The world's largest maker of memory chips, smartphones and TVs will release preliminary earnings results for the next three months on October 11, but financial analysts are already estimating a poor showing for the group.

Specifically, nearly 20 analysts said Samsung's profit could fall to just 2.1 trillion won ($1.56 billion) in the July-September quarter, compared with 10.85 trillion won in the same period last year.

The decline is believed to be due to the chip business, typically the group's biggest earner, likely reporting a quarterly loss of 3 trillion to 4 trillion won, after bottoming memory chip prices failed to recover as quickly as some had predicted.

Samsung's chip production cuts also hurt economies of scale, raising chip manufacturing costs, analysts said.

Samsung first announced production cuts in April 2023 and continued to cut more in the third quarter to clear inventory, an effort to balance a microprocessor glut that has led to the worst recession in decades for the entire industry.

Samsung's rival Micron Technology also forecast a loss in September 2023, raising concerns among observers about a slow recovery in end-use markets such as data centers.

Smartphone and personal computer makers, instead of new orders, have opted to use inventory that has been sitting on them for months amid the economic downturn.

Business inventories are low enough that demand is expected to recover early next year, analysts say.

Samsung recently received its first order in a year for server memory chips from a North American data center company, KB Securities said in a report late last month, raising hopes of a revival in the data center chip market.

Strong demand for memory chips used in artificial intelligence such as high-bandwidth memory (HBM) remains a bright spot, but Samsung is behind compatriot SK Hynix in developing such chips.

For the mobile business, the average forecast from five analysts suggests operating profit could reach around 3 trillion won. The smartphone giant launched high-end foldable phones this quarter, boosting sales despite a sluggish overall market.

(According to Reuters)

AI chip 'unicorn' joins hands with Samsung, challenging Nvidia

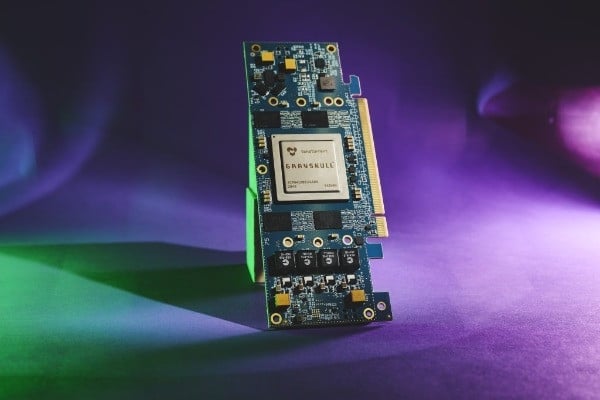

Tenstorrent, a billion-dollar AI chip startup headquartered in Canada, has just reached an agreement to use Samsung's 4-nanometer (nm) microprocessor manufacturing technology.

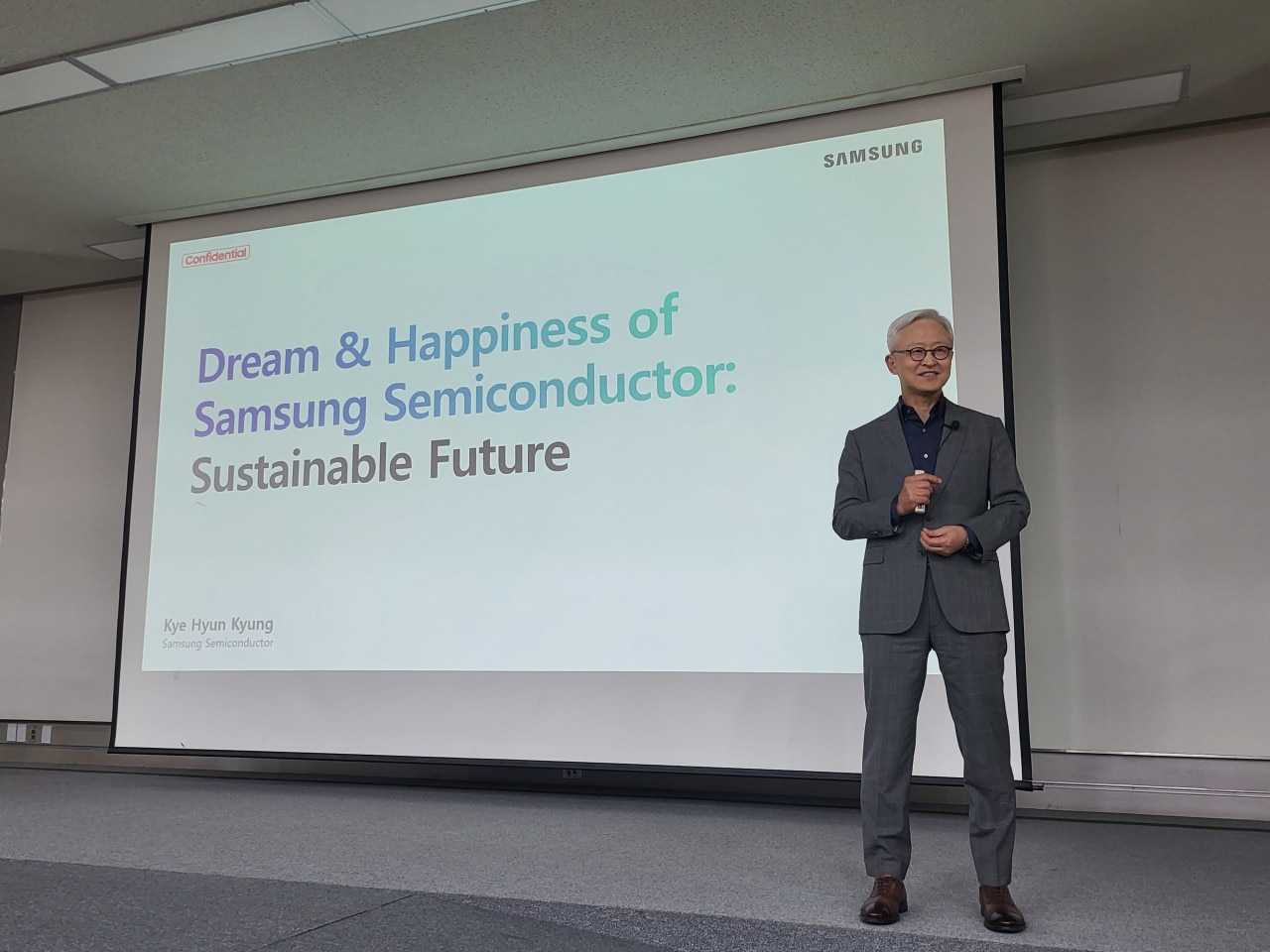

Samsung CEO confident in competing with TSMC

Kyung Kye Hyun, co-CEO of Samsung Electronics, expressed confidence in the chip foundry war between the company and its fierce rival TSMC.

Samsung, Apple dominate smartphone market in first half of year

In the first 6 months of 2023, the 10 best-selling smartphones in the world were all from Samsung and Apple.

Source

Comment (0)