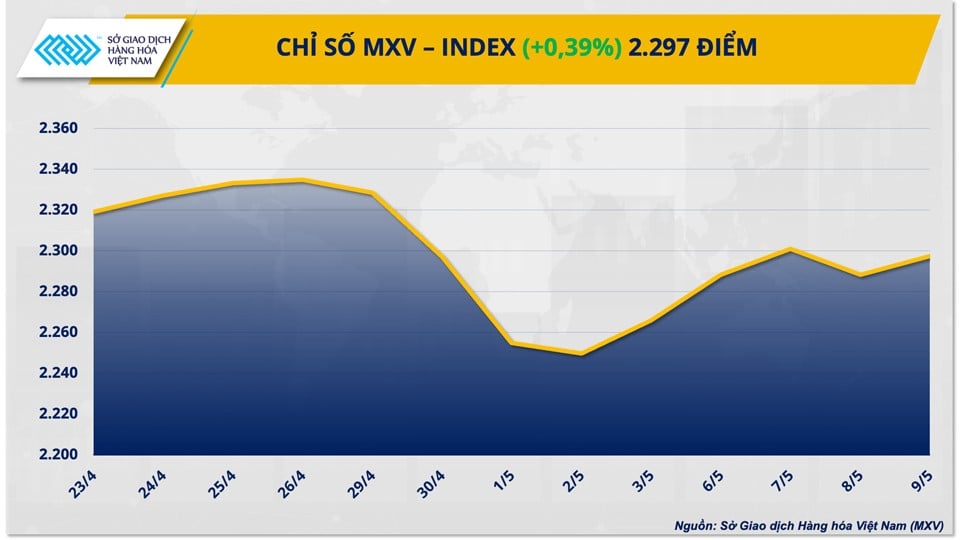

| Commodity market today, May 8: Raw material prices are steadily recovering Commodity market today, May 9: MXV-Index commodity price index breaks recovery streak |

However, most commodities fluctuated within a narrow range, causing the MXV-Index to close the day up only 0.39% to 2,297 points.

Notably, all metal and energy commodities closed in the green. Along with that, the total trading value of the entire Exchange increased sharply again, reaching over VND8,100 billion, up to 73% compared to the previous day. In particular, the cash flow was mainly concentrated in the agricultural group, accounting for more than 50% of the total trading volume of the market, and also reaching a record high ever recorded.

|

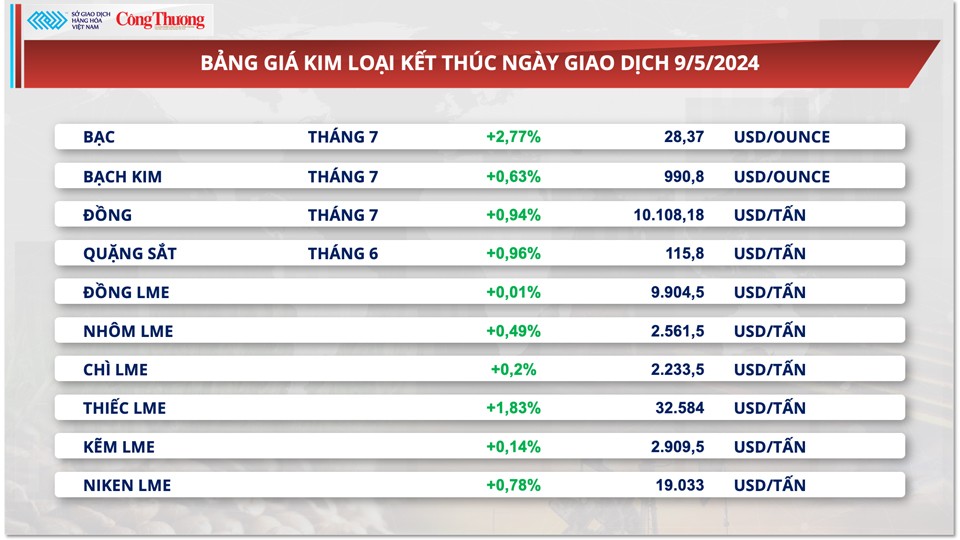

Weakening USD brings green to cover metal price chart

At the end of the trading day on May 9, silver prices led the metal market's gains. For precious metals, both commodities benefited from the weakening of the greenback. At the end of the day, silver prices regained the $28 mark after increasing 2.77%, closing at $28.36/ounce, a three-week high. Platinum prices recovered 0.63% to $990.8/ounce, the highest level in nearly a month.

|

| Metal price list |

According to data released by the US Department of Labor yesterday, the number of US unemployment benefit applications reached 231,000 in the week ending May 4, 19,000 higher than forecast and the highest level since August 2023. Meanwhile, the four-week average of benefits applications increased to 215,000, the highest level since February this year.

