Bank interest rates today November 27, 2024, SeABank sharply increased deposit interest rates after more than 3 months, Bac A Bank suddenly reduced deposit interest rates at all terms.

After more than 3 months of no change, Southeast Asia Commercial Joint Stock Bank ( SeABank ) has just sharply increased its deposit interest rates for terms from 1-12 months.

According to the online interest rate table, interest is received at the end of the term, the 1-2 month term increases by 0.45%/year to 3.4%/year, the 3-5 month term increases by 0.65%/year to 4.1%/year.

Interest rates for 6-11 month deposits increased by 0.75% per year. Specifically, 6-month deposits increased to 4.5% per year, 7-month deposits to 4.6% per year, 8-month deposits to 4.65% per year, 9-month deposits to 4.7% per year, 10-month deposits to 4.75% per year, and 11-month deposits to 4.8% per year.

12-month term bank interest rate increased by 0.5%/year to 5%/year.

This bank keeps the deposit interest rates unchanged for the remaining terms. The 15-month term currently has an interest rate of 5.25%/year, and the 18-36 month term is 5.45%/year.

In fact, over the past few months, SeABank transaction points in Hanoi have displayed signs inviting customers to deposit money with interest rates up to 5.95%/year (down from the previously advertised interest rate of 6.1%/year).

Since last October, staff have been calling customers to deposit savings online with interest rates up to 6.15%/year for 12-month term, 5.95%/year for 6-month term. These two interest rates are much higher than listed at banks.

An Binh Commercial Joint Stock Bank ( ABBank ) increased the interest rate for 6-month term by 0.1%/year. However, this bank reduced the same rate for 12-month term. Currently, the interest rates for these two terms are 5.6% and 5.7%/year, respectively.

This is the third time this month that ABBank has adjusted its savings interest rates. ABBank is publicly listing the highest interest rate of up to 6.3%/year for online deposits with a term of 24 months, and 6.2%/year for terms of 15-18 months.

Meanwhile, Bac A Commercial Joint Stock Bank ( Bac A Bank ) suddenly reduced 0.1%/year interest rates for all terms from today.

According to the interest rate table for deposits under 1 billion VND, the 1-2 month term is reduced to 3.85%/year, 3 months is 4.15%/year, 4 months is 4.25%/year, and 5 months is 4.35%/year.

Bank interest rates for terms of 6-8 months have decreased to 5.3%/year, and for terms of 9-11 months they are 5.4%/year.

Interest rate for 12-month term is 5.7%/year, 13-15 months is 5.75%/year.

Bac A Bank is also one of the few banks that maintain deposit interest rates above 6%/year. Currently, the interest rate for 18-36 month term deposits has decreased to 6.05%/year. For the same term, customers who deposit over 1 billion VND enjoy interest rates up to 6.25%/year.

| INTEREST RATE TABLE FOR ONLINE DEPOSITS AT BANKS ON NOVEMBER 27, 2024 (%/YEAR) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| AGRIBANK | 2.4 | 2.9 | 3.6 | 3.6 | 4.8 | 4.8 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETINBANK | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

