Some current regulations on voluntary social insurance policy, specifically as follows:

- Vietnamese citizens from 15 years of age and older are not subject to compulsory social insurance and are not recipients of pensions, social insurance benefits, or monthly allowances;

- Employees working under indefinite-term labor contracts, labor contracts with a term of 01 month or more, and civil servants whose labor contracts or work contracts are temporarily suspended.

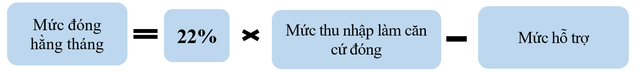

MONTHLY PAYMENT LEVEL

Contribution level:

In there:

- Voluntary social insurance participants can choose the income level as the basis for payment as follows:

+ The lowest level is equal to the poverty line of rural areas (1,500,000 VND/month).

+ The highest level is 20 times the reference level at the time of closing (Currently the reference level is equal to the basic salary of VND 2,340,000/month).

- Voluntary social insurance participants are supported by the State with payment at a percentage (%) of the monthly social insurance payment equal to the poverty line in rural areas:

+ 50% for participants from poor households; people living in island communes and special zones according to regulations.

+ 40% for participants from near-poor households.

+ 30% for ethnic minority participants.

+ 20% for other groups of participants.

** Support period depends on each person's actual voluntary social insurance participation time but not more than 10 years (120 months).

Closing method:

- Selected to close by the following closing method:

+ monthly

+ Every 3 months.

+ Every 6 months.

+ Every 12 months.

+ Many years at a time (no more than 5 years (60 months)/time).

+ One-time payment: For the remaining time (not more than 5 years (60 months)) to qualify for pension.

BENEFITS AND LEVELS OF BENEFITS

Voluntary social insurance participants, when meeting all the prescribed conditions, are entitled to the following benefits:

Maternity leave

- Object:

+ Female workers giving birth;

+ Male workers have wives and children.

- Conditions for benefit: Having paid voluntary social insurance or having paid both compulsory social insurance and voluntary social insurance for at least 06 months within 12 months before giving birth.

- The subsidy level is 2 million VND for each child born and each fetus 22 weeks or older that dies in the womb or dies during labor.

Retirement regime

- Conditions for enjoyment

+ From July 1, 2025, voluntary social insurance participants will receive pensions when they have paid social insurance for 15 years or more and reach the prescribed retirement age.

+ Retirement age: From January 1, 2025

Male: 61 years and 3 months old. After that, increase by 03 months each year. Retirement age for male workers will reach 62 years old in 2028.

Female: 56 years and 8 months old. Then, increase by 4 months each year. Retirement age for female workers will reach 60 years old in 2035.

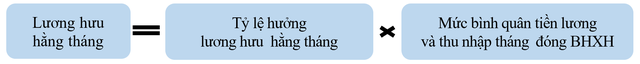

- Benefit level

In which, the monthly pension rate of employees is calculated at 45% corresponding to the number of years of social insurance contribution as follows:

For male workers, it is 20 years. In case the social insurance payment period is from 15 years to less than 20 years, the benefit rate is 40% corresponding to 15 years, then for each additional year of payment, 1% is added.

Female workers are 15 years.

After that, for each additional year of social insurance contribution, both male and female employees will be calculated an additional 2%; the maximum level is 75%. In case the social insurance contribution period is according to the provisions of the International Treaty of which Vietnam is a member but the social insurance contribution period in Vietnam is less than 15 years, each year of contribution during this period will be calculated as 2.25%.

- One-time allowance: Male workers with social insurance payment period of more than 35 years, female workers with social insurance payment period of more than 30 years, when retiring, in addition to pension, will also receive a one-time allowance:

One-time benefit level = 0.5 x Average income level used as basis for social insurance contribution for each year of contribution higher than the prescribed retirement age.

In case the employee is eligible for pension but continues to pay social insurance:

Subsidy level = 02 x Average income level used as basis for social insurance contributions for each year of contribution higher than the prescribed number of years from the time of reaching the prescribed retirement age to the time of retirement.

One-time social insurance

- Conditions for benefit : Subjects in one of the following cases:

(a) Reaching retirement age but not having paid social insurance for 15 years and not continuing to participate in social insurance.

(b) Going abroad to settle down.

(c) People suffering from one of the following diseases: cancer, paralysis, decompensated cirrhosis, severe tuberculosis, AIDS.

(d) People with a working capacity reduction of 81% or more; people with especially severe disabilities.

