Truong Hai Group Joint Stock Company ( Thaco ) has just announced its financial report for 2022. This enterprise recorded a profit after tax of 7,420 billion VND, a sharp increase compared to 5,294 billion VND in 2021.

After many years, Mr. Tran Ba Duong's Thaco has recorded a profit of over 7,000 billion VND.

However, the debt/equity ratio increased sharply compared to the previous year, from 1.76 times at the end of 2021 to 2.16 times at the end of 2022.

At the end of last year, Thaco recorded equity of VND48,445 billion.

Total liabilities are over 104,000 billion VND. Thaco recorded bond debt on the company's equity at 0.17 times. This means Thaco has about 8,200 billion VND of bond debt.

According to HNX, Thaco is circulating a batch of bonds worth a total of VND6,200 billion, maturing in December 2024, December 2025 and September 2026, respectively.

Profit in 2022 increased sharply, thereby helping the group's return on equity (ROE) improve from 11.3% to 15.3%.

Thaco Truong Hai Group is known as a private enterprise of Mr. Tran Ba Duong and Ms. Vien Dieu Hoa's family. This enterprise is currently not a public company and is not required to disclose information.

Thaco’s main business is the wholesale of automobiles and other motor vehicles. This enterprise manufactures, distributes and owns a retail system of passenger cars with many brands: Kia (Korea), Mazda (Japan), Peugeot (France), BMW (Germany)…

Kia is a subsidiary of Hyundai but operates separately in Vietnam. Truong Hai (Thaco) has the right to assemble and distribute Kia cars. The factory is located in Chu Lai Industrial Park, Quang Nam province with a designed capacity of about 50,000 cars/year. Kia products in Vietnam include Morning, Soluto, K3, Sonet, Seltos, Sorento, Carnival...

Besides Kia, Thaco also assembles two other brands: Mazda and Peugeot.

Over the past decade, Thaco has expanded into many fields, including agriculture, real estate, retail, logistics, etc.

In 2023, billionaire Tran Ba Duong's group continues to set big ambitions.

In the automobile segment, Thaco expects sales to reach over 120,000 vehicles (of which 96,000 are passenger cars). Total revenue is over 90,000 billion VND. In the agricultural segment, Thaco Agri will develop banana growing areas, fruit orchards and rubber plantations up to tens of thousands of hectares.

In the real estate sector, Thadico - Dai Quang Minh will accelerate the deployment of available land funds, planning to start dozens of commercial projects with a total investment of thousands of billions of VND in 2023.

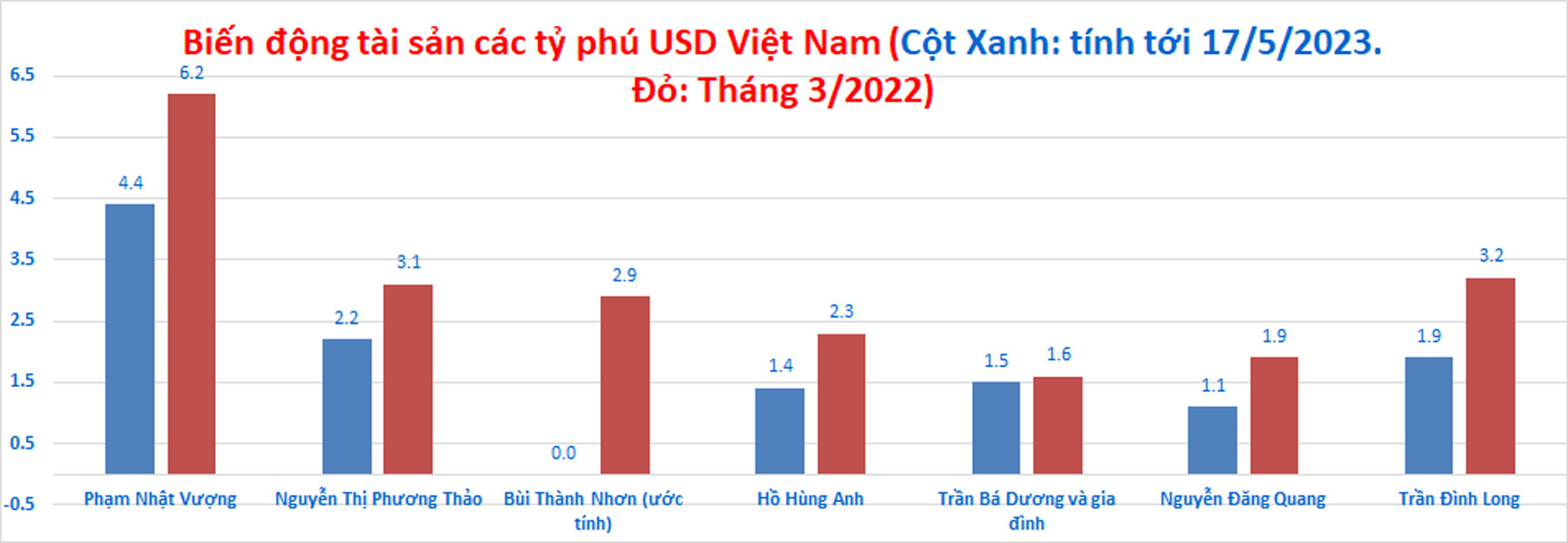

According to the list of world USD billionaires in 2023 published by Forbes Magazine (USA) in early April 2023, Vietnam has 6 representatives. Vietnamese billionaires have assets worth 12.6 billion USD, "evaporating" 8.6 billion USD compared to 2022. However, the assets of Thaco Chairman Tran Ba Duong's family remain unchanged, at 1.5 billion USD.

Thaco has poured billions of dollars into HAGL Agrico, but the company's recovery has been slow. Previously, at the extraordinary shareholders' meeting in early 2021, Mr. Tran Ba Duong said that he joined HAGL Agrico only to help the company escape danger and wanted the country to have a large-scale agricultural enterprise following the industrial production model.

Previously, Thaco had invested in Hung Vuong Seafood and it was also unsuccessful. HVG's business was bad, this stock was delisted from HOSE.

On May 15, HAGL Agrico signed the handover of Nong Khang airport in Houaphan province (Laos).

The total investment of the project is 82 million USD, the source of funding for the project construction is Hoang Anh Gia Lai Joint Stock Company (HAGL) signed a contract to lend to the Lao Government, represented by the Lao Ministry of Finance. By December 2019, the project changed the lending entity from HAGL to the International Agriculture Joint Stock Company (HAGL Agrico).

In 2021, Thaco Group took over and operated HAGL Agrico Company, and at the same time, Thaco also took over the Nong Khang airport project to continue to accelerate the handover progress.

After billionaire Tran Ba Duong and his private company withdrew all capital from Hung Vuong, a Thaco leader also registered to sell the remaining HVG shares.

Source

Comment (0)