Bitcoin fell more than 3% on August 14 from a record high hit the day before after higher-than-expected US inflation data dampened expectations for a sharp interest rate cut by the US Federal Reserve in September 2025.

This development was also influenced by the statement of Treasury Secretary Scott Bessent that the US Government will not buy bitcoin to add to the strategic reserve.

Previously, on August 13, bitcoin hit a new record high, surpassing $123,500, thanks to expectations that the Fed will soon loosen monetary policy and strong buying activity from businesses.

However, this increase quickly slowed down when the producer price index (PPI) for July 2025 was announced much higher than forecast.

Speaking on Fox Business, Minister Bessent said the amount of bitcoin in the US reserve is currently worth about $15-20 billion at market prices.

“We have entered the 21st century with the formation of a strategic reserve of bitcoin. We will not buy more, but will use the seized assets to continue to increase this holding,” he emphasized.

Expectations of a Fed rate cut and a wave of large-scale corporate buying have been the main drivers of bitcoin’s strong price rise since early 2025. The digital currency has risen 25% since the start of the year and is now up about 57% from its April 2025 low.

Inflows into spot bitcoin exchange-traded funds (ETFs) and increased purchases of bitcoin by public companies, following the example of MicroStrategy (MSTR), have also contributed to the rally. Analysts say the Trump administration's crypto-friendly stance is a key support.

Last week, President Donald Trump signed an executive order directing the U.S. Department of Labor to study the possibility of allowing 401(k) retirement funds to invest in digital currencies and other alternative assets, an order that is expected to significantly expand access to the cryptocurrency market for individual investors.

The rise in bitcoin prices comes as US stocks continue to hit new highs, thanks to expectations that the Fed will cut interest rates in September 2025 and that Trump's nominee for the next Fed chair is likely to support loose monetary policy.

Along with bitcoin, the price of ethereum - the world's second largest cryptocurrency by capitalization - also fell more than 3% on August 14, after approaching a record high.

Wall Street investors' interest in ethereum has grown, as many companies add the asset to their balance sheets, seeing it as a way to access the technological infrastructure behind decentralized finance (DeFi) and other digital assets, including stablecoins - cryptocurrencies pegged to fiat currencies like the USD or euro to stabilize their value./.

Source: https://www.vietnamplus.vn/bitcoin-lao-doc-sau-khi-so-lieu-lam-phat-my-tang-vuot-du-bao-post1055927.vnp

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

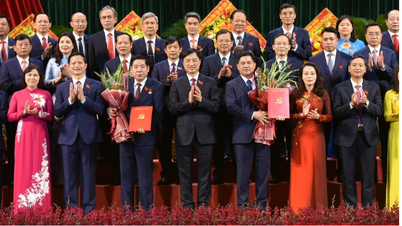

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

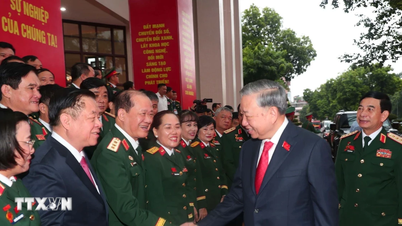

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)