Saving online is a convenient and safe option. But if you are not careful, you can lose money due to unnecessary mistakes.

Online savings is a safe form of deposit if customers choose a reputable bank and follow the bank's security instructions.

To ensure security and safety for users, banks have applied many new technologies according to international standards such as: multi-factor authentication, fingerprint/Face ID biometric passwords, data encryption... Therefore, the risk rate when depositing savings is very rare, if any, it is due to the user's habit of using services that are not really safe.

Risks due to user habits

To completely eliminate risks when saving online, users need to be alert to the following risks:

Deposit to fake bank

More and more banks are offering online savings services, but there are also more fake websites appearing. If you accidentally click on a link sent via text message, an application downloaded from an unofficial source, or an interface that looks exactly like a real bank, your money can disappear.

If you have transferred money to a fake bank account, the chance of getting it back is very difficult. Fraudsters can withdraw all the money in a few minutes without leaving a trace. Therefore, if you do not carefully check the website address, login link or the origin of the application, the risk of losing money is always lurking.

Lost money due to forgetting interest rate conditions

The advantage of online savings is that the interest rate is higher than at the counter, usually from 0.1-0.5%/year. However, if customers do not read the terms carefully, they may lose interest or receive a lower interest rate than expected.

For example, a customer deposits a 6-month term deposit but closes it early. Therefore, the customer will not receive the term deposit interest rate (about 3-6%/year) but will only receive the non-term deposit interest rate (about 0.5%/year).

Customers should carefully read the terms of the online savings service before confirming to open an account, including how to calculate interest rates, minimum deposit amount, conditions for early settlement, promotion application period... If there is any information that is unclear or incomprehensible, contact the bank immediately for clarification.

Negligence in account security

Saving online is faster but also comes with security risks. Sharing OTP codes, revealing login information, using passwords that are too simple... can cause your account to be hijacked.

Many people are careless when logging into their bank accounts on public devices or unsafe Wi-Fi networks. At that time, criminals can steal information and make transactions without the account owner knowing.

Notes when saving online

According to experts, before depositing money, check the bank carefully, keep your account secure, and read the terms of interest clearly. A little carelessness can make the money accumulated over many years disappear in the blink of an eye.

To be 100% safe, instead of depositing money online, users can deposit savings at the counter and keep the physical book. Because once they have the paper savings book in hand, if they accidentally lose their savings, the fault lies entirely with the bank, so customers can ask the bank to refund.

If depositing savings online, customers can request the bank to confirm that online settlement is not allowed. Request the bank to freeze the account, only opening it when the owner directly comes to the transaction office to request.

In addition, it is possible to deposit jointly owned savings at the counter. When needing to close or withdraw part of the savings, the signatures of the two people whose names are on the savings book are required.

If you want to be more secure with your money in your payment account, you should register for biometric authentication. You can even ask your bank to confirm that your account is only allowed to transfer a certain maximum limit, which can be under 10 million VND.

Things to do immediately when you lose money

Banks recommend that when losing savings in online savings accounts, customers need to quickly contact the bank for the fastest support, providing evidence to prove they were scammed by:

Keep the original and print out a copy of all communications with the scammer such as SMS messages, social media messages, emails, letters, call recordings (if any); make a written statement/report of the incident, listing the entire timeline, the content of the incident and all the information you have about the scammer.

If there are receipts or transaction documents, customers must also keep the original and print out a copy to send to the bank.

In addition, customers can request to print transaction statements to prove asset loss.

You need to contact the bank via hotline or customer care center as soon as possible from the time of discovery, within 30 days from the date of the incident.

After receiving the information, the bank will proceed to check and retrieve information about the fraudulent transaction. At this time, the customer needs to provide additional evidence and documents that the bank requires to serve the investigation such as a copy of the police report, a report of the incident, etc.

After 30 days, if there is still no result, customers should contact the bank's hotline or customer service center to ask about the complaint handling process. Normally, banks will try to resolve the problem within 60 days, maximum 90 days as prescribed in Article 512 of the 2015 Civil Procedure Code.

To ensure the complaint handling process goes smoothly and quickly, customers can invite a consulting lawyer to follow up on the case, advise on optimal solutions, help customers store documents/records as well as communicate with the bank on your behalf.

In addition to the bank, customers also need to report the incident to the police so that the authorities can quickly prepare a file and process it.

Source: https://vietnamnet.vn/nhung-rui-ro-khi-gui-tiet-kiem-online-can-biet-de-tranh-2381022.html

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

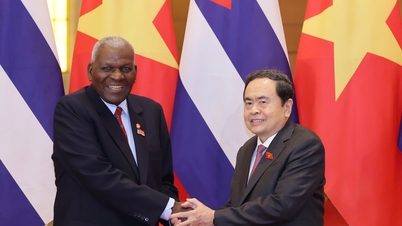

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)