(d) After 12 months of not continuing to pay social insurance but not having paid for 20 years (for employees who have paid social insurance before July 1, 2025).

- Benefit level calculated based on the number of years of contributions and the basis for social insurance contributions

In which, for each year of social insurance payment:

+ 1.5 times the average monthly income for social insurance contributions for years before 2014.

+ 02 times the average monthly income for social insurance contributions for years from 2014 onwards.

In case the social insurance payment period is less than 01 year, the benefit level is equal to the paid amount but not more than 02 times the average income used as the basis for social insurance payment.

+ The one-time social insurance benefit level of the subjects supported by the State does not include the amount of state budget support for voluntary social insurance payments, except for the cases specified in points (c) and (d) above.

Monthly allowance

- Conditions: Vietnamese citizens who are of retirement age but do not meet the conditions for pension according to regulations and do not meet the conditions for social pension benefits, if they do not receive one-time social insurance benefits and do not reserve them but have a request, they will receive monthly benefits from their own contributions.

- Benefit level:

+ The duration and level of monthly benefits are determined based on the employee's social insurance contribution period and basis. The lowest monthly benefit level is equal to the social pension benefit level.

+ In case the monthly benefit period calculated based on the social insurance contribution period is not enough to receive the monthly benefit until reaching the age of receiving social retirement benefits, the employee can make a one-time payment for the remaining amount to receive until reaching the age of receiving social retirement benefits.

+ In case a person receiving monthly benefits dies, relatives will receive a one-time benefit for the months not yet received and a one-time funeral benefit if they meet the prescribed conditions.

+ People who are receiving monthly benefits will have their health insurance premiums paid by the State budget.

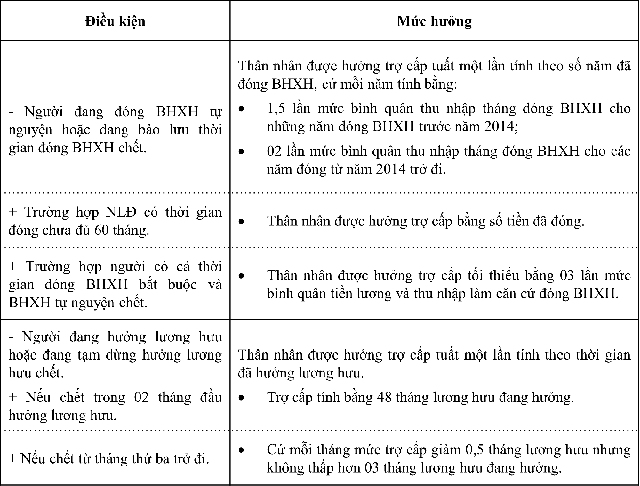

Death benefit

- Funeral allowance

+ Conditions: The following people when they die:

People who have paid social insurance for 60 months or more.

Pensioners, pension suspension.

+ Beneficiaries: Organizations and individuals in charge of funerals.

+ Benefit level: 10 times the reference level in the month the voluntary social insurance participant dies.

-One-time death benefit

Issued health insurance card

Voluntary social insurance participants when receiving pension will be issued a health insurance card by the social insurance agency.

Pension adjustment

Pensions and monthly allowances are adjusted based on the increase in the consumer price index and economic growth in accordance with the State budget and the Social Insurance Fund.

REGISTRATION PLACE AND PARTICIPATION PROCEDURES

- Fill out the participation form according to the prescribed form and register at:

+ Headquarters of provincial and grassroots social insurance agencies.

+ Social insurance and health insurance collection service organizations.

+ National Public Service Portal or Public Service Portal of Vietnam Social Security.

INFORMATION SEARCH

- Electronic information portal: baohiemxahoi.gov.vn

- Hotline: 1900 9068 for advice and support.

- VssID application - Social Insurance number: To update information on social insurance, health insurance, unemployment insurance policies and the payment and benefit process of participants.

(Vietnam Social Security Electronic Information Portal)

xaydungchinhsach.chinhphu.vn

Source: https://baolaocai.vn/nhung-dieu-can-biet-ve-chinh-sach-bao-hiem-xa-hoi-tu-nguyen-post882089.html

![[Photo] Soldiers guard the fire and protect the forest](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/27/7cab6a2afcf543558a98f4d87e9aaf95)

![[Photo] Prime Minister Pham Minh Chinh attends the 1st Hai Phong City Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/27/676f179ddf8c4b4c84b4cfc8f28a9550)

Comment (0)