The Government requested the Ministers to direct the drafting agencies to promptly complete the draft laws and resolutions to ensure proper implementation of the provisions of the Law on Promulgation of Legal Documents; closely coordinate with the National Assembly Committees to ensure the quality and progress of submission to the National Assembly at the 10th Session of the 15th National Assembly.

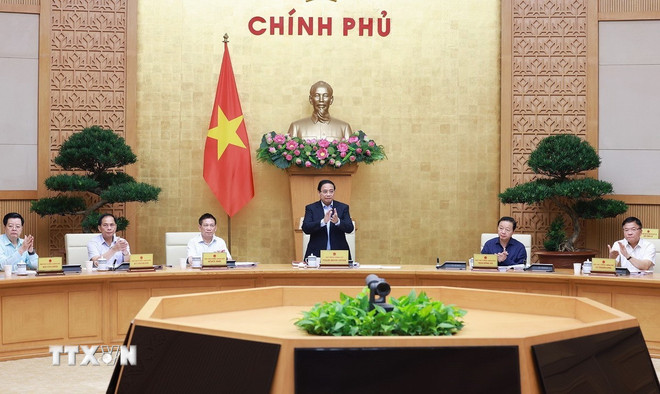

This is one of the main contents of Resolution No. 290/NQ-CP of the thematic meeting on law-making in September 2025 (Second session) recently issued by the Government .

At this session, the Government discussed and commented on 11 draft laws and resolutions in key areas of political , economic, social and foreign affairs life, including: Law amending and supplementing the Law on Urban and Rural Planning; Law on Construction (amended); Resolution of the National Assembly on special mechanisms and policies to implement Resolution No. 59-NQ/TW dated January 24, 2025 of the Politburo on international integration in the new situation; Law amending and supplementing a number of articles of the Law on Insurance Business; Law amending and supplementing a number of articles of the Law on Public Debt Management; Law amending and supplementing a number of articles of the Law on Anti-Corruption; Law amending and supplementing a number of articles of the Law on Citizen Reception, the Law on Complaints, the Law on Denunciations; Law on Tax Administration (amended); Law amending and supplementing a number of articles of the Law on Statistics; Law amending and supplementing a number of articles of the Law on Prices; Law on Investment (amended).

The Government requested the Ministers to direct the drafting agencies to promptly complete the draft laws and resolutions to ensure proper implementation of the provisions of the Law on Promulgation of Legal Documents; closely coordinate with the National Assembly Committees to ensure the quality and progress of submission to the National Assembly at the 10th Session of the 15th National Assembly; the Deputy Prime Ministers in charge of the fields to direct the completion of the above draft laws and resolutions, coordinate with the Vice Chairmen of the National Assembly in the process of submitting the draft laws and resolutions to the National Assembly. Based on the review of the submission documents of the ministries and the opinions expressed at the Session, the Government unanimously resolved on the above draft laws.

Effectively implement the policy of eliminating tax collection for business households and individual businesses.

Among them, regarding the Draft Law on Tax Administration (amended), the Government basically agreed on the necessity of developing a draft Law to institutionalize the Party's guidelines and policies and the State's policies. At the same time, comprehensively amending the Law is necessary to perfect the organizational model of the tax administration apparatus, create a legal corridor for digital transformation, promote administrative procedure reform, enhance decentralization and combat tax losses, and meet practical requirements and socio-economic development requirements in the coming period.

The Government assigned the Ministry of Finance to preside over and coordinate with relevant ministries and agencies to study and absorb to the maximum the opinions of Government members, the opinions of delegates attending the Meeting and the conclusions of the Prime Minister, to complete the Law project to ensure the following requirements: Timely amend and supplement the provisions of the Law project to remove difficulties and obstacles arising in practice, speed up tax refunds, strengthen the application of information technology, improve tax management, prevent tax losses, collect correctly, collect fully and collect on time. Review to ensure conformity and consistency with the provisions of the Constitution, the provisions of other relevant Laws (Law on Electronic Transactions, Law on Value Added Tax, Law on Corporate Income Tax, Law on Inspection, Law on Fees and Charges, Law on International Treaties...) and international commitments.

Regarding tax declaration, tax calculation, and tax deduction for business households and business individuals (Article 13): Carefully assess the impact, ensure that new regulations and alternative solutions are effective, highly feasible, and have a reasonable roadmap for application and conversion; at the same time, effectively implement the policy of eliminating tax assignment for business households and business individuals according to Resolution No. 68-NQ/TW dated May 4, 2025 of the Politburo on private economic development, Resolution No. 198/2025/QH15 dated May 17, 2025 of the National Assembly on a number of special mechanisms and policies for private economic development.

Review and minimize unnecessary administrative procedures that cause difficulties and obstacles for people and businesses; research regulations on applying information technology, building databases... to simplify and modernize tax management processes.

Strengthen decentralization and delegation of authority to ensure compliance with regulations on decentralization, delegation of authority, division of authority, and organization of two-level local government; in which the Government/Ministry of Finance is assigned to specify details on fluctuating issues to ensure flexibility in direction and administration.

The Ministry of Finance shall preside over and coordinate with relevant ministries and agencies to promptly complete the draft Law dossier in accordance with the provisions of the Law on Promulgation of Legal Documents. The Minister of Finance shall be assigned, on behalf of the Government, to sign the submission to the National Assembly of the draft Law at the 10th Session of the 15th National Assembly.

