On September 9, Deputy Prime Minister Ho Duc Phoc signed and issued Resolution No. 5/2025 of the Government on piloting the crypto asset market in Vietnam. This Resolution takes effect from September 9. The pilot implementation period is 5 years.

Resolution regulating the pilot implementation of offering and issuance of crypto assets, organization of crypto asset trading market and provision of crypto asset services; state management of crypto asset market in Vietnam.

In particular, one of the conditions to be granted a License to provide services to organize crypto-asset trading markets is that the enterprise providing services to organize crypto-asset trading markets must have a minimum capital of VND 10,000 billion, with at least 65% of the charter capital contributed by shareholders and members being organizations, of which over 35% of the charter capital is contributed by at least 2 organizations such as commercial banks, securities companies, fund management companies, insurance companies, and enterprises operating in the technology sector.

With this regulation, commercial banks, securities companies, fund management companies, and insurance companies are considered to have significant advantages in the roadmap to build a digital asset market in Vietnam.

VPBank and MB have expressed their interest in participating.

Commercial banks, securities companies, fund management companies, and insurance companies have significant advantages in the digital asset playground (Photo: DT).

Several banks and securities companies with great potential have been preparing for the upcoming race. In the latest announcement, VPBank said it is completing the final procedures to participate in the pilot implementation of a crypto-asset trading floor. VPBank Securities Joint Stock Company (VPBankS) - a subsidiary of this bank - plays a leading role in their crypto-asset trading floor project.

At the annual meeting in April, Mr. Nguyen Duc Vinh, General Director of VPBank, said that the crypto-asset market is a new, important but potentially risky field that requires a legal framework and the participation of organizations with strong foundations. Mr. Vinh also revealed that the bank has analyzed and contacted partners to prepare to enter this market.

Before VPBank, a number of organizations also made moves to approach this field. In mid-August, the Military Commercial Joint Stock Bank (MB) started with the information of signing a memorandum of understanding (MoU) with Dunamu Group at the Vietnam - Korea Business Forum in Seoul to cooperate in deploying the first domestic digital asset trading floor in Vietnam.

A series of securities companies join the race

On the side of securities companies, the race is getting "hotter" with the participation of familiar names such as SSI Securities, Techcombank Securities, VIX Securities...

VIX Securities established VIX Cryptocurrency Exchange Joint Stock Company (abbreviated as VIXEX) and directly owns a 15% capital contribution ratio. FTG Vietnam Joint Stock Company is the largest shareholder with a 64.5% capital contribution ratio (FTG was related to VIX Securities in the previous period).

VIX Crypto Asset Exchange has a charter capital of 1,000 billion VND, Mr. Nguyen Van Hieu (born in 1978) is the General Director and Legal Representative.

Techcom Securities (TCBS) is also not out of the game. In early May, this company was included in the list of founding shareholders of Techcom Crypto Asset Exchange Joint Stock Company (TCEX) with an initial charter capital of 3 billion VND.

SSI Securities has also established a subsidiary, SSI Digital Technology Joint Stock Company (SSI Digital - SSID), since 2022. In June, member units of this securities company also signed a strategic cooperation agreement with Tether - the world's largest stablecoin issuer, U2U Network and Amazon Web Services (AWS). Tether is the issuer.

An attractive "piece of cake" that no company wants to miss

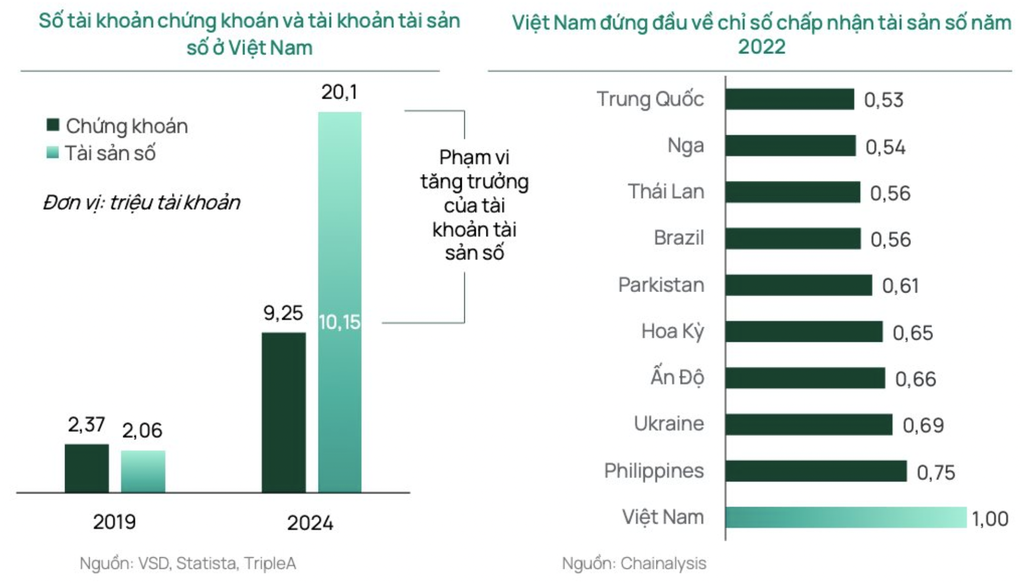

The number of digital asset account users in Vietnam increased fivefold in the period 2019-2024 (Photo: Screenshot from Statista report).

At the annual meeting on the afternoon of April 18, when asked about digital assets, Mr. Nguyen Duy Hung - Chairman of the Board of Directors of SSI Securities - said that a few years ago, he, like many people, considered digital assets to be of no value. Since the governments of some countries considered adding digital currencies to national reserves similar to gold, he has changed his opinion.

"This is an inevitable and irresistible trend. When there is a legal framework, we should not consider this as a "herding chickens and ducks" meme in the market. Blockchain technology and digital currency are the future and they will bring great value to the economy," Mr. Hung told shareholders.

Smaller securities companies are also actively issuing new issues to qualify for participation.

Sharing with Dan Tri newspaper reporter, Mr. Nguyen The Minh - Director of Analysis of Yuanta Vietnam Securities Company - said that digital assets are an extremely attractive "piece of cake" that no securities company wants to ignore.

Because Vietnam is one of the top countries in the world in terms of digital asset ownership and trading (about 17 million people, with 1,000 billion USD in transactions in 2024), in which, it ranks in the top 5 in the world in terms of interest in digital assets and top 3 in terms of using international exchanges.

According to statistics from Statista in 2024, the number of digital asset account users in Vietnam is estimated to reach 10.15 million people, not including the NFT (Non-fugible token) market, 5 times more than in 2019. Another statistic from Triple A in 2023 shows that this number can reach 20.1 million accounts.

Source: https://dantri.com.vn/kinh-doanh/loat-ngan-hang-cong-ty-chung-khoan-chay-dua-vao-linh-vuc-tai-san-so-20250910100436603.htm

![[Photo] Soldiers guard the fire and protect the forest](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/27/7cab6a2afcf543558a98f4d87e9aaf95)

![[Photo] Prime Minister Pham Minh Chinh attends the 1st Hai Phong City Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/27/676f179ddf8c4b4c84b4cfc8f28a9550)

Comment (0)