The data followed a report that US payrolls fell sharply and job openings fell to a three-year low, further indicating that the US labor market is under pressure. The US dollar fell sharply after the data was released, with the Dollar Index closing down 0.3% at 105.23 points, supporting precious metals prices.

For base metals, the falling US dollar is also a supportive factor for commodity prices. Moreover, optimistic economic data from China, the world's largest metal consumer, further boosted the buying power of base metals. At the end of the day, the prices of two key commodities, COMEX copper and iron ore, increased by 0.94% and 0.96%, respectively.

China's goods exports rose 1.5% year-on-year in April, beating expectations by 0.5 percentage point and rebounding sharply from a 7.5% decline in March, according to the General Administration of Customs. Goods imports also jumped 8.4% in April, much higher than the market forecast of a 5.4% increase and reversing a sharp increase from a 1.9% decline in March.

Customs data also showed that China's copper and iron ore imports both increased in April as the country increased its stockpiling of raw materials for the peak consumption season. Specifically, imports of unwrought and semi-finished copper reached 438,000 tonnes, up 7.5% year-on-year. Meanwhile, iron ore imports reached 101.82 million tonnes in April, up 11.35% year-on-year and 1.1% month-on-month.

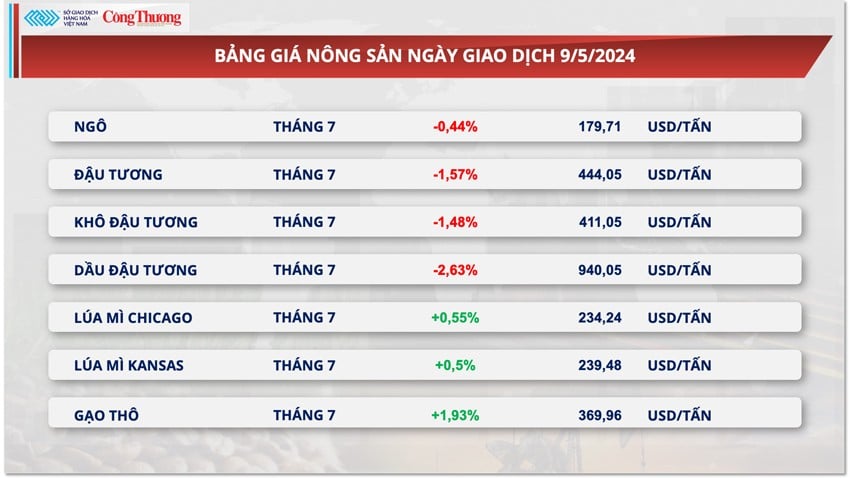

Soybeans extend decline

In the agricultural market, soybeans led the decline. This commodity continued to extend the decline on the trading day of May 9 with a decrease of 1.57%, marking the third consecutive day of closing in the red. The prospect of slowing international demand for US supplies, combined with the return of positive signals on South American supplies, is the factor that has promoted selling pressure in the market.

|

| Agricultural product price list |

Specifically, in the Export Sales report last night, the US Department of Agriculture (USDA) said that the country's 2023-2024 soybean sales reached 428,898 tons in the week ending May 2, up slightly by 3.6% from the previous week and still within the market's expectations. However, the cumulative soybean exports since the beginning of the crop year are still 17.3% lower than the previous crop year, at 41.91 million tons. This shows that the US supply is under strong competitive pressure from Brazil.

Meanwhile, the Brazilian Vegetable Oil Industry Association (Abiove) has raised its 2023-2024 soybean production forecast to 153.9 million tonnes, up 100,000 tonnes from April. In Rio Grande do Sul alone, farmers had harvested about 75% of the soybean area before recent heavy rains caused flooding, with a record 22 million tonnes of output. This is also a sharp increase of 68% compared to the previous crop, which has somewhat eased concerns about supply in Brazil.

