Developed based on product models that have successfully become standards in countries around the world such as Singapore, the US, and China, Techcombank Automatic Profit possesses outstanding features and is more suitable for the Vietnamese market such as: one-day profit, 24/7 flexibility, interest rates up to 4.4% and safety guaranteed by strict security layers including legality, brand reputation, and technology.

Currently, more than 4.1 million customers have activated Techcombank Automatic Profit, daily idle cash flow is optimized with many outstanding added values.

Techcombank Automatic Profit is a pioneering product that optimizes payment accounts and also possesses a multi-layered protection system.

Comply with global standards and regulations of the State Bank

In developed financial markets, people are familiar with the fact that money in payment accounts automatically generates interest through “sweep accounts” products. These models are widely developed not only because they bring optimal benefits to customers but also because they ensure absolute safety thanks to a strict legal framework, such as the deposit insurance regulations of the Federal Deposit Insurance Corporation (FDIC) in the US and national Deposit Guarantee Schemes (DGS) across the EU.

In Vietnam, the Law on Deposit Insurance and Decision 32 clearly stipulate that depositors are entitled to insurance benefits of up to VND 125 million per individual at a credit institution, under the management of the Deposit Insurance of Vietnam (DIV) and the State Bank of Vietnam (SBV). In addition, SBV also requires banks to maintain a minimum capital adequacy ratio (CAR) of 8% and conduct periodic audits to ensure compliance. These regulations not only help protect people's assets but also play an important role in ensuring the safety and stability of the national financial system.

On that solid legal foundation, Techcombank has pioneered the model of paying interest on idle cash flow in customers' payment accounts since 2024, and continuously upgraded with superior versions, called Techcombank Automatic Profit.

The model of paying interest on idle cash flow in customers' payment accounts has been implemented by Techcombank since 2024, before upgrading to Techcombank Automatic Profit.

Affirming prestige and pioneer position

During 32 years of operation, Techcombank has received the trust of customers and recognition from management agencies. The awards that Techcombank has achieved from domestic to international have shown the image of a leading joint stock commercial bank in Vietnam.

For many years, Techcombank has maintained a strong financial foundation, good profit growth, high CASA ratio and effective digitalization strategy. In the second quarter of 2025, Techcombank reached VND 1,000 trillion in total assets, with quarterly pre-tax profit reaching its highest level in history. The current account balance (CASA) ratio exceeded 41%. Net interest margin (NIM) improved to 3.8%, demonstrating operational efficiency and sustainable profitability. The Basel II capital adequacy ratio (CAR) was at 15%, far exceeding the minimum requirement, affirming the bank's good risk tolerance.

In 2024, the bank was honored by Euromoney, FinanceAsia and Global Finance as “Best Bank in Vietnam”, becoming the first Vietnamese bank to win all three awards in the same year. In addition, Techcombank was awarded “Best Transaction Bank in Vietnam” and “Best Cash Management Bank in Vietnam” by The Asian Banker in 2024. Forbes also ranked Techcombank as “No. 1 Bank in Vietnam” in the World's Best Banks 2024 ranking based on customer surveys.

Recently, Techcombank's Automatic Profit product also won 3 Stevie Awards including 1 gold award and 2 bronze awards. Techcombank was also honored within the framework of the 22nd annual International Business Awards organized by Stevie Awards.

