VSDC has certified registration 2,311,308,021 shares for TCBS , equivalent to a charter capital of VND 23,113 billion. Accordingly, from September 26 , 2025 , all TCX shares have been registered at VSDC according to regulations.

Previously, the State Securities Commission issued an official dispatch confirming that TCBS met the conditions to become a public company according to the provisions of the Securities Law , and at the same time foreign ownership approval up to 100%. This means that TCX shares are not subject to foreign room restrictions, creating favorable conditions for international investment funds to participate and increase liquidity .

|

| Since September 26 , 2025 , all TCX shares have been registered at VSDC as prescribed. |

The success of TCBS IPO (initial public offering) This is clearly demonstrated by the strong attraction , when the total number of registered purchases reached more than 575.16 million shares, 2.5 times higher than the number offered, equivalent to a total registered value of more than VND 27,000 billion (more than USD 1 billion). This demand far exceeding supply is a signal that investors are still willing to wait for the opportunity to buy more when TCBS shares are listed. In the market, a number of financial institutions have also expressed their desire to find partners to conduct negotiated purchases as soon as TCBS officially trades on HoSE.

TCBS IPO recorded more than 26,000 investors participating in the purchase, including 78 reputable international financial institutions and investment funds, registering nearly 500 million USD, accounting for 48% of the total registration volume. In addition, individual investors also participated strongly with more than 34,000 registrations, especially 90% of registration orders were made online through the iPO feature on TCInvest. This impressive number not only affirms the superior technological strength, but also shows that TCBS is pioneering in digitizing the capital market, bringing a modern, fast and different investment experience to customers.

With a total offering value of more than VND 10,800 billion, this is a record-breaking IPO in the history of the Vietnamese securities industry , far exceeding the scale of previous IPOs such as DSE (VND 900 billion) or VCI, MBS (approximately VND 1,000 billion) , affirming the attractiveness of TCBS 's shares and the effectiveness of the online self-serve model according to the WealthTech strategy.

The question many investors are asking right now is: can TCBS shares soon join the VN30 index basket, which gathers stocks with the top capitalization, liquidity and reputation in the market?

In terms of capitalization, with the scale of issuance and enterprise value, TCBS is currently in the leading group of the securities industry, qualified to be in the top of large-scale enterprises on HOSE. In terms of shareholder structure, TCBS has up to 28,000 shareholders since listing, a new record, far exceeding previous IPO deals , creating a solid foundation for liquidity. For a clearer comparison, PV Power's IPO in 2018 only attracted nearly 2,000 investors, while a top enterprise in the securities industry like SSI, after nearly 20 years of listing, currently has about 80,000 shareholders (as of 2024) . Thus , TCBS has owned an impressive number of shareholders right from the starting line.

With up to 48% of total registrations coming from international financial institutions , including foreign funds with total assets under management of hundreds of billions, even trillions of USD. shows that they appreciate not only the financial capacity but also the leadership team, operating model and long-term strategy of TCBS . The balanced structure between individual and institutional investors, between domestic and international, is an important factor in strengthening the sustainability and liquidity of listed shares.

With a large capitalization, balanced shareholder structure and positive forecast liquidity, TCBS is assessed by analysts to have a high possibility of joining the VN30 index basket in the upcoming review periods. Prerequisites such as listed company status, free-float ratio and adjusted capitalization are all met. Of course, liquidity criteria will need time to verify in the first 6 months after listing, but with demand exceeding supply by 2.5 times and a large number of shareholders from the beginning, there are many grounds to believe that TCBS shares will be present in the portfolio of leading bluechip stocks in Vietnam.

|

Capital strength is also a key advantage that helps TCBS differentiate itself. As of June 30, 2025, the company had a charter capital of VND 20,802 billion and equity of VND 30,063 billion, the highest in the securities industry. After successfully issuing 231.15 million IPO shares, the charter capital increased to more than VND 23,113 billion, and equity increased to nearly VND 41,000 billion. Thanks to that, the margin lending limit was expanded to about VND 82,000 billion, while TCBS is currently disbursing only about half. This large space not only shows solid capital potential but also affirms TCBS's outstanding liquidity support ability, thereby further consolidating the basis for the stock to become a bright candidate for the VN30 basket.

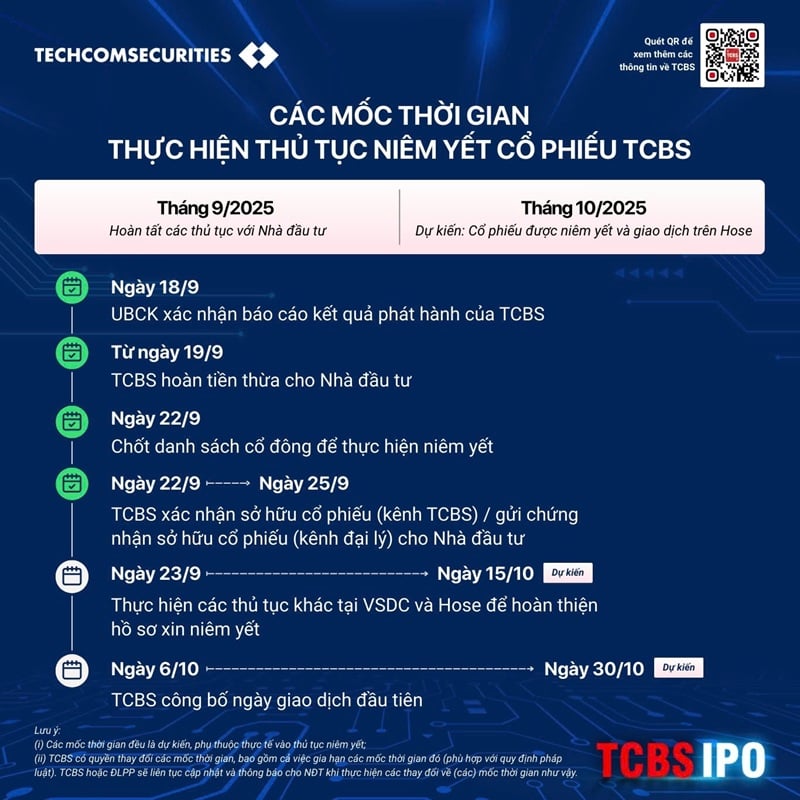

In addition to internal factors, the listing process of TCBS is also supported by Decree 245/2025/ND-CP of the Government , shortening the time to list shares on the stock exchange to 30 days after completing the required documents and removing barriers for foreign investors. This is a strong boost for foreign capital flows, creating favorable conditions for TCBS shares to quickly become the focus of attention of both domestic and international investors . It is expected that in October, TCBS will be listed and traded on HOSE.

|

Decoding the TCBS IPO, it can be seen that this is not only a big milestone for the company itself, but also an event that reflects the strong attraction of the Vietnamese stock market in the context of preparing for upgrading. With a record issuance scale, strong interest from investors, and the prospect of joining VN30, TCBS shares are expected to become a new bright spot in the market right after listing.

Source: https://baodautu.vn/tcbs-chinh-thuc-duoc-cap-ma-chung-khoan-sap-chao-san-vao-thang-10-d394551.html

![[Photo] General Secretary To Lam chairs the meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/fb2a8712315d4213a16322588c57b975)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

Comment (0)