| ABBANK | 3.2 | 4.1 | 5.6 | 5.6 | 5.7 | 6.2 |

| ACB | 3.1 | 3.5 | 4.2 | 4.3 | 4.9 | |

| BAC A BANK | 3.85 | 4.15 | 5.3 | 5.4 | 5.7 | 6.05 |

| BAOVIETBANK | 3.3 | 4.35 | 5.2 | 5.4 | 5.8 | 6 |

| BVBANK | 3.8 | 4 | 5.2 | 5.5 | 5.8 | 6 |

| CBBANK | 3.8 | 4 | 5.5 | 5.45 | 5.65 | 5.8 |

| DONG A BANK | 3.9 | 4.1 | 5.55 | 5.7 | 5.8 | 6.1 |

| EXIMBANK | 3.9 | 4.3 | 5.2 | 4.5 | 5.2 | 5.8 |

| GPBANK | 3.4 | 3.92 | 5.25 | 5.6 | 5.95 | 6.05 |

| HDBANK | 3.85 | 3.95 | 5.3 | 4.7 | 5.6 | 6.1 |

| IVB | 3.8 | 4.1 | 5.1 | 5.1 | 5.8 | 6.1 |

| KIENLONGBANK | 3.7 | 3.7 | 5.2 | 5.3 | 5.6 | 5.7 |

| LPBANK | 3.6 | 3.8 | 5 | 5 | 5.5 | 5.8 |

| MB | 3.7 | 4 | 4.6 | 4.6 | 5.1 | 5.1 |

| MSB | 3.9 | 3.9 | 4.8 | 4.8 | 5.6 | 5.6 |

| NAM A BANK | 4.5 | 4.7 | 5 | 5.2 | 5.6 | 5.7 |

| NCB | 3.9 | 4.2 | 5.55 | 5.65 | 5.8 | 5.8 |

| OCB | 3.9 | 4.1 | 5.1 | 5.1 | 5.2 | 5.4 |

| OCEANBANK | 4.1 | 4.4 | 5.4 | 5.5 | 5.8 | 6.1 |

| PGBANK | 3.4 | 3.8 | 5 | 5 | 5.5 | 5.8 |

| PVCOMBANK | 3.3 | 3.6 | 4.5 | 4.7 | 5.1 | 5.8 |

| SACOMBANK | 3.3 | 3.6 | 4.9 | 4.9 | 5.4 | 5.6 |

| SAIGONBANK | 3.3 | 3.6 | 4.8 | 4.9 | 5.8 | 6 |

| SEABANK | 3.4 | 4.1 | 4.5 | 4.7 | 5 | 5.45 |

| SHB | 3.5 | 3.8 | 5 | 5.1 | 5.5 | 5.8 |

| TECHCOMBANK | 3.35 | 3.65 | 4.55 | 4.55 | 4.85 | 4.85 |

| TPBANK | 3.5 | 3.8 | 4.7 | 5.2 | 5.4 | |

| VIB | 3.6 | 3.9 | 4.8 | 4.8 | 5.3 | |

| VIET A BANK | 3.7 | 4 | 5.2 | 5.4 | 5.7 | 5.9 |

| VIETBANK | 3.9 | 4.1 | 5.2 | 5 | 5.6 | 5.9 |

| VPBANK | 3.6 | 3.8 | 4.8 | 4.8 | 5.3 | 5.3 |

According to statistics, 14 banks have increased their deposit interest rates since the beginning of November, including: SeABank, BaoViet Bank, HDBank, GPBank, LPBank, Nam A Bank, IVB, Viet A Bank, VIB, MB, Agribank, Techcombank, ABBank, and VietBank. Of which, MB, Agribank and VIB are the banks that have increased their interest rates twice since the beginning of the month.

ABBank alone has adjusted interest rates three times with increases for terms under 12 months. However, ABBank has also reduced 12-month savings interest rates twice during these adjustments.

Meanwhile, Bac A Bank is the only bank that reduces interest rates across all terms.

According to VCBS, the trend of increasing deposit interest rates in the remaining months of 2024 is unlikely to continue and there will be differentiation among banking groups.

For the state-owned banking group, deposit interest rates are expected to remain stable at the current level and may be adjusted down slightly at the end of the year to support the economy, especially in the context of the economy being affected by recent natural disasters.

For the group of private commercial banks, there is still pressure to slightly increase deposit interest rates to increase capital mobilization to promote credit growth, especially for banks with a high level of dependence on customer deposits and a less flexible capital mobilization structure.

Increasing deposit interest rates unlikely to continue, putting pressure on small banks

From today, November 23, the highest interest rate increased to 6.4%/year.

Increasing interest rates, Agribank is leaving the Big 4 group far behind in terms of deposit interest rates

Source: https://vietnamnet.vn/lai-suat-ngan-hang-hom-nay-27-11-2024-them-ngan-hang-tang-manh-lai-huy-dong-2345989.html

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

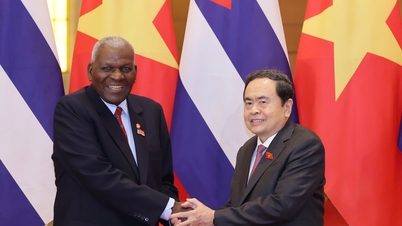

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

Comment (0)