COMEX copper prices are under dual pressure from macro and supply-demand situations.

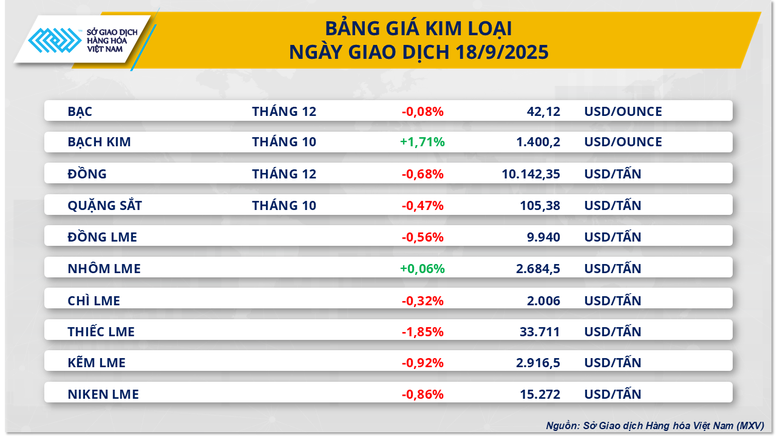

At the end of yesterday's trading session, selling pressure dominated the metal market, causing 8/10 commodities to decrease in price. COMEX copper prices in particular extended their decline to the third consecutive session, closing at 10,142 USD/ton, down 0.6%.

According to MXV, the main reason for the pressure on the copper in the session came from the USD's continued strong recovery. After the press conference, Federal Reserve Chairman Jerome Powell emphasized that the interest rate cut was only for risk management purposes in the face of signs of weakness in the labor market, thereby reducing expectations for a rapid and strong interest rate cut cycle. The greenback thus increased for the second consecutive session, up 0.49% to 97.35 points, becoming a direct factor pulling the copper price down.

In addition, the prospect of abundant supply in Chile - the world's largest copper producer - continues to reinforce the pessimism. The country's Minister of Mines forecasts steady growth in output in the coming years, possibly reaching a record 6 million tonnes by 2027. Indeed, output at the Escondida mine in the first half of the year increased 11% year-on-year, while new mining cooperation agreements between Codelco, Anglo American and Teck are expected to add around 300,000 tonnes of copper.

However, copper's decline was somewhat capped by the risk of supply disruption in Indonesia following the incident at the Grasberg Block Cave mine, with operations at the main site still suspended and total mine output remaining below 30% of capacity.

Sugar prices fell for three consecutive sessions due to oversupply pressure from Brazil and India.

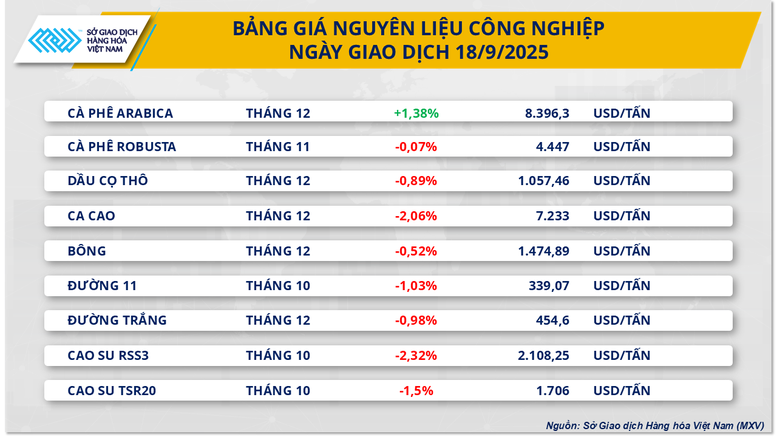

Meanwhile, the industrial raw material market also recorded a sharp decline when most of the key products in the group closed in red. In particular, the prices of two sugar products continued to extend their decline to the third consecutive session. Specifically, the price of sugar 11 decreased by more than 1% to 339 USD/ton while the price of white sugar also lost nearly 1% to 454 USD/ton.

World sugar supply continues to send positive signals with crop output assessed to have increased sharply compared to last year in India and Thailand, along with clear signs of improvement in Brazil.

A report released yesterday by UNICA shows that Brazil’s sugar production this year continues to maintain a strong growth momentum despite the effects of last year’s drought. Specifically, sugar production in the Central-South region of Brazil in the second half of August reached 3.87 million tons, higher than the market forecast of about 3.8 million tons. The proportion of cane allocated to sugar production remained stable over the months at 54.2%, exceeding ethanol at 45.8%.

Sugar production has been steadily increasing since June, thanks to dry weather that has been favorable for harvesting, after a wet June period that caused delays. Brazil’s sugar production typically peaks in late July, but this year’s slow start could see a sharp spike in the latter part of the season.

In addition, earlier this week, Sucden's co-head of sugar trading predicted that India could export up to 4 million tonnes of sugar in the 2025-2026 crop year, double the 2 million tonnes previously proposed by the Indian Farmers' Association.

Source: https://baochinhphu.vn/thi-truong-hang-hoa-sac-do-bao-trum-102250919085646201.htm

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

Comment (0)