In the modern financial world , few companies have the looming influence of Nvidia, whose stock moves have the potential to shake up the S&P 500, where it makes up nearly 8% of the index.

So as the chip giant prepares to unveil its latest financial report, it is no longer a story of a single business but a signal, a barometer for the health of the entire technology industry and the psychology of global investors.

It has been an extraordinary two years for Nvidia, transforming from a graphics chip maker into the most valuable company on the planet, with a market capitalization exceeding $4 trillion. Chips like the Blackwell B200 have become the backbone that powers the AI superpowers of Microsoft, Meta, Amazon, and Alphabet. But all good things must come to an end.

This second-quarter report is expected to be the first chapter of a new era: an era of "excellent" growth, rather than "utopia."

The financial picture: When "lightning-fast" growth begins to slow

According to Bloomberg forecasts, Nvidia will announce numbers that any company would dream of: revenue of $46.2 billion (up 53% year-on-year) and earnings per share (EPS) of $1.01 (up 49%). The data center segment, the heart of the AI revolution, is expected to contribute $41.2 billion.

These are certainly impressive results. But for Wall Street, context is always more important than numbers. Between 2023 and 2024, Nvidia had five consecutive quarters of triple-digit revenue growth—a nearly unprecedented feat. Now, growth has fallen to double digits.

This slowdown, while inevitable, raises the core question that has haunted investors for months: How long can this miraculous run of success last?

Attention will be focused on the small but important details: the progress of the GB200 superchip shipments, the plans for the next generation of Blackwell Ultra chips, and most importantly, management's forecast for the next quarter. A forecast that is even slightly below expectations could wipe out hundreds of billions of dollars in market capitalization.

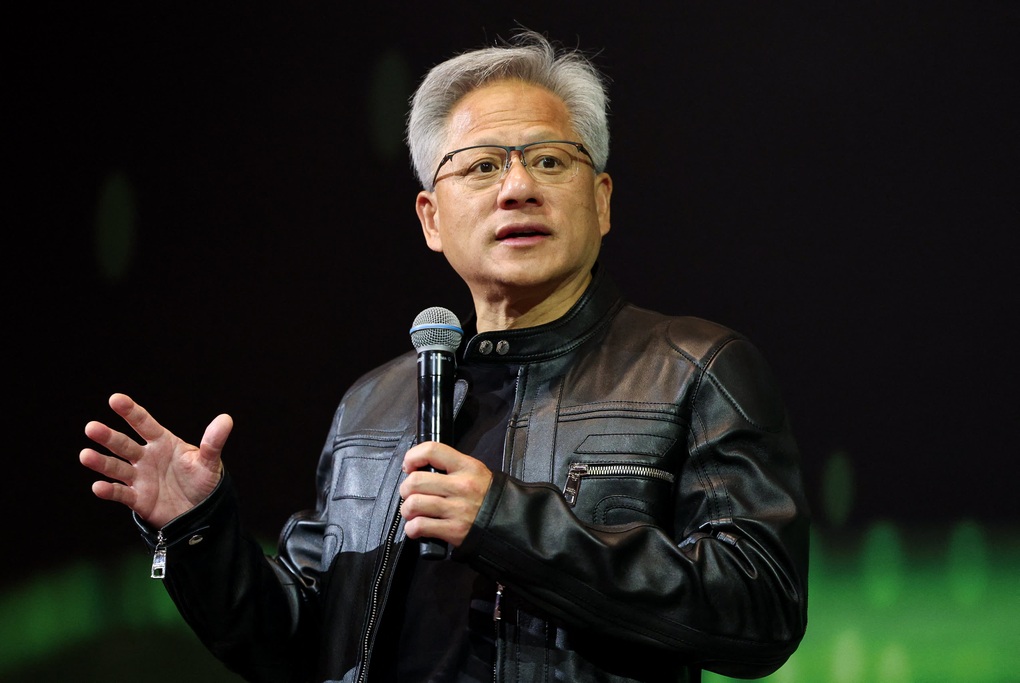

Despite the “policy shocks”, Nvidia shares are still up 35% since the beginning of the year and nearly 44% over the past 12 months. In July, the company became the first company to reach a market capitalization of $ 4,000 billion (Photo: Getty).

