According to the draft revised Law on Personal Income Tax, medical and educational expenses will be deducted before calculating tax - Photo: QUANG DINH

In addition to the family deduction level (GTGC), the progressive tax schedule is an important factor in regulating the personal income tax (PIT) payable, so how to amend it is something that taxpayers and experts are very interested in.

Extend tax rates but not much

In the draft law, the Ministry of Finance proposed to amend the progressive tax schedule with 2 options, both with 5 levels instead of 7 levels as currently, and at the same time widen the gap between levels. According to the Ministry of Finance, narrowing the number of tax levels will simplify management and tax collection, facilitate declaration and tax reform trends in the world.

The current progressive tax schedule consists of 7 levels, the gap between taxable incomes between levels is too large, leading to a rapid increase in tax regulation at the following tax levels. For example, taxable income above 10 million VND falls into level 2 with a tax rate of 15%. If taxable income is above 18 million VND, it falls into level 4 with a tax rate of 20%, above 32 million VND, it falls into level 5 with a tax rate of 25%...

With option 1 as proposed in the draft law, the regulation level at the first 3 levels is more relaxed, but the regulation level for those with taxable income of over 50 million VND is almost unchanged. Option 2 reduces tax more for taxable income over 50 million VND.

The Ministry of Finance also proposed that the Government regulate the level of VAT to ensure flexibility and proactive adjustment to suit the reality of life and the requirements of socio -economic development. In particular, the Ministry of Finance proposed to deduct from the income before calculating tax the expenses for health care, education and training of the taxpayer and the taxpayer's parents, spouse, and children who are dependents...

Speaking to Tuoi Tre, a member of the drafting committee of the replacement Personal Income Tax Law said that depending on the socio-economic conditions and tax policy orientation of each country, the taxable income and corresponding tax rates are determined. In most countries, the number of tax rates ranges from 5 to 13, notably Singapore has the highest number of tax rates at 13.

Reducing the number of tax brackets and raising the VAT rate will help taxpayers reduce the amount of tax they have to pay. For example, an individual with a taxable income of 10 million VND/month will receive a reduction of 250,000 VND/month. With a taxable income of 30 million VND/month, the reduction will be 850,000 VND/month...

"Taxable income is understood as income after deductions such as VAT for the taxpayer himself, for dependents (if any), insurance... An important content that the Ministry of Finance proposed is to deduct medical and educational expenses before calculating tax", informed a representative of the Ministry of Finance.

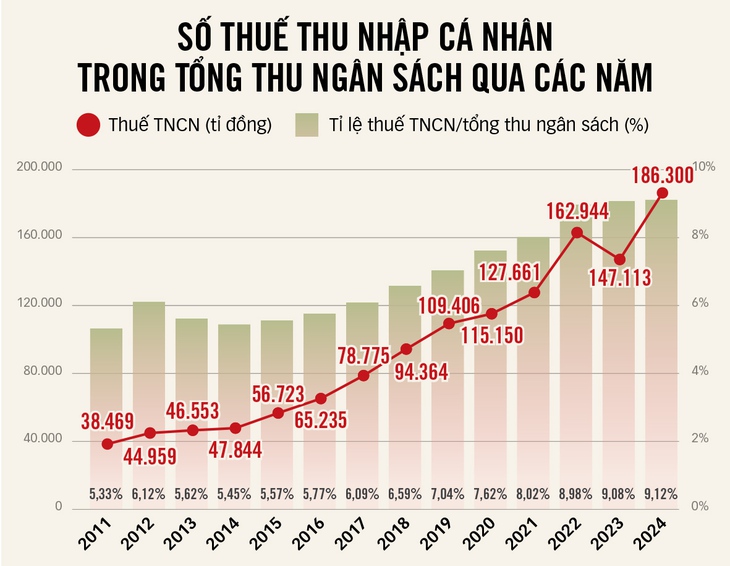

Source: Ministry of Finance - Data: Le Thanh - Graphics: TAN DAT

Vietnam is in the group of high tax countries.

Commenting on Vietnam's progressive tax schedule and taxable income by level, Ms. Vu Thu Ha - Deputy General Director, Tax Consulting Services, Deloitte Vietnam - said that Vietnam is in the group of countries with high personal income tax compared to the Southeast Asian region.

Specifically, Vietnam's maximum tax rate is 35%, equivalent to Thailand and the Philippines. Meanwhile, Singapore's highest tax rate is 24%, Malaysia and Myanmar are 30%.

Meanwhile, the taxable income at each tax level is quite low compared to the region, maintained for more than 15 years. With the roadmap for the draft Personal Income Tax Law to be issued and applied in 2026 (after 17 years of applying the Personal Income Tax Law, since 2007), combined with the increase in personal income from wages and salaries and consumer price indexes, it can be seen that the taxable income level is outdated, providing little support for the workforce.

"The tax schedule needs to be redesigned to reasonably adjust the difference between tax thresholds and tax rates to ensure fairness. This will help limit the situation of "stepping up" - when income only increases slightly but taxpayers are moved to a higher tax bracket with a large difference in tax rates - causing inequity between people with similar income levels," said Ms. Ha.

According to Ms. Ha, reducing tax rates will significantly reduce the tax burden for taxpayers at lower levels, especially those at the first three levels - which are mainly individuals with incomes just enough to meet basic living needs.

According to lawyer Tran Xoa - director of Minh Dang Quang Law Firm, the 35% tax rate - the highest rate - should be abolished to encourage taxpayers with high technical qualifications and good management capacity to work hard and produce and do business to earn more income. At the same time, the progressive tax rate should be improved in a more "open" direction, there should be only 4 rates: 5 - 10 - 20 - 30%.

