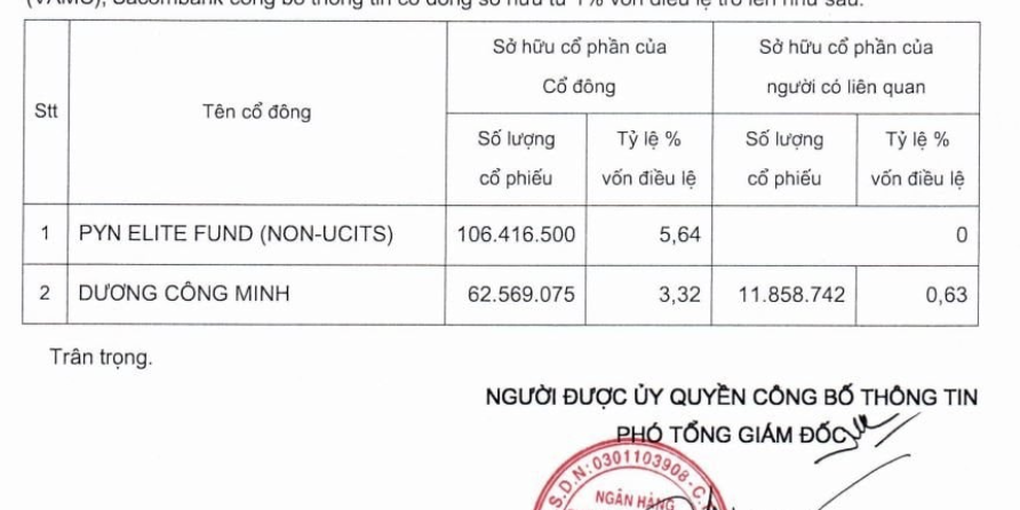

Saigon Thuong Tin Commercial Joint Stock Bank ( Sacombank , stock code: STB) has just announced information on shareholders owning 1% or more of charter capital.

Accordingly, there are currently only two major shareholders: Pyn Elite Fund - holding more than 106.4 million shares (5.64% of charter capital), and Mr. Duong Cong Minh - Chairman of the Board of Directors, owning more than 62.5 million shares (3.32% of capital). People related to Mr. Minh also hold an additional 11.8 million shares (0.63%).

In total, Pyn Elite Fund, Mr. Duong Cong Minh and related parties are holding more than 168.9 million shares, equivalent to 8.96% of Sacombank's capital.

The list of shareholders holding more than 1% of capital at Sacombank has only 2 representatives (Photo: Screenshot of text from Sacombank).

Notably, the list announced this time no longer includes the fund group under Dragon Capital including Vietnam Enterprise Investments Limited (VEIL), Norges Bank, Amersham Industries Limited as well as the SCB Vietnam Alpha Fund Not For Retail Investors.

Previously, the VEIL investment fund owned nearly 19.3 million shares (1.02%) and a person related to this shareholder owned nearly 22.7 million shares (1.2%). In parallel, Norges Bank owned more than 22.1 million bank shares (1.17%) while the Amersham Industries Limited fund owned more than 19.07 million shares (1.01%) and a person related to this shareholder owned more than 22.86 million shares (1.21%).

In terms of business, in the first half of 2025, Sacombank's pre-tax profit reached VND7,331 billion.

Still stuck with bad debt in Phong Phu Industrial Park

One of Sacombank's big problems now is the bad debt related to the Phong Phu Industrial Park (IP) project.

According to Mirae Asset’s report, although the bank has made full provisions, this bad debt situation still exists. At the April 2025 shareholders’ meeting, Sacombank confirmed that it is gradually handling the debt.

The debt arose from loans granted by SouthernBank in the period 2011-2012. After SouthernBank merged with Sacombank (2015), all of them became bad debts of Sacombank. By 2023, the bank had put 18 related debts up for sale 6 times, with a starting price of nearly 7,934 billion VND.

To date, Sacombank has only recovered about VND1,600 billion (20%). The bank aims to recover another 30-40% in 2025, with the remainder to be processed in 2026.

Source: https://dantri.com.vn/kinh-doanh/sacombank-mat-di-co-dong-lon-dragon-capital-20251015125101903.htm

![[Photo] The 18th Hanoi Party Congress held a preparatory session.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/15/1760521600666_ndo_br_img-0801-jpg.webp)

Comment (0)