According to the Vietnam Commodity Exchange (MXV), the world raw material market was divided on the last trading day of October.

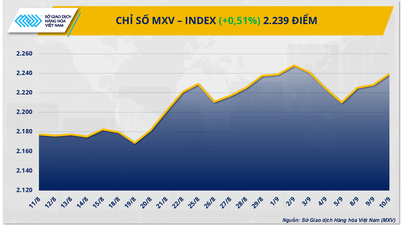

However, selling pressure still dominated, pulling the MXV-Index down nearly 1.8% to 2,130 points. In which, industrial materials and metals led the weakening trend of the whole market.

|

| MXV-Index |

Precious metal prices fall to two-week low

At the close of yesterday's trading session (October 31), the metal market had mixed developments. For precious metals, silver prices fell 3.75% to $32.79/ounce, the lowest level in two weeks. This was also the session that recorded the largest daily decline in silver prices in the past three weeks. Platinum prices also lost the $1,000/ounce mark after falling more than 2%, closing at $999.6/ounce, the lowest level in two weeks.

|

| Metal price list |

On October 31, the US Department of Commerce announced that the Personal Expenditures Price Index (PCE) in September increased 2.1% compared to the same period last year. This rate is lower than the 2.3% rate in August and is closer to the 2% target set by the US Federal Reserve (FED), reinforcing the possibility that the FED will cut interest rates next week. However, excluding energy and food, which are often volatile, the US PCE increased 2.7% compared to the same period last year and 0.3% last month. The market is still expecting the FED to continue to lower interest rates at the policy meeting on November 6-7 after reducing 50 basis points in September.

In addition, the easing of fears of a US recession has also weakened the precious metal's role as a haven. Recent US data has shown that the world's largest economy is still growing steadily, the labor market is strong, and consumer, business and government spending are increasing. US GDP in the third quarter recorded a steady growth of 2.8%.

For base metals, prices of items in the group all recorded quite low fluctuations, most of them changing less than 1%. Of which, iron ore prices increased by 0.15% to 103.89 USD/ton, marking the third consecutive increase.

Iron ore prices benefited from positive economic data from China yesterday, bolstering the outlook for consumption. China's manufacturing activity has expanded again after five consecutive months of contraction, as shown by the country's General Statistics Office, with the manufacturing purchasing managers' index (PMI) coming in at 50.1 in October. This was slightly higher than the forecast of 50 and up from 49.8 in September.

Coffee prices turn to weaken

According to MXV, at the end of yesterday's trading day, selling pressure dominated the industrial raw materials market. For two coffee products, the price of Arabica coffee for December delivery decreased by 1.48% to 5,421 USD/ton and the price of Robusta coffee for January delivery decreased by 1.89% to 4,369 USD/ton.

|

| Industrial raw material price list |

In Vietnam, the rains from Typhoon Tra Mi have not had much impact on coffee plants as the harvest has only reached about 5% of the output. Traders expect trading to pick up from late November when supplies are replenished.

Coffee prices were pressured by the exchange rate as the weakening Brazilian Real kept the USD/BRL exchange rate at a 12-week high, despite the Dollar Index falling 0.31%. This raised concerns that Brazil would boost coffee exports in the coming time, causing oversupply in the market.

On the domestic market on November 1, the price of green coffee beans in the Central Highlands and Southeast regions dropped to 107,800 - 108,200 VND/kg. Compared to the beginning of the year, the price has increased by more than 40,000 VND/kg from 67,500 - 68,400 VND/kg. The current price is almost double that of the same period last year when it only fluctuated around 60,200 - 61,000 VND/kg.

Experts predict that coffee trading will be more active from the end of November when supplies are supplemented from Vietnam's new harvest. However, the market still needs to closely monitor weather developments in major production areas as well as exchange rate fluctuations in the coming time.

Prices of some other goods

|

| Energy price list |

|

| Agricultural product price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-111-gia-kim-loai-quy-lao-doc-356136.html

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)