At the same time, the remaining levels should be extended, specifically: apply a 5% tax rate to taxable income up to 20 million VND, a 10% tax rate to taxable income from over 20 - 40 million VND, a 20% tax rate to taxable income from over 40 - 80 million VND. The 30% rate applies to taxable income over 80 million VND.

"This adjustment is to be compatible with countries in the region, reduce obligations for taxpayers, encourage taxpayers to work creatively with high income, get rich legitimately and at the same time attract highly qualified and technical foreign experts to work in Vietnam," said Mr. Xoa.

Don't let it become outdated as soon as it is applied.

Since the application of the Personal Income Tax Law, the personal income tax rate has been increased twice, but the personal income tax revenue has continuously increased over the years. Therefore, according to Mr. Xoa, the personal income tax rate for taxpayers should be increased to 18-20 million VND/month because 15.5 million VND/month is still too low.

"This adjustment is for the future, not for the past period, so it is necessary to raise the VAT rate to avoid the situation where it becomes outdated as soon as it is applied," Mr. Xoa suggested. Also according to Mr. Xoa, in recent years, enterprises have enjoyed many incentive policies such as exemption and reduction of corporate income tax, preferential tax rates, tax payment extension, and most recently, according to Resolution 198, newly established small and medium-sized enterprises are exempted from corporate income tax for the first three years.

Authorities are also proposing to apply a preferential tax rate of 15% to enterprises with total annual revenue of no more than 3 billion VND and a tax rate of 17% to enterprises with total annual revenue from over 3 billion VND to no more than 50 billion VND... "Therefore, there needs to be a policy to encourage salaried workers to help them overcome difficulties in the current period," said Mr. Xoa.

While the prices of many essential foods are increasing, the family deduction level is being slowly adjusted - Photo: TTD

* Delegate NGUYEN QUANG HUAN (HCMC):

Apply the new taxable starting point immediately

The VAT rate has been maintained since 2020, while many essential goods and services have increased sharply in price over the past 5 years, some even increasing faster than income. In addition, the average income of people over the past 5 years has also increased. From July 1, 2024, the basic salary has been adjusted to increase by 30% and the regional minimum wage has also increased over the years.

In recent times, many National Assembly deputies and voters have voiced their request to soon adjust the GTGC level to suit the reality. Therefore, the early adjustment of the GTGC level is an urgent requirement that needs to be implemented immediately.

However, compared to reality, the adjustment of this VAT rate has been slower and has not met the requirements. In addition, the Ministry of Finance has proposed two options and proposed to apply the VAT rate from the 2026 tax period, which is not appropriate. Because if submitted to the National Assembly Standing Committee for approval, it will still take several months to reach the 2025 personal income tax settlement period.

Therefore, it should be applied from the 2025 tax period instead of waiting until the 2026 tax period. Doing so will cause taxpayers to have to wait longer. The Ministry of Finance is seeking comments on the draft Law on Personal Income Tax, which proposes assigning the Government to regulate the VAT rate in accordance with the socio-economic situation in each period.

This proposal is completely suitable, ensuring flexibility and proactive adjustment to suit the reality and requirements of the country's socio-economic development in each period.

Another content, the Ministry of Finance proposed to reduce the number of levels in the personal income tax table from 7 levels to 5 levels and widen the income range at each level, starting from taxable income of 10 million VND/month with a tax rate of 5%.

Compared to the current law, the starting level is higher but still low, not meeting the reality of life, especially with the income level of people, life in big cities. Therefore, in my opinion, we need to continue to research to raise the starting level appropriately, at the same time consider widening the income range at each level to a higher level.

* Delegate HOANG VAN CUONG (Hanoi):

Add actual expenses to deduct tax

In principle, personal income tax is not only a tool to generate revenue for the budget but also a way for the State to regulate income in a fair direction.

Those who have more pay more, those who have less pay less. But to be fair, we must first calculate correctly. Meanwhile, the standard of living between localities, especially in big cities and urban areas, is very different from other regions.

House rent, medical expenses, education, other living expenses... in big cities are many times higher than in rural areas or mountainous provinces.

However, it is unreasonable that the level of GTGC for people in big cities and people in mountainous areas is still the same. Therefore, it is necessary to rely on the regional minimum wage which is adjusted annually to determine the level of GTGC.

It is possible to take 4 times the regional minimum wage as a deduction for the taxpayer himself and 2 times for each dependent... Thus, workers in areas with high living costs will have more income tax deductions.

If applied, the tax policy will be closer to real life, reducing unnecessary burdens for people. In addition, the draft law being consulted by the Ministry of Finance has proposed to reduce the tax rate from 7 levels to 5 levels and widen the gap between levels, which is appropriate.

But further research is needed to ensure consistency, more clearly demonstrating the principle that higher income earners should pay higher taxes.

Along with that, we should add actual expenses that are deductible when calculating taxes, such as education, medical, insurance, home loan interest... These are expenses directly related to social security and people's quality of life.

Allowing deductions would both reduce the tax burden and encourage spending on education and health care - areas that the State is also prioritizing. In addition, we should not wait for the price index (CPI) to increase by 20% before adjusting the VAT rate.

In reality, the CPI is calculated on average for 752 items, while workers mainly spend on a few dozen essential items. Therefore, this calculation method is prone to delays and even backwardness.

Instead, a periodic mechanism should be established - for example, a review every two years - to adjust the deduction levels, ensuring that tax policies always keep up with real life. At the same time, the Government should be given the right to make adjustments to ensure flexibility, in accordance with the conditions and socio-economic development of each period.

Source: https://tuoitre.vn/sua-thue-thu-nhap-ca-nhan-phai-tinh-duong-dai-20250723094105757.htm

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)