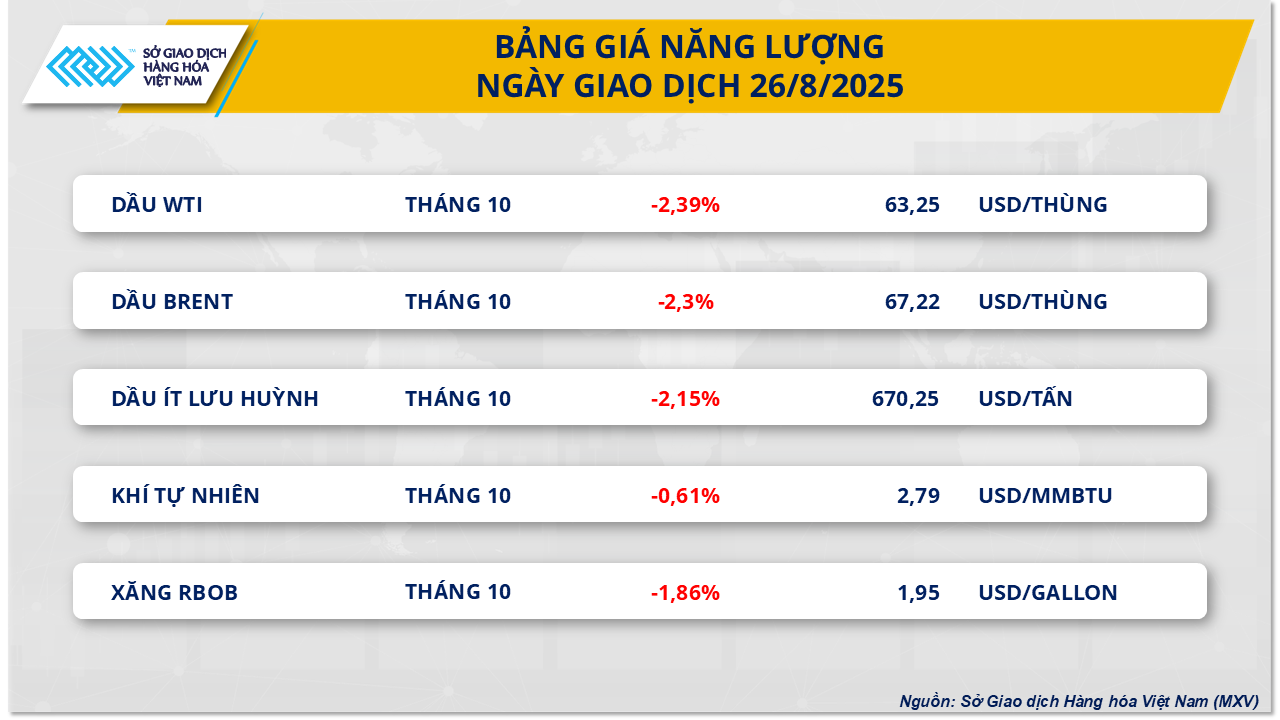

Energy commodity market is red. Source: MXV

According to MXV, at the end of yesterday's trading session, all 5 commodities in the energy group were under strong selling pressure. In particular, both main crude oil commodities recorded a decrease of more than 2%.

Specifically, Brent oil price fell to 63.25 USD/barrel, corresponding to a decrease of 2.3%; while WTI oil price recorded a decrease of 2.39%, stopping at 67.22 USD/barrel.

US President Donald Trump's surprise move to request a change in senior personnel at the US Federal Reserve (FED) is seen by investors as a new effort to increase pressure on the FED to soon lower interest rates, but it also increases cautious sentiment in the market.

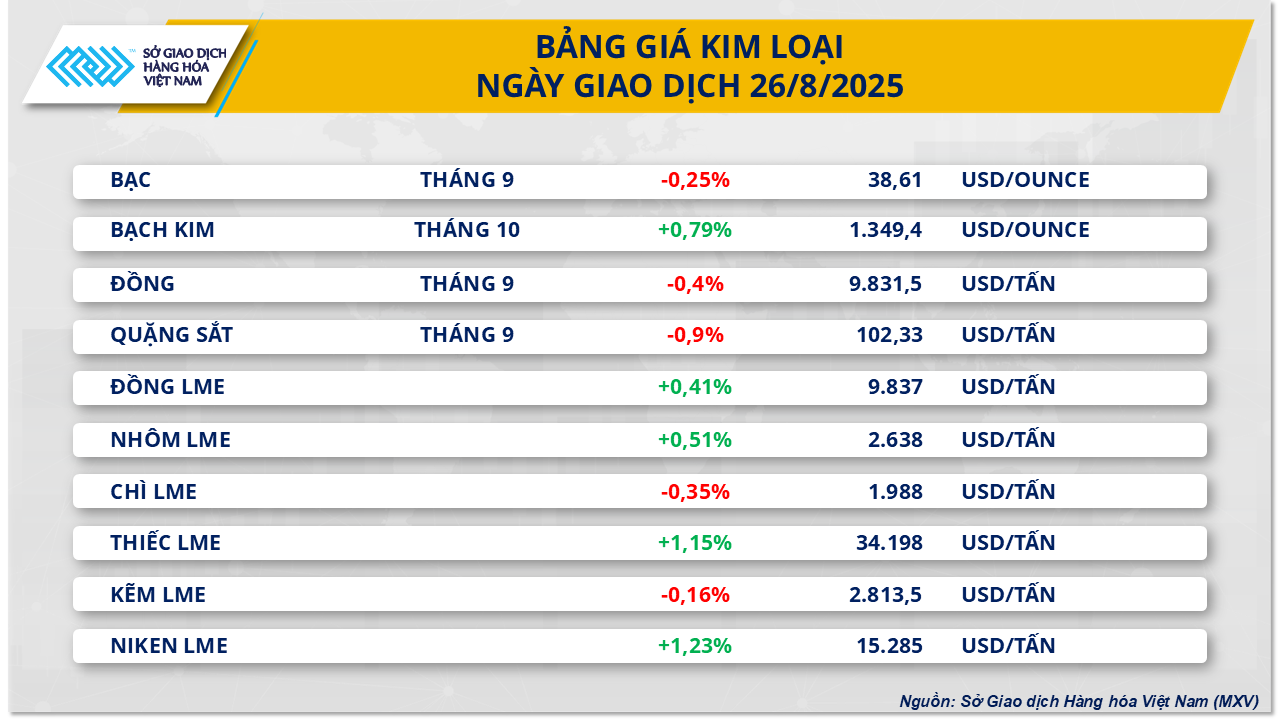

The metal commodity market is divided. Source: MXV

Meanwhile, the metal market continued to have clear differentiation. Notably, COMEX copper price turned down 0.4%, back to 4.46 USD/pound, equivalent to 9,831 USD/ton, ending the previous 4 consecutive sessions of increase.

According to MXV, copper prices are under pressure as concerns about the risk of supply disruptions at major copper mines have been somewhat alleviated.

In Vietnam, despite global supply surplus, copper prices remain high thanks to expectations of recovering industrial demand and stable demand from the electricity and construction sectors.

According to the Customs Department, in the first half of August, copper imports reached 19,448 tons, up more than 6% over the same period last year. Accumulated from the beginning of the year to August 15, the total import volume reached more than 309,000 tons, up nearly 15% over the same period in 2024.

Source: https://hanoimoi.vn/ap-luc-ban-manh-cat-dut-da-tang-4-phien-cua-mxv-index-714135.html

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)