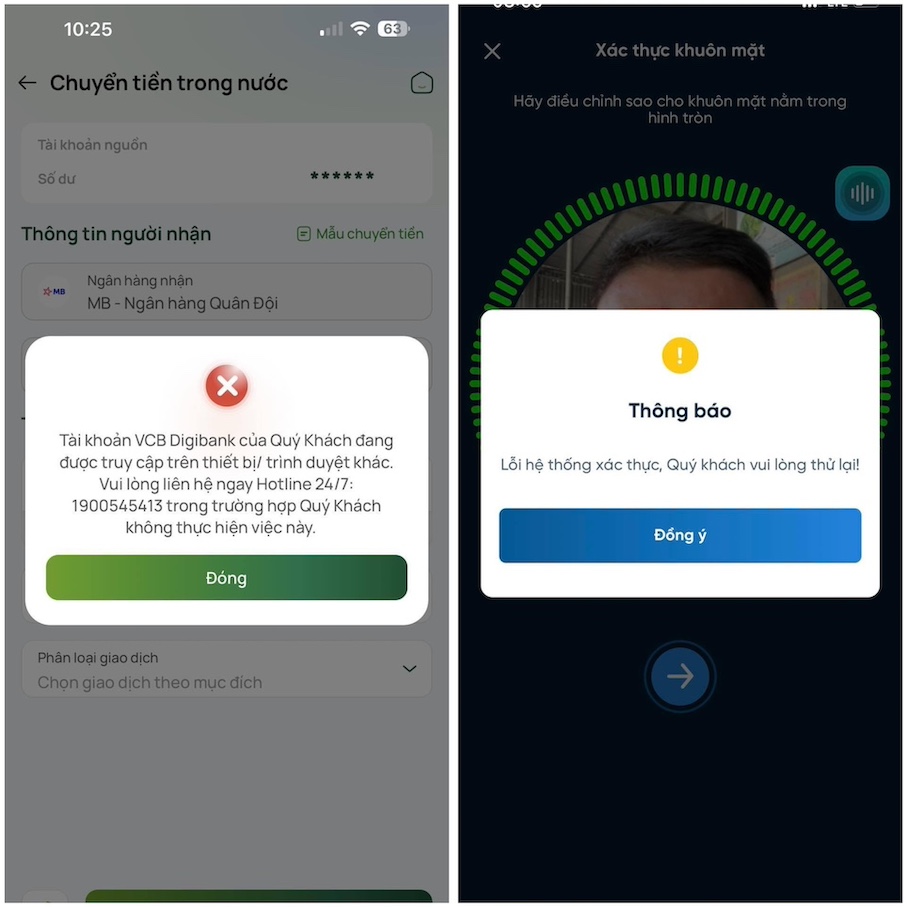

Using the payment application of Vietcombank Joint Stock Commercial Bank as the main means of payment, but since the announcement of updating the biometric feature, Mr. Hoang Duc Phuc ( Thai Binh ) has continuously encountered problems when he cannot update successfully.

Mr. Phuc said: "There are times when money needs to be transferred immediately but it is not successful. The bank informed that it was due to a server error when registering."

Also at Vietcombank, on the morning of July 1, Mr. Hieu Trung (residing in Dam Ha, Quang Ninh ) panicked when he continuously encountered the error "account is being accessed on another device/browser", making it impossible for him to make timely transactions.

Similar to Vietcombank, with Vietnam International Commercial Joint Stock Bank (VIB), many customers also cannot update biometrics.

Hoang Ngoc Tuan (Hanoi) said he spent two days over the weekend updating this feature, but when his phone scanned his ID card, it repeatedly failed. On the morning of July 1, when he tried to complete it, Tuan encountered a connection error.

“I couldn’t call the bank hotline. When I got to the bank, it was crowded and I had to wait. At times like these, customers can’t stay calm,” Tuan shared.

According to the new regulations, from today (July 1), individual customers who transact more than 10 million VND or total daily transactions more than 20 million VND will have to check biometric signs (face). Therefore, customers need to authenticate biometrics with the bank to ensure successful transactions.

Therefore, many people "cried out" because they could not make transactions during the day because the bank's application continuously displayed a notification requesting a biometric update.

Pham Hoang Lan (Ha Dong, Hanoi) said: "This morning, I wanted to transfer 20,000 VND but the banking application kept showing a notification asking for an update, this is very annoying."

Banks work overtime to support biometric installation for people

Besides those who have difficulty updating biometrics, some others have found solutions to make the biometric authentication process easier. Talking to reporters, Mr. Vu Phan Anh (currently residing in Ho Chi Minh City) said that IPhone models are installed with near-field readers (NFC) at the device head to read the electronic chip on the citizen identification card. Users can bring the phone head close to the chip card to easily complete the biometric registration.

Ms. Hoang Hoa (Hanoi) also shared that scanning the chip with the front camera and placing the citizen ID card vertically will help scan the citizen ID card successfully and faster.

To support people, many banks have increased support for biometric installation at transaction points and branches over the past two weekends, June 29 and 30.

This week, residents are encouraged to visit bank branches in their neighbourhoods to avail biometric authentication support.

According to people's feedback, many branches are overloaded with customers coming to handle issues related to biometric installation. However, some bank branches said that the number of customers coming is not too large, people can look for other branches in the area to perform authentication faster.

In addition to commercial banks, the National Population Data Center and the Department of Administrative Police for Social Order have also prepared plans to handle difficulties and problems that people encounter.

According to the regulator, the mandatory biometric update is aimed at preventing losses to account holders when fraudsters withdraw money repeatedly in large amounts. The purpose of these regulations is to ensure that it is the right person who is transferring money, thereby contributing to the safety of account holders.

According to the representative of the Payment Department (SBV), the above regulation only applies to regular money transfer transactions, not to payment transactions where the recipient is a clear destination. All payment transactions that are authenticated by payment acceptance units, credit institutions, and payment intermediaries do not require biometric authentication. For example, payment of electricity, water, tax, transportation fees, etc., all transactions with a clear destination do not require biometric authentication.

Source: https://laodong.vn/kinh-doanh/muon-kieu-kho-khan-cua-nguoi-dan-ngay-dau-trien-khai-sinh-trac-hoc-khi-giao-dich-1360205.ldo

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)