| Commodity market today September 25: Corn and wheat prices weakened simultaneously Commodity market today September 27: Oil prices fell after news of OPEC+ increasing production |

According to the Vietnam Commodity Exchange (MXV), prices of many commodities in the group of metals, agricultural products and industrial raw materials such as iron ore, cereals, coffee, etc. increased sharply in the last trading week (September 23-29).

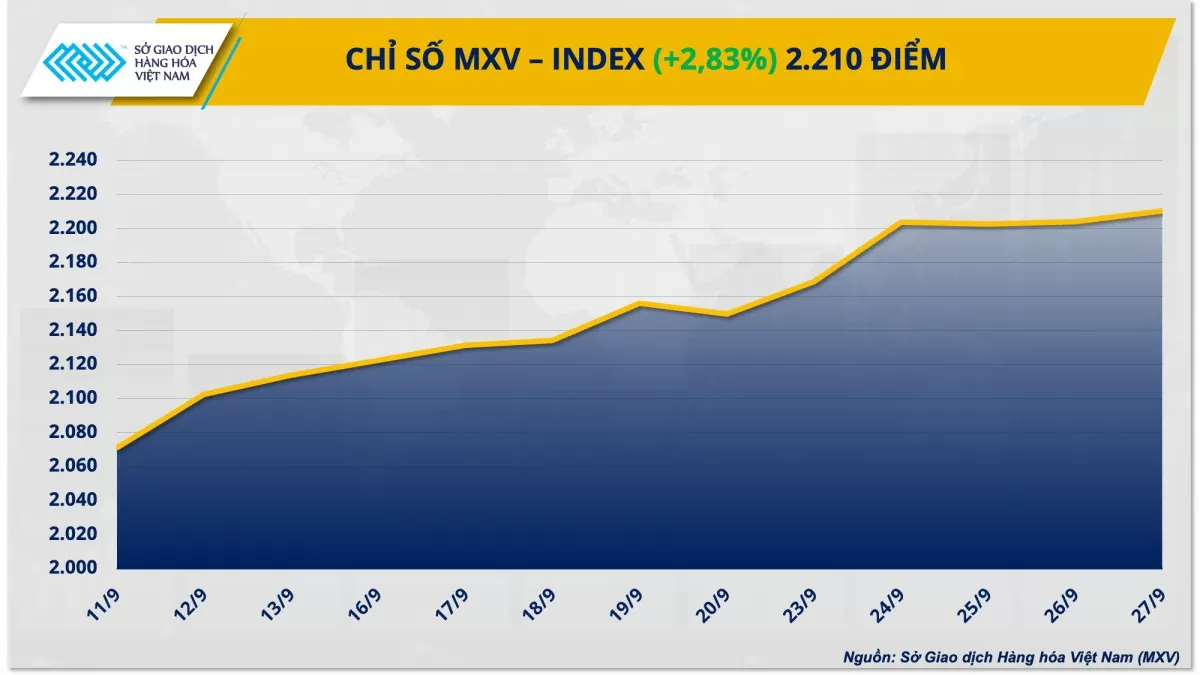

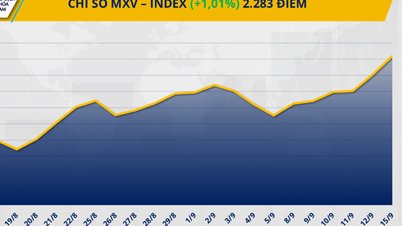

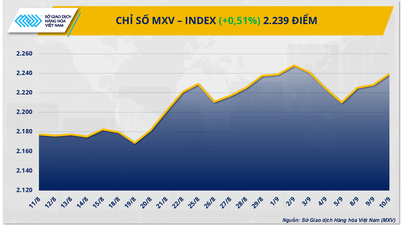

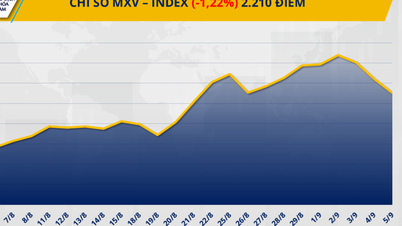

After the Fed's decision to cut interest rates sharply, in the last trading session of the week, the market received positive signals about the US PCE inflation measure. In addition, China also launched a stimulus package to revive the economy . These factors pushed metal prices up sharply. The agricultural market was also flooded with green in the context of supply being threatened by the weather. Closing, the MXV-Index increased by nearly 3% to 2,210 points - the highest level in more than two months.