Geopolitical "headache": The $8 billion chess game in China

If slowing growth is a gray cloud, geopolitical tensions with China are a storm. This report will for the first time fully reflect the impact of the Trump administration's volatile "tariff war."

The chain of events surrounding Nvidia is dramatic. In April, Washington suddenly banned the company from selling its H20 chip line exclusively to China. By July, the ban was lifted, and it seemed like the door had opened. But just a month later, a new agreement forced Nvidia to give 15% of its revenue from H20 sales to China to the US government .

Nvidia had predicted that the charge could knock as much as $8 billion off its second-quarter profit. This is a huge blow, a direct “tariff” on the company’s cash-printing machine. Analysts at KeyBanc warned that if Nvidia completely excluded direct revenue from China in its third-quarter forecast, the figure would likely be significantly lower than market expectations.

The game is further complicated by Beijing’s recent warnings to domestic companies about the security risks posed by Nvidia chips. While the US giant has denied the allegations, pressure is coming from both sides. In the meantime, Nvidia is reportedly developing a new chip for China based on the Blackwell architecture, but its launch will require a “nod” from Washington.

Clearly, Nvidia's business path in the billion-people market is becoming more bumpy than ever.

Behind the Numbers: Fears of an "AI Bubble" and the Lessons of the "Nifty Fifty"

Despite the challenges, Nvidia shares are up 35% year to date. Wall Street’s optimism seems limitless. But this euphoria raises a larger, systemic concern: Are we in an AI bubble?

Even one of the pioneers of this revolution, OpenAI CEO Sam Altman, admits: “Are we at a stage where investors are getting too excited about AI? I think so,” he says.

Some more seasoned analysts have even compared the current mania to the collapse of the “Nifty Fifty” group of the 1970s. This group of 50 leading American companies of the time (such as Xerox, IBM) were considered “buy and hold forever” investments. They were priced at absurd levels until the bubble burst in the crisis of 1973-1974, causing the value of the group to plummet by more than 50%.

Arun Sai, senior strategist at Pictet Asset Management, offered a sharp warning, drawing on that historical lesson: "You can be a great company, but not necessarily a great stock if the price is wrong."

Five decades later, the same question is being asked of the “Magnificent Seven.” Are their trillion-dollar valuations overblown by the AI wave?

The AI Arms Race and the Big Question of Profit

The AI craze has created what Arun Sai calls a “hyper-concentrated pocket of growth.” In a slowing US economy, AI has become a rare bright spot, a major driver of GDP growth. This has sparked a massive spending arms race. Amazon plans to spend $85 billion on AI next year, while Microsoft is projecting a figure as high as $100 billion.

But this cash-burning race will sooner or later face a harsh reality: profitability. A recent MIT survey poured cold water on the general excitement when it revealed that 95% of businesses surveyed have yet to see a return on their AI investments, despite the huge sums spent.

The pressure to prove effectiveness is growing, especially as new entrants like China’s DeepSeek challenge the market with cheaper but still powerful products. The AI game is entering a phase where return on investment (ROI) will become the most important metric, not just the potential of the technology.

Nvidia’s second-quarter earnings report is more than just a story about a company. It’s a story about the intersection of disruptive technology, powerful politics, and the immutable laws of financial markets. Nvidia is on a high, but it’s also walking a delicate line between booming demand and macro risks, between record valuations and fears of a cyclical downturn.

The results, which will be announced soon, will be a key indicator. Not only will it determine the fortunes of millions of investors, but it could also be a prophecy about the direction of the AI era: whether it will continue to be a sustainable revolution, or just a brilliant but short-lived gold rush.

Source: https://dantri.com.vn/kinh-doanh/nvidia-truoc-gio-g-cuoc-choi-260-ty-usd-dinh-doat-thoi-dai-ai-20250827225450058.htm

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

Comment (0)