Strong selling pressure from STB and VHM triggered sell orders in many large stocks in the market in the session on October 24.

Strong selling pressure from STB and VHM triggered sell orders in many large stocks in the market in the session on October 24.

|

| VHM was the stock that had the most negative impact on VN-Index, taking away 3.31 points. |

After the session on October 23rd increased by more than 1 point, investors remained cautious when entering the trading session on October 24th. This caused the market to fluctuate. After a few minutes of increasing points, VN-Index reversed and fell below the reference level. The differentiation among stock groups is very strong.

Trading got worse in the afternoon session when a series of stock groups plummeted, with the focus being on the banking group and the "Vin" family.

During most of the trading session, stocks in the “Vin” family put pressure on the general market. This was also the second consecutive session that VHM fell sharply despite the fact that this enterprise started buying treasury stocks since yesterday, October 23. For most of the trading session, the group of stocks in the “Vin” family, including VHM, VIC and VRE, traded at red prices and had “supporting price” demand. However, due to strong selling pressure at the end of the session, all three stocks closed at the lowest level of the day. VHM fell 6.7% to 43,850 VND/share, VRE fell 2.7% to 18,150 VND/share and VIC fell 2.66% to 42,050 VND/share.

According to the latest update on the Ho Chi Minh City Stock Exchange (HoSE), Vinhomes has purchased a total of more than 19.1 million treasury shares, accounting for 5.17% of the total registered number. According to the plan, Vinhomes will buy back a maximum of 370 million treasury shares (accounting for 8.5% of the total outstanding shares) by order matching and/or negotiation from October 23 to November 21, 2024.

In addition, the market fell sharply under great pressure from banking stocks, of which STB was the "culprit" that triggered strong selling in this industry group. STB closed at the session's lowest level of 6.7% down to only VND 33,400/share. In addition, banking stocks such as TPB, TCB, VPB, MBB,ACB ... also had a decrease of over 1%. TPB decreased by 3.4%, TCB decreased by 2.3%, VPB decreased by 2.2%...

VHM was the stock that had the most negative impact on the VN-Index, taking away 3.31 points. Next, STB and VIC took away 1.09 points and 1.06 points, respectively.

|

| VHM is the stock that has the most negative impact on VN-Index. |

In the group of small and medium-cap stocks, a series of stocks in the securities group such as FTS, CTS, SHS, HCM, MBS or VCI all fell sharply. FTS decreased by 3.1%, CTS decreased by 2.8%, HCM decreased by 2.4%, MBS decreased by 2.4%... The retail group also recorded PET, DGW, MWG or FRT being submerged in red. PET decreased by 4.6%, DGW continued to decrease by 1.4%...

On the other hand, VNM, VCB, GAS andFPT are the stocks that have made important contributions to "balancing" the index, in which VNM increased by 1.63% and contributed the most to the VN-Index with 0.56 points. VCB and KDH increased by 0.22% and 1.05% respectively with the contribution of 0.27 points and 0.08 points.

At the end of the trading session, VN-Index decreased by 13.49 points (-1.06%) to 1,257.41 points. The entire floor had 102 stocks increasing, 284 stocks decreasing and 52 stocks remaining unchanged. HNX-Index decreased by 1.81 points (-0.8%) to 224.69 points. The entire floor had 56 stocks increasing, 95 stocks decreasing and 57 stocks remaining unchanged. UPCoM-Index decreased by 0.06 points (-0.07%) to 92.06 points.

|

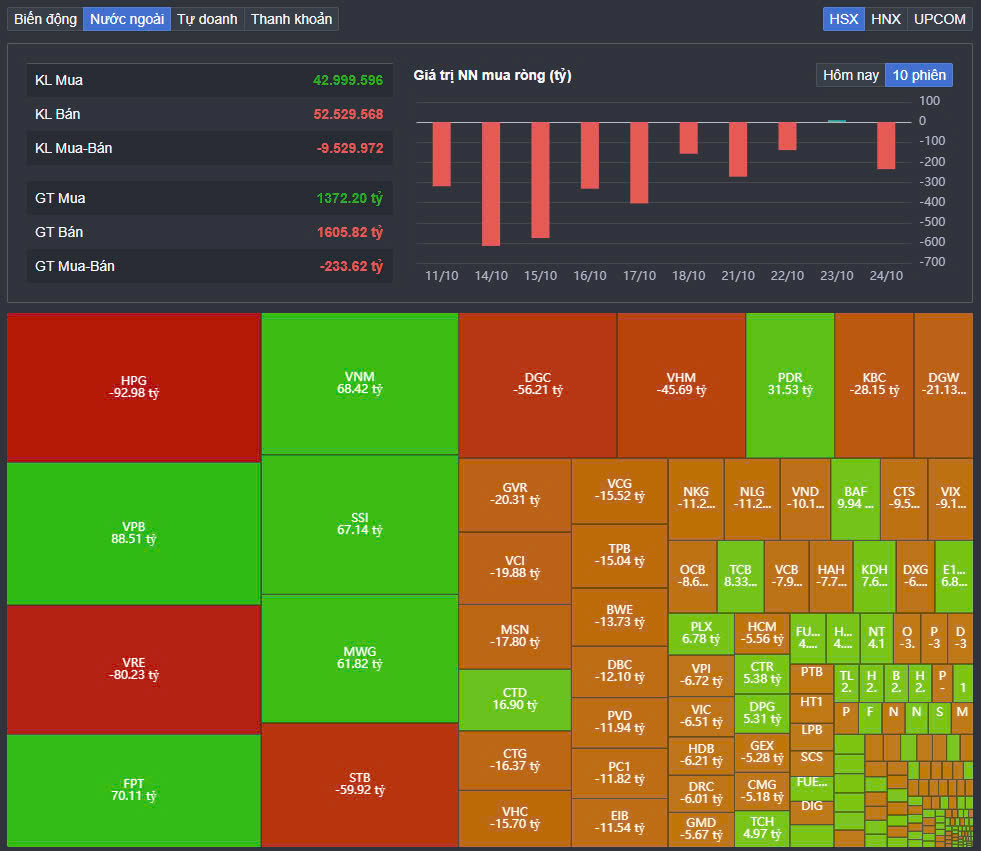

| Foreign investors returned to net selling after a light buying session yesterday. |

Total trading volume on HoSE reached 673 million shares, equivalent to a trading value of VND15,981 billion (up 14% compared to the previous session), of which negotiated transactions reached VND1,897 billion. Trading values on HNX and UPCoM reached VND650 billion and VND355 billion, respectively.

Foreign investors returned to net selling VND230 billion on HoSE, in which, this capital flow sold the most net code HPG with VND93 billion. VRE was also net sold VND80 billion. STB and DGC were net sold VND60 billion and VND56 billion respectively. In the opposite direction, VPB was net bought the most with VND89 billion. FPT and VNM were net bought VND70 billion and VND68 billion respectively.

Source: https://baodautu.vn/ban-manh-co-phieu-ngan-hang-vn-index-giam-hon-13-diem-d228267.html

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam chairs the meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/fb2a8712315d4213a16322588c57b975)

Comment (0)