|

| MXV-Index |

Iron ore prices soar after China's stimulus package

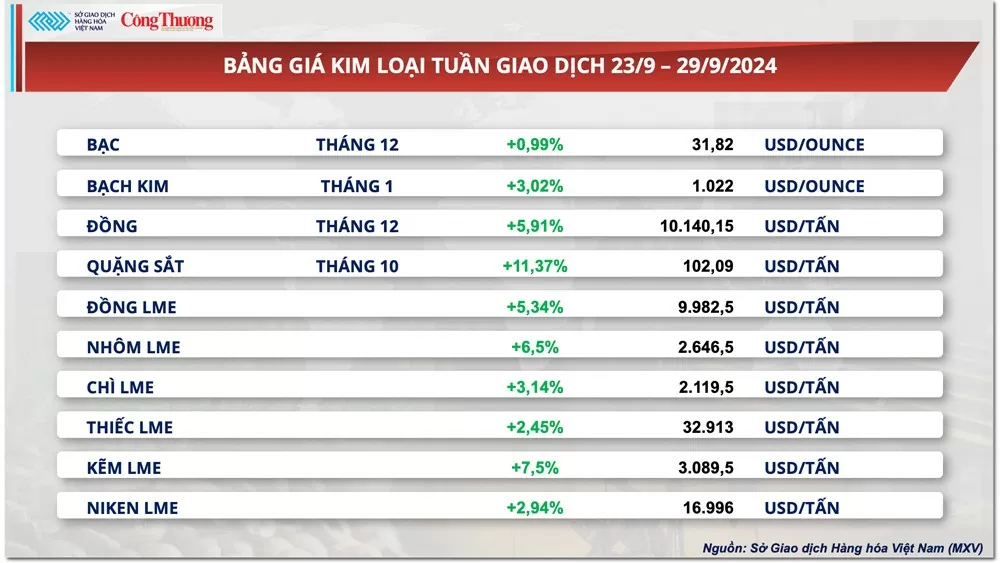

Closing the last trading week of September, the metal market experienced a positive week when prices of all commodities increased sharply, especially the breakthrough of more than 11% in iron ore prices.

China’s strong economic stimulus, the leading metal consumer, has given a boost to commodity prices since the beginning of the week. COMEX copper prices rose 5.91% to $10,140 a ton, the highest level in nearly three months. Iron ore prices also jumped 11.37% to $102.09 a ton.

|

| Metal price list |

Last week, the Chinese government announced plans to roll out its biggest and most significant economic stimulus package since the Covid-19 pandemic to revive the slowing economy. The stimulus package includes lowering the reserve requirement ratio, cutting lending rates, issuing 2 trillion yuan ($285.2 billion) in special bonds, along with a support package for the real estate sector that includes reducing borrowing costs by up to $5.3 trillion for mortgages and easing requirements for home purchases.

In addition, the government's commitment to deploy the necessary fiscal spending to meet its economic growth target of around 5% further raised market expectations for new fiscal stimulus measures.

In terms of precious metals, silver prices extended their gains for the third consecutive week, rising 0.99% to $31.81 an ounce. Platinum prices also reclaimed the $1,000 an ounce price zone, rising 3.02% to close the week at $1,022 an ounce.

The first week after the US Federal Reserve (FED) decided to cut interest rates aggressively, precious metals prices continued to benefit, and at one point silver prices surpassed the peak of May and anchored to the highest price range in 12 years. The low interest rate environment will continue to create favorable conditions for precious metal prices to increase this year.

In addition, according to data released by the US Department of Labor over the weekend, the country's personal consumption expenditures (PCE) price index fell to 2.2% in August, the lowest level since February 2021. The fact that US inflation is still on track to cool down to 2% further strengthens expectations that the FED will implement another 50 basis point reduction at its November meeting.

Adding to the support, precious metal prices also benefited from escalating tensions in the Middle East, with Israel's attack on Lebanon prompting investors to seek safe-haven assets.