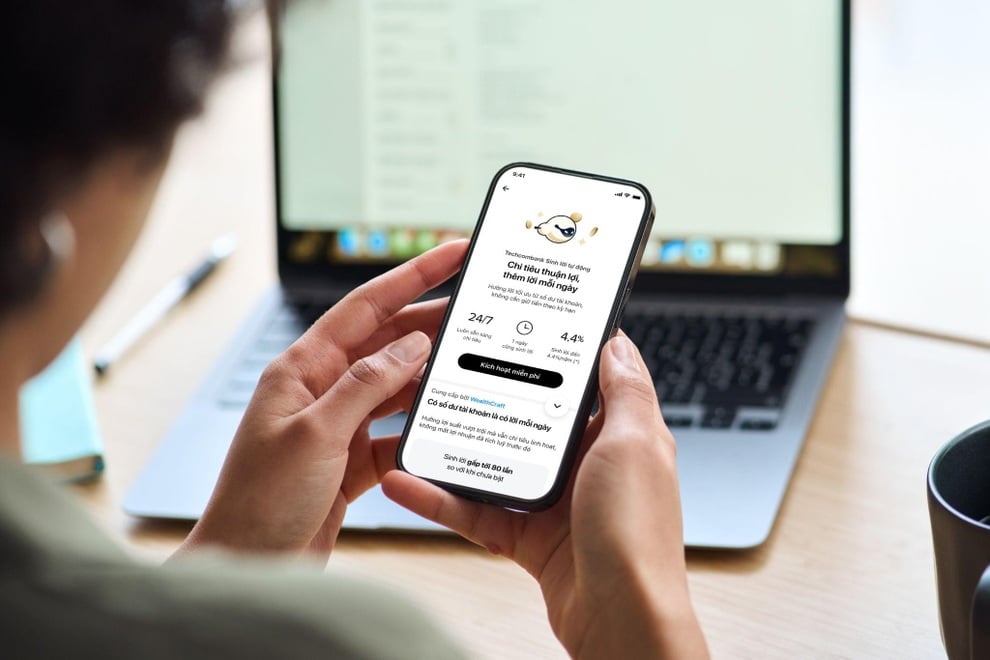

Automatic profit is a prominent financial product of Techcombank in recent times, attracting up to 4.1 million activated customers.

Protective fence with modern technology

Pioneering in applying modern technology, Techcombank has integrated artificial intelligence (AI) into Automatic Profit to create a transparent, secure and efficient operating system.

Mr. Jens Lottner, General Director of Techcombank, emphasized: “For Techcombank Auto Profit to really work, it requires a lot of investment in technology, artificial intelligence and the connection between different products and features. Techcombank has had a long time of strong investment in AI, GenAI, data platforms and especially the comprehensive financial ecosystem model. We will also continuously improve Techcombank Auto Profit according to customer feedback to make the product more and more outstanding."

Techcombank received many domestic and international awards.

Accordingly, technology platforms are used to analyze users' financial behavior, thereby automatically allocating balances to safe investment channels, optimizing profits without user intervention. In addition, digital technology and smart data also help make the user experience seamless, helping TCB achieve a customer satisfaction index (CSAT) of up to 91% in the first quarter of 2025.

At the same time, the Techcombank Mobile application acts as a personal financial control center, allowing customers to track daily profits, check balances and manage accounts anytime, anywhere. Techcombank is committed to always ensuring 24/7 payment ability on the profit balance, money in the Automatic Profit account can still be transferred, paid, withdrawn at any time and customers are still charged interest for the balance maintenance period, even if it is only one day.

With investment in technology and increased customer experience, Techcombank has been continuously recognized by The Asset Triple A Digital Awards as “Best Digital Bank in Vietnam” and “Best Mobile Banking Application in Vietnam” for 3 consecutive years (2023-2025).

In the context of constantly innovating global finance, following Zero Fee, Techcombank Automatic Profit thanks to its pioneering, superior technology and comprehensive protection layers, has affirmed its difference, not only optimizing benefits for customers but also shaping a safe and smart financial future.

Source: https://dantri.com.vn/kinh-doanh/techcombank-sinh-loi-tu-dong-khi-tien-khach-hang-an-toan-sinh-loi-moi-ngay-20250912115435904.htm

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] General Secretary To Lam, Secretary of the Central Military Commission attends the 12th Party Congress of the Army](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/9b63aaa37ddb472ead84e3870a8ae825)

Comment (0)