(NLDO)- On March 12, Prime Minister Pham Minh Chinh , Head of the National Steering Committee on Inclusive Finance, chaired the 2nd meeting of the Steering Committee.

According to Decision 149 of the Prime Minister , financial inclusion is the ability of all people and businesses to access and use financial products and services conveniently, in accordance with their needs, at reasonable costs, provided responsibly and sustainably, with a focus on the poor, low-income earners, vulnerable people, small and medium-sized enterprises, and micro-enterprises.

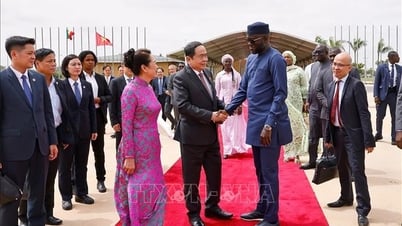

Prime Minister Pham Minh Chinh delivered a concluding speech at the meeting. Photo: Nhat Bac

Reports and opinions at the meeting showed that after 5 years, the tasks and solutions of the National Inclusive Financial Strategy have been actively implemented by ministries and branches.

The national comprehensive financial strategy sets out 9 specific targets, and so far 5/9 targets have been able to be completed, including: The proportion of adults with transaction accounts at banks; the growth rate of the number of non-cash payment transactions; the number of small and medium enterprises with outstanding loans at credit institutions; outstanding credit for agricultural and rural development; the proportion of adults with credit history information in the State Bank's credit information system.

Indicators on the number of branches, transaction offices, the rate of financial service points, the rate of adults saving at credit institutions, etc. are being evaluated.

In his concluding remarks, Prime Minister Pham Minh Chinh emphasized that the National Comprehensive Financial Strategy is of utmost importance to the country's socio-economic development, especially in the era of our nation's rise.

Financial inclusion helps all people and businesses access resources and financial services necessary for development, contributing to improving people's living standards, promoting savings and investment, thereby bringing great, positive benefits to society and the economy.

In addition to the achievements, the Prime Minister frankly pointed out that the implementation of the Strategy still has some shortcomings and limitations that need to be focused on and resolved, and some things that need to be done better. In particular, it is necessary to continue to develop reasonably and increase the coverage of financial services provided to people in rural areas, remote areas, economically disadvantaged areas, and vulnerable groups.

Modern financial products and services have many advantages, but need to continue to be diversified and designed to be more suitable for people in remote areas, the poor, low-income people, and people in special circumstances; and to strengthen solutions to ensure safety and information security so that customers can confidently use the services.

In the coming time, the Prime Minister requested to ensure equal access for all citizens to financial services, especially those in difficult circumstances, vulnerable groups, remote areas, border areas, islands, pupils and students.

People must be protected in terms of safety and security when accessing financial services, especially when these services are digitized, to prevent bad actors from taking advantage of them and affecting people and businesses.

To achieve the above goals, according to the Prime Minister, it is necessary to amend, supplement, and perfect institutions, create a legal corridor. Develop smooth, synchronous, and uniform infrastructure nationwide, covering all regions and subjects. Train, disseminate knowledge, and develop digital citizens nationwide, leaving no one behind. Along with that, further promote non-cash payments, build roadmaps and steps for agencies, units, localities, remote areas, borders, and islands.

Ministries, sectors, localities and relevant agencies need to effectively apply achievements of the fourth industrial revolution; financial inclusion needs to be implemented through digital platforms and financial technology.

In particular, technologies such as blockchain, artificial intelligence (AI) and big data play an important role in creating new, convenient financial products and services, optimizing processes and reducing costs, providing widespread, equal access and improving the quality of financial services.

For the State Bank of Vietnam, the Prime Minister requested the development of mechanisms and policies to facilitate digital transformation in banking activities and promote cashless payments.

The Ministry of Finance needs to promote the payment of State budget expenditures and those of State budget origin by non-cash payment methods; promote non-cash payments by individuals and businesses for tax collection, payment, fees, charges and collection of administrative fines.

The Ministry of Public Security is assigned to coordinate with relevant ministries, agencies, credit institutions, and service providers to connect and clean data with the National Population Database to serve professional activities. Other ministries, based on their functions and tasks, will implement solutions to promote the implementation of comprehensive financial goals.

Source: https://nld.com.vn/thu-tuong-phat-trien-cong-dan-so-tren-ca-nuoc-khong-de-ai-bi-bo-lai-phia-sau-196250312132342378.htm

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

Comment (0)