Corn and wheat prices increased sharply

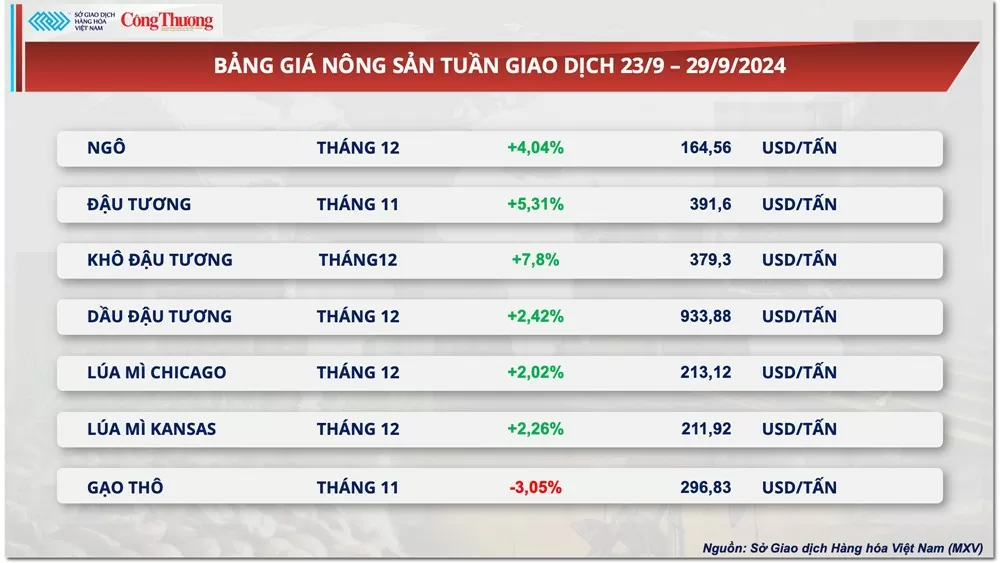

Green covered the agricultural market in the final trading week of the month, in which the cereal group played a leading role in the group's increase. December corn contract prices recorded a gain of more than 4%, in the context of supply threats in the South American region due to weather.

|

| Agricultural product price list |

The Buenos Aires Grains Exchange forecasts Argentina's 2024-2025 corn production could reach 47 million tons, down 5% from the previous crop. Due to lower expected corn profits compared to soybeans and the risk of brown planthoppers continuing to wreak havoc this year, many Argentine farmers have decided to reduce corn acreage. Argentina is the world's third-largest corn exporter, so lower production could lead to a global supply squeeze in the coming period.

In addition, the outlook for Brazil’s second corn crop in 2024-2025, which accounts for more than 70% of the country’s total annual corn production, is also quite bleak. Soybean planting in Brazil is currently delayed due to prolonged drought conditions and weather forecasts show that the country’s agricultural regions will continue to face drought in the next two weeks. The second corn crop is planted after the soybean harvest, so the delay in the soybean crop also means a late start for the second corn crop and affects the potential yield.

The December wheat contract also closed the week up more than 2%. Buying was boosted in the early sessions of the week by the negative outlook for supplies from the Black Sea region. However, the wheat price rally was somewhat curtailed in the last two sessions of the week due to profit-taking pressure from the market.

Some 8.3 million hectares of winter cereals had been planted in Russia as of September 20, down from 9.3 million hectares a year earlier, consultancy SovEcon reported. This is the slowest pace of winter sowing since 2013, as a prolonged dry spell has delayed production and raised concerns about yield prospects. In addition, growing conditions in Ukraine have been unfavorable as there has been no rain for weeks, leaving much of the agricultural region parched.

Prices of some other goods

|

| Energy price list |

|

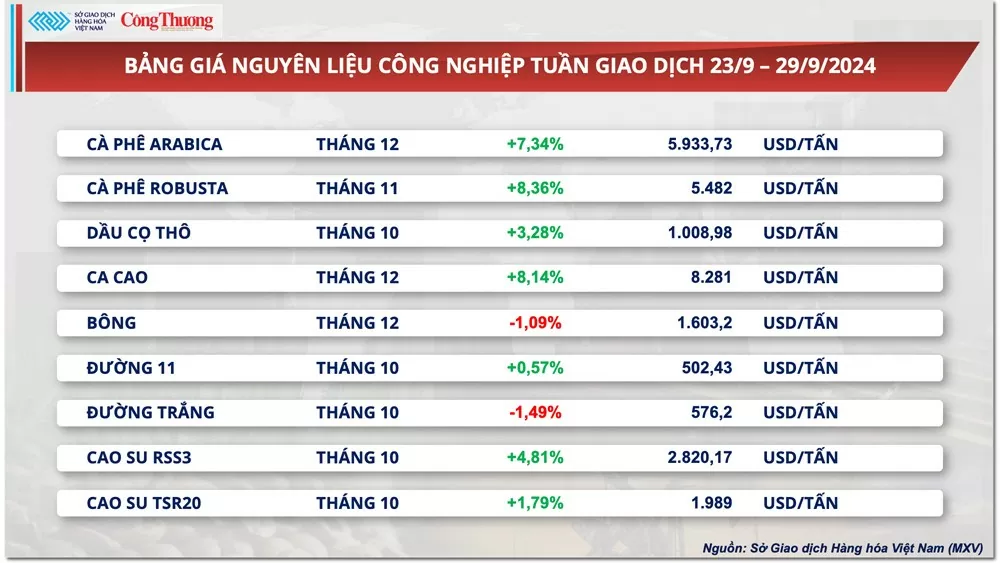

| Industrial raw material price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-309-chi-so-mxv-index-ve-lai-muc-cao-nhat-trong-vong-hon-hai-thang-349218.html

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)