Loss from buying gold on God of Fortune day

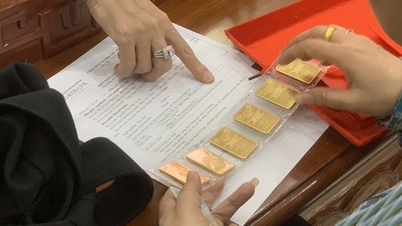

The price of SJC gold bars on February 19 (God of Wealth Day) fluctuated continuously within the range of 500,000 VND to 1.3 million VND per tael. In the morning, gold trading units continuously reduced the price of SJC gold bars with a total reduction of 900,000 VND to 1.3 million VND per tael. By early afternoon of the same day, the price of gold bars increased again by 500,000 VND per tael. Saigon Jewelry Company - SJC bought 75 million VND/tael, sold 78 million VND/tael. Doji Group bought 74.9 million VND, sold 77.9 million VND/tael. Bao Tin Minh Chau Company bought 75.25 million VND, sold 78 million VND/tael...

The difference between the buying and selling price of SJC gold bars widened to 3 million VND per tael, so gold buyers lost money on the same day. For 4-number 9 gold rings, the price decreased slightly by 100,000 VND per tael. SJC Company reduced the price of gold rings to 63.4 million VND, selling at 64.7 - 64.8 million VND/tael. Bao Tin Minh Chau Company also reduced the buying price to 64.5 million VND, selling at 65.9 million VND/tael...

Customers buy gold rings on God of Fortune day

Domestic gold prices fluctuated continuously during the day despite the relatively stable price of precious metals on the international market. The world gold price increased by 7 USD/ounce and remained at 2,020 USD/ounce almost all day on February 19. SJC gold bars were 17.85 million VND/tael higher than international prices, while gold rings were 4.65 - 5.75 million VND/tael higher. The fluctuation of domestic gold prices came from the constantly changing demand for gold on God of Wealth Day. According to some gold trading units, the demand for selling SJC gold bars in the morning was higher than the market's gold buying power, causing the gold buying price of trading units to drop faster than selling. Meanwhile, people buy gold on God of Wealth Day mainly gold rings, small gold products with the image of God of Wealth, dragons, etc., so the price is more stable.

Compared to previous years, the number of customers buying gold before and during God of Fortune Day this year has decreased sharply. Financial economist, Associate Professor, Dr. Dinh Trong Thinh said that the trend of buying gold bars for luck on God of Fortune Day has only appeared in the last 14-15 years. This partly comes from people's belief in buying and selling for luck at the beginning of the new year. Similar to the Vieng market ( Nam Dinh ), which only meets once in the early morning of January 8 every year to pray for luck, buying and selling here does not bargain. However, the sudden increase in demand on God of Fortune Day in recent years has pushed up the price of gold, causing buyers to often suffer losses.

"Gradually, many people have come to understand that buying gold on God of Wealth Day is not the only lucky thing for the new year. Because if you have money to deposit in the bank on the first days of the new year, you will also receive lucky money, which is a sign of luck instead of having to wait in line to buy gold at a high price on this day. Maybe this is the main reason why the gold market on God of Wealth Day is gradually not so bustling anymore," Associate Professor, Dr. Dinh Trong Thinh said.

"Shy" before management information

On the other hand, Mr. Nguyen Ngoc Trong, Director of New Partner Gold Company, analyzed that the gold market is expected to be disrupted when Prime Minister Pham Minh Chinh requested the State Bank (SBV) to urgently summarize Decree No. 24/2012 dated April 3, 2012 on the management of gold trading activities (abbreviated as Decree 24); propose solutions to effectively manage the gold market in the new situation, to be completed in the first quarter of 2024. This information is mentioned in the Prime Minister's recent Directive 06. This information will affect the gold price in a downward trend.

In fact, at the end of December 2023, when the Prime Minister issued Official Dispatch 1426 requesting the State Bank to take measures to manage the gold market; immediately, the domestic gold price dropped sharply after this directive. SJC gold bars went from being 18 - 19 million VND/tael higher than the world price to 13 - 14 million VND/tael. However, by the end of January, the State Bank had not yet come up with any solution to solve the gold market problem. Therefore, SJC gold bars "returned to the old way", with the same price, more expensive than the world price, at times up to nearly 20 million VND/tael.

Mr. Huynh Trung Khanh, Vice President of the Vietnam Gold Trading Association, said frankly: The problem of domestic gold prices being higher than the world price will not be resolved until the problem of supply and raw material sources in the gold market is solved. Before the God of Wealth Day, Prime Minister Pham Minh Chinh issued Directive 06, once again mentioning the summary of Decree 24 in the first quarter of 2024. Therefore, those who buy SJC gold bars at this time are afraid of risks when domestic prices are higher than the world price and the difference between buying and selling prices is up to 3 million VND/tael. That is why demand has decreased.

According to Mr. Khanh, the summary of Decree 24 may be completed in the first quarter, but there are two major issues that need to be mentioned. First, whether SJC gold bars have a monopoly as in the past or allow other gold bar brands to enter the market. Second, the import of gold materials. Decree 24 does not prohibit the import of gold, so whether it is amended or not, it will be difficult to solve the existing problems in the gold market. For many years, the association has also petitioned the State Bank to allow some business units to import raw materials, but this has not been resolved.

"To solve the situation of SJC gold bars being more expensive than the world price, we just need to increase the gold supply to the market, the domestic price will immediately decrease. To increase the supply of SJC gold bars, there are 3 ways: the State Bank sells gold reserves, then re-stamps gold bars to replenish reserves; the State Bank imports raw materials to produce gold bars to sell to intervene in the market; SJC Company imports raw gold to produce gold bars to intervene in the market," Mr. Khanh proposed.

Associate Professor, Dr. Dinh Trong Thinh emphasized: At present, the most important thing is to quickly amend Decree 24 in the direction of not "tightly" allowing only the State Bank to have the monopoly on producing gold bars or importing raw gold to produce gold bars as it does now. It is possible to open up to allow a number of qualified enterprises to participate in importing raw gold to produce gold bars and jewelry to serve domestic consumption needs. On the contrary, if allowed, Vietnam's jewelry industry can also boost exports when the skills of workers and technology of many units are also highly appreciated and the world market is ready to accept. The State Bank can research to build a gold floor, gold certificate trading... to meet the investment needs of a segment of the population.

Source link

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)