In the domestic market, following the global trend, it was noted that yesterday morning, May 9, the offering price of South American soybean meal to our country's ports slightly decreased. In the Northern region, at Cai Lan port, the offering price of soybean meal for delivery in the second quarter of this year fluctuated around 13,050 - 13,350 VND/kg. Meanwhile, at Vung Tau port, the offering price of South American soybean meal was at 12,950 - 13,200 VND/kg.

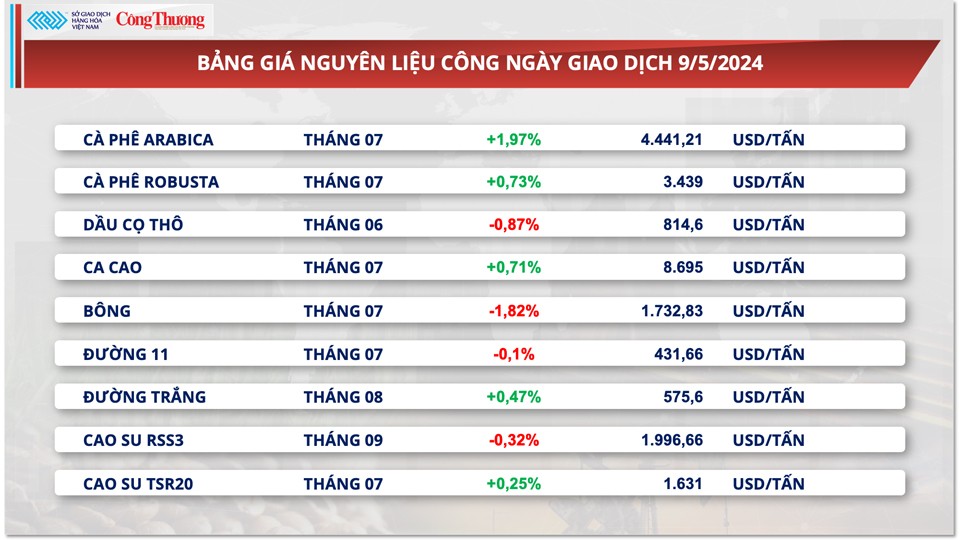

Prices of some other goods

|

| Industrial raw material price list |

|

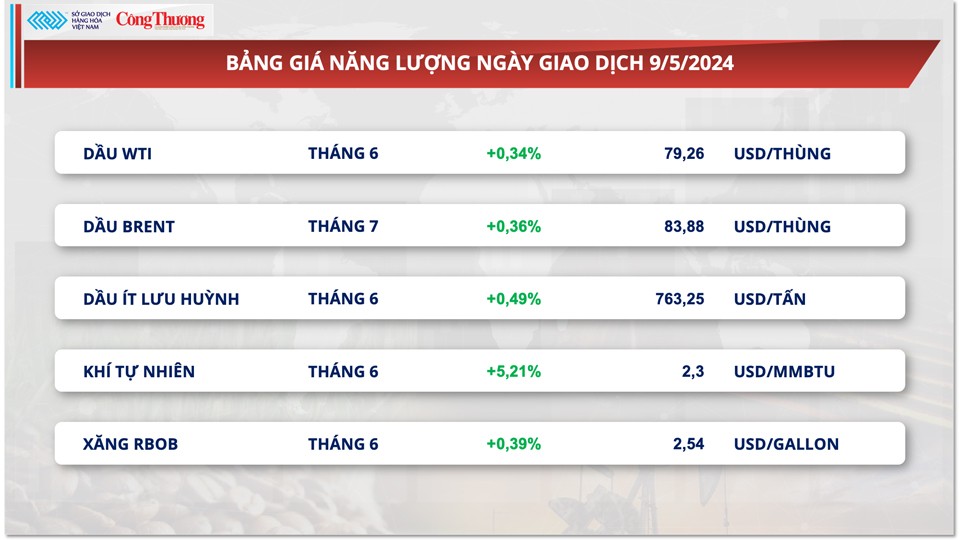

| Energy price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-105-dau-tu-hang-hoa-nhom-nong-san-dat-muc-ky-luc-319301.html

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)