US President Donald Trump refused to comment on the prospect of a US recession due to the trade war. The refusal meant he could not guarantee that the US economy would not fall into recession, thus triggering a sell-off earlier this week on Wall Street. The anxiety spread to investors in the Asia- Pacific (APAC).

Red wave spreads to APAC

In Asia, stock markets were in the red, with Japan's Nikkei and Taiwan's TWII down about 3%, marking their lowest levels since September last year. MSCI's broadest index of Asia- Pacific shares outside Japan fell more than 1%, according to Reuters.

White House reassures, Wall Street worries about risk of US economic recession

Similar developments occurred in markets in Sydney (Australia), Singapore, Seoul (South Korea), Wellington (New Zealand), Mumbai (India), Bangkok (Thailand) and Manila (Philippines). Even Chinese stocks were not immune to this wave of red. Shanghai (China) CSI 300 index (China) fell about 1% while Hong Kong's Hang Seng index fell 1.5%.

Regional tech stocks were among the hardest hit. Japanese tech giants Sony and Hitachi fell more than 4.5% on the day, while Softbank fell 4.4%. Taiwan-based TSMC, the world's largest contract chipmaker and Apple supplier Foxconn, fell more than 3%. South Korea's Samsung fell more than 2%.

Japan's Nikkei index fell 2.64% on March 11.

European stock futures also fell, with Germany's DAX futures down 0.8% and the Eurostoxx index (which represents Europe's 50 largest and most popular stocks) down 0.9%, suggesting the risk of further sell-offs in the coming days.

Risks to the US economy

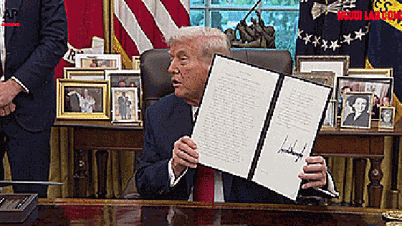

The global stock market's performance reflects investors' concerns after US President Donald Trump "declared war" with the country's largest economic partners. When asked whether the leader expected a recession this year, Mr. Trump refused to comment directly, instead acknowledging that the US economy was facing a "transitional period," Fox News reported on March 10.

AFP quoted Nigel Green, founder and CEO of financial consultancy deVere Group (headquartered in Dubai, UAE), warning that the US market is entering a correction phase, which could fall about 10% from its recent high. According to Shaun Murison, market analyst at online trading platform IG (headquartered in the UK), investors are increasingly concerned about economic instability and the risk of recession from the trade policies applied by the Trump administration.

'Devastating impact': Canadian small businesses fear Trump tariffs

On March 10 (US time), the Nasdaq index experienced its deepest one-day drop since September 2022, while the Dow and S&P 500 indexes witnessed their worst day of the year so far. The Dow index fell 2.08%, the S&P 500 fell 2.7% and the Nasdaq plunged 4% due to a sharp drop in shares of billionaire Elon Musk's Tesla.

Tokyo's failed mission

Yesterday, Japanese Trade Minister Yoji Muto said he had asked the US not to impose tariffs on the country, but had not received any assurances from ally Washington. From March 12, the US will impose a 25% tax on imported aluminum and steel, and "we have not received a response that Japan will be exempted," Reuters quoted Mr. Muto. To convince the White House, the Tokyo government is offering to buy more liquefied natural gas and steel from the US. The two sides agreed to continue negotiations in the coming days.

Source: https://thanhnien.vn/chung-khoan-the-gioi-chao-dao-vi-kinh-te-my-185250311200429305.htm

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)