Perfecting the legal corridor on prices to meet the requirements of socio-economic development in the new situation

Regarding the draft Law amending and supplementing a number of articles of the Law on Prices, the Government basically agrees on the necessity of developing a draft Law to implement the Party and State's policy of perfecting the institution to promote decentralization and delegation of power in accordance with the model of streamlining the State apparatus at the central and local levels, creating a legal corridor, promptly handling practical issues, removing institutional "bottlenecks", contributing to the realization of socio-economic development goals, to perfect the legal corridor on prices to meet the requirements of socio-economic development in the new situation.

The Government assigned the Ministry of Finance to preside over and coordinate with relevant ministries and agencies to study and absorb to the maximum the opinions of Government members, the opinions of delegates attending the Meeting and the conclusion of the Prime Minister, to complete the Law project to ensure the following requirements: Timely amend and supplement regulations to remove difficulties and obstacles from practice; shortcomings, problems and limitations of current legal regulations on prices; ensure the scope, subjects of application, groups of goods and services priced by the State and the authority and form of pricing are consistent with the provisions of specialized legal documents, overcome difficulties and shortcomings in practice. Strengthen decentralization and delegation of power along with the allocation of resources, clearly define the content of state management for local authorities, ensure compliance with regulations on the division of authority, decentralization, delegation of power, and organization of 2-level local authorities. Review, reduce, and simplify investment and business conditions and inappropriate administrative procedures; remove unnecessary, difficult, and obstructive regulations.

The Ministry of Finance shall preside over and coordinate with relevant ministries and agencies to urgently complete the draft Law dossier in accordance with the provisions of the Law on Promulgation of Legal Documents. The Minister of Finance shall be assigned, on behalf of the Government, to sign the Government's Submission on the draft Law to be submitted to the National Assembly at the 10th Session of the 15th National Assembly.

Clearly stipulate the authority, order, procedures, criteria, and documents to decide on "stopping/terminating project activities"

The Government basically agrees on the necessity of developing a draft Law amending and supplementing a number of articles of the Investment Law (amended) submitted by the Ministry of Finance in Submission No. 596/TTr-BTC dated September 12, 2025. The Ministry of Finance is assigned to preside over and coordinate with relevant ministries and agencies to study and absorb as much as possible the opinions of Government members, the opinions of delegates attending the Meeting and the conclusion of the Prime Minister, and to complete the draft Law to ensure the following requirements: The content of decentralization and delegation of authority to approve project investment policies from the National Assembly to the Prime Minister, from the Prime Minister to the Provincial People's Committees is consistent with the directions of the Party and State leaders. However, it is necessary to study in the direction of having breakthrough solutions, changing the approach to the issue of approving investment policies (not only the content but also the form); it is necessary to simplify the contents in the documents approving/adjusting investment policies; The decision on the project investment policy is only the agreement in principle of the competent authority. The establishment and implementation of the project is the step of concretizing the project content (scale, objectives, investment capital, progress, efficiency, technical technology, environmental impact,...)

For projects of special scale and nature, it is necessary to study and stipulate the feasible and effective operation time and the ability to recover capital (capital recovery time can be more than 70 years), ensuring compliance with the spirit of Resolution No. 68-NQ/TW of the Politburo as well as the direction of the Party and State leaders on attracting and encouraging the private economy to participate in projects, especially large, important and essential infrastructure in specific fields with very large investment and management costs such as railways, airports, seaports, etc. (Deputy Prime Minister Tran Hong Ha has directed the Ministry of Finance to study this content in the process of adjusting the Investment Law in Document No. 8576/VPCP-CN dated September 12, 2025).

Regarding the "Stopping" and "Terminating" of investment project activities (Articles 39 and 40 of the draft Law), currently, there are many investment projects using land that have been abandoned or stopped operating for many years, causing prolonged waste due to problems and difficulties (such as power projects, urban area projects, Thach Khe iron mine project, Thai Nguyen Iron and Steel Plant Phase 2 expansion project, etc.). Therefore, it is necessary to conduct research to clearly stipulate the authority, order, procedures, criteria, and documents to decide to "stop/terminate project activities" to thoroughly handle the above projects, avoiding wasting resources of the state, businesses, and people.

Continue to review and minimize conditional investment and business sectors; strongly shift from pre-inspection to post-inspection.

Review to ensure compliance with Resolution No. 173/2024/QH15 on questioning activities at the 8th Session of the 15th National Assembly, including content on preventing e-cigarettes and heated cigarettes.

The Ministry of Finance shall preside over and coordinate with relevant ministries and agencies to urgently complete the draft Law dossier in accordance with the provisions of the Law on Promulgation of Legal Documents. The Minister of Finance shall be assigned, on behalf of the Prime Minister, to sign the Submission to the National Assembly for consideration and comment on this draft Law at the 10th Session of the 15th National Assembly.

The Government assigned Deputy Prime Minister Ho Duc Phoc to direct the completion of the above three draft laws./.

Source: https://www.vietnamplus.vn/hoan-thien-cac-du-an-luat-bao-dam-chat-luong-tien-do-va-hieu-qua-post1063392.vnp

![[Photo] High-ranking delegation of the Russian State Duma visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/c6dfd505d79b460a93752e48882e8f7e)

![[Photo] Joy on the new Phong Chau bridge](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/b00322b29c8043fbb8b6844fdd6c78ea)

![[Photo] The 4th meeting of the Inter-Parliamentary Cooperation Committee between the National Assembly of Vietnam and the State Duma of Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/9f9e84a38675449aa9c08b391e153183)

![[Photo] Preserving traditional Mid-Autumn Festival in modern life](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/26/d4d4767169c646a2836dcee6bd34581a)

Comment (0)