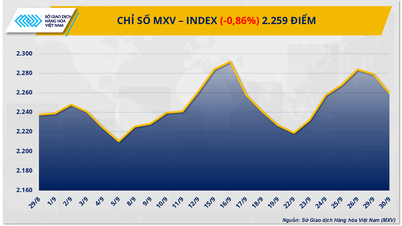

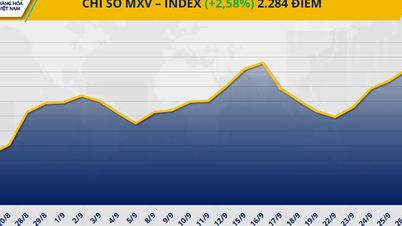

Prices of industrial raw materials increased across the board. Source: MXV

According to the Vietnam Commodity Exchange (MXV), at the end of yesterday's trading session, the prices of both coffee products increased sharply by over 5.2%. At the end of the session, the price of Arabica coffee was fixed at 9,207 USD/ton, while Robusta coffee also returned to the 4,842 USD/ton range.

The ongoing tariff tensions between the US and Brazil since July have caused Brazilian coffee exports to the US in August to fall by 46% compared to the same period last year. Meanwhile, US coffee roasters have been forced to increase purchases on the ICE exchange to meet short-term demand, causing coffee inventories on the ICE exchange to also fall sharply.

In addition, the sharp increase in coffee prices was also driven by active buying power from investment funds.

In the domestic market, as recorded this morning, coffee prices fluctuated between 122,000 - 122,700 VND/kg, an increase of 2,200 VND compared to yesterday. The purchase of new crop coffee (delivered in December) has begun.

Farmers and dealers are also taking advantage of the opportunity to sell old crop inventories, in the context of coffee prices continuously recovering in recent days. Notably, foreign customers have begun to survey the demand for new crop purchases, but the export market is still quite quiet.

7/10 metal group items increased in price. Source: MXV

According to MXV, the metal group also recorded overwhelming buying power when 7/10 items increased in price simultaneously. Notably, platinum continued to maintain its upward momentum for the fourth consecutive session, inching up 0.39% to 1,417.2 USD/ounce.

In yesterday's trading session, the US dollar index (DXY) reversed to decrease by 0.25%, down to 97.3 points, thereby making USD-priced commodities such as platinum more attractive to investors holding other currencies, thereby stimulating buying power.

Platinum prices also received strong support from concerns about a prolonged supply shortage. According to the World Platinum Investment Council (WPIC)'s second quarter report, total global platinum supply fell 4% year-on-year, mainly due to a decline in mine production of up to 8%, equivalent to about 123,000 ounces.

Source: https://hanoimoi.vn/gia-ca-phe-tang-manh-tren-5-2-bach-kim-tiep-da-di-len-716190.html

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

Comment (0)