The Ministry of Finance is studying investment support policies for FDI enterprises, as Vietnam applies a global minimum tax from the beginning of this year.

The information was shared by Mr. Mai Xuan Thanh, Director General of the General Department of Taxation (Ministry of Finance) with nearly 300 Korean and Vietnamese enterprises, at an investment promotion conference in Korea on March 7.

Vietnam will impose a global minimum tax from early 2024. The tax rate is 15% for multinational enterprises with a total consolidated revenue of 750 million euros (about 800 million USD) or more in two of the four most recent years. About 122 foreign-invested corporations must pay this tax in Vietnam, according to a review by the tax authority.

Many investors are concerned that applying this tax will affect FDI capital flows, because the tax incentives previously given to them will no longer be effective.

Sharing at today's conference, Mr. Mai Xuan Thanh said that the Government assigned ministries and branches to coordinate in researching investment support policies for FDI enterprises subject to global minimum tax, from additional corporate income tax sources.

The ministry also reviewed current tax incentives to make them more attractive, consistent with the new situation and international practices. The incentive policies of countries that have applied global minimum tax were also studied by the agency, so that "Vietnam's mechanism is no less attractive than theirs."

"This also attracts foreign capital from future investors and protects existing businesses," said the General Director of the General Department of Taxation.

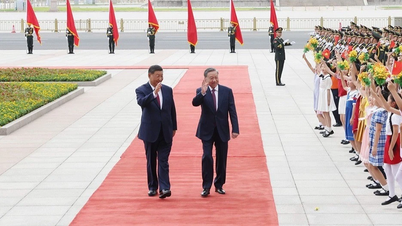

Mr. Mai Xuan Thanh, Director General of the General Department of Taxation, spoke at the investment promotion conference in Korea on March 7. Photo: Ministry of Finance

The need for accompanying preferential policies and support to help foreign enterprises feel secure in investing when applying global minimum tax was suggested by many National Assembly deputies at the end of last year. According to the deputies, these supports will help Vietnam avoid the risk of foreign investors transferring capital and projects to other countries.

In front of Korean enterprises today, Finance Minister Ho Duc Phoc said that tax policy will create maximum convenience for FDI enterprises to invest in Vietnam. The Government has proposed many solutions to support taxes, fees, and land rents for enterprises, including Korean investors.

He reiterated the Vietnamese Government's view that it creates a favorable and attractive investment and business environment for foreign investors.

According to Mr. Kim Yong Jae, Standing Member of the Financial Supervisory Commission of Korea (FSC), the total investment capital of Korea in Vietnam reached about 90 billion USD. Currently, there are more than 8,000 Korean enterprises operating in Vietnam, with 9,863 projects.

Vietnam is the second country in the world to receive investment from Korean financial institutions, with 46 enterprises in the fields of banking, insurance, and securities.

Phuong Dung

Source link

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)