In its recently released strategic report for the second half of 2025 and the first half of 2026, Dragon Capital Securities (VDSC) said that Vietnam’s macro picture in the next 6-12 months will be driven by two key factors: reform and adaptation. In particular, adaptation to an uncertain environment is considered the foundation to help stabilize growth expectations.

In Vietnam's monetary policy, in the trend of global monetary easing, the US Federal Reserve (Fed) is expected to start its interest rate reduction cycle from the fourth quarter of 2025, helping the State Bank not to further reduce the operating interest rate this year.

What are the chances for VN-Index to reach 1,750 points?

Notably, VDSC's analysis team forecasts that the VN-Index could reach the 1,513-1,756 point range in the next 6-8 months. The direct impact of tariffs on Vietnam's economic growth in 2025 will not be too large. Positive supporting factors such as loose fiscal and monetary policies help maintain low interest rates, and expectations of market upgrade in FTSE's September 2025 review.

"When the upgrade becomes a reality, the Vietnamese market will attract large capital flows from global reference funds of about 1 billion USD, contributing to improving liquidity and valuation," said a VDSC expert.

Meanwhile, SSI Securities Company's second half 2025 strategy report forecasts a positive view of the market in the long term but only sets a target of 1,500 points for the VN-Index by the end of 2025.

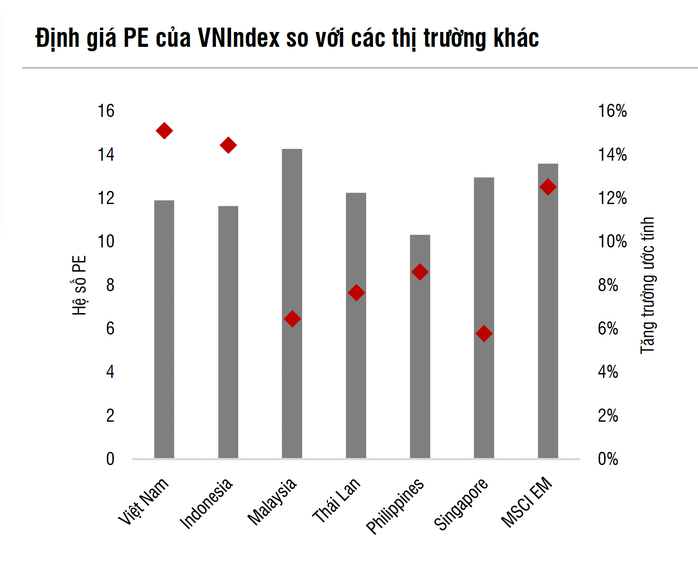

The drivers are the prospect of sustainable profit growth. The total net profit of more than 79 stocks in SSI Research's research scope is estimated to increase 14% year-on-year this year and will continue to maintain a growth momentum of 15% in 2026. The main contributing sectors include banking, real estate, raw materials and consumer goods.

Source: SSI Research

The US's 90-day tax deferral has helped Vietnamese businesses boost exports of many products in the second quarter, and have time to prepare to reduce the impact from this market in the following quarters.

"The 8.4% yield on the stock market is quite attractive compared to the average deposit interest rate of around 4.6% and the potential to attract a portion of residential deposits has tended to increase rapidly in recent quarters even though the deposit interest rate level remains low" - said an SSI expert.

What are the risks to watch for?

MBS Securities Company also forecasts that in the second half of 2025, cash flow will spread to large-cap stocks that have not increased strongly in price in the past time thanks to attractive valuations and profit growth potential.

In the base case scenario, with a 17% growth in listed companies’ profits and a valuation of 13.5-13.8 times P/E, the VN-Index will reach 1,500-1,540 points in the final months of the year. The VN-Index could even reach 1,580 points in a positive scenario.

"In a more positive scenario, the impact from the US tariff policy is less than expected, foreign capital flows strongly into the Vietnamese market thanks to the prospect of upgrading, the market's profit growth expectation reaches 19%, the VN-Index can advance to the 1,580 point zone by the end of the year" - MBS forecast.

However, experts also warn that risks to watch will be geopolitical fluctuations, exchange rate pressure if the FED delays lowering interest rates, and uncertainty in the US President's administration's policies.

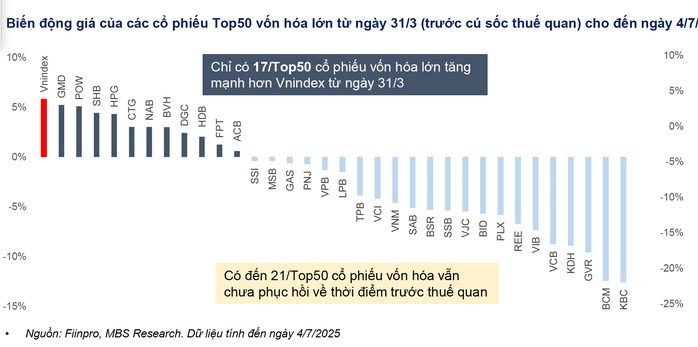

Statistics show that although the VN-Index has recovered strongly by more than 300 points since the April 2 tariff event, the increase has not spread to all stock classes. MBS data shows that only 12/50 stocks with the largest market capitalization have increased more strongly than the VN-Index since March 31, about 9 stocks have increased less than the general market. In fact, nearly half of the stocks in the top 50 have not yet recovered to pre-tariff levels.

In this context, if any investor buys the wrong stocks that increase in price, the probability of losing money or "not reaching shore" is still very high, despite the VN-Index heading towards the 1,500 point mark.

Source: https://nld.com.vn/du-bao-nong-vn-index-co-the-len-toi-1750-diem-nhung-dung-voi-mung-196250717085957781.htm

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

Comment (0)