The gold market saw a notable move this past trading week, sparked by a political event in Washington. The news that President Donald Trump intended to dismiss Fed Governor Lisa Cook immediately impacted gold prices, pushing the precious metal to its highest level in more than two weeks.

This event, while a single development, is a clear demonstration of gold's role as a safe haven asset. Any uncertainty, especially those that could affect the independence of central banks or the stability of the economy , tends to increase the appeal of gold.

A year of two opposite halves

The year 2025 started like a dream for gold investors. From a price of about 2,600 USD/ounce at the beginning of the year, this precious metal had a spectacular breakthrough, continuously breaking records and at one point surpassing the 3,400 USD/ounce mark. The main driving force came from persistent inflation fears and the need to find a safe “haven” for assets.

However, the party seemed to have ended in April. The meteoric rise slowed, and the market entered a period that experts call “sideways.”

“I expect gold to continue to move sideways until a new catalyst emerges,” said Brett Elliott, director of marketing at the American Precious Metals Exchange (APMEX). “Gold has been trading in a range of $3,180 to $3,440 an ounce since April. That range is gradually narrowing and consolidating, but it needs a real push to move into the next phase.”

So where will that “push” come from? The answer that most markets are holding their breath waiting for lies in the upcoming Fed decision on interest rates.

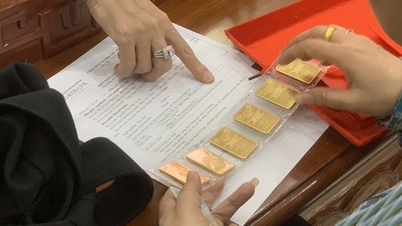

After an impressive start to 2025, which took gold prices from $2,600 to new records above $3,400/ounce, the precious metal has entered a sideways phase over the past few months (Photo: Getty).

The Fed's interest rate roadmap - the game-changer

Gold is a non-interest-bearing asset. This means that when interest rates rise, holding gold becomes less attractive than depositing money in a bank or investing in bonds that pay interest. Conversely, when interest rates fall, the opportunity cost of holding gold also decreases, making the precious metal more attractive to investors.

That’s why all eyes are on the Fed’s September policy meeting. According to CME Group’s FedWatch tool, there is an 87% chance the Fed will cut interest rates by 0.25 percentage points at its September policy meeting.

"The main driver that could push gold prices higher between now and the end of the year is the expectation that the Fed will cut interest rates," said Chris Mancini, portfolio manager at Gabelli Gold Fund.

All eyes are now on Friday's report on the Personal Consumption Expenditures (PCE) Index - the Fed's preferred inflation measure. Economists expect the index to have risen 2.6% in July, unchanged from June. That figure, while still above the Fed's 2% target, is not expected to be hot enough to stop the Fed from taking action.

"I think it would take an extremely high inflation number to cause the Fed to delay a rate cut," commented Jim Wyckoff, senior analyst at Kitco Metals.

If the PCE data comes in as expected or lower, it will further bolster the belief that the Fed will soon ease monetary policy, and that will be the "kick" the gold market has been waiting for.

2 scenarios for the future: $4,000 or $3,200?

With the current variables, experts have outlined two main scenarios for gold prices from now until the end of the year.

Optimistic scenario: Conquering the $4,000/ounce mark

This is the scenario many analysts are aiming for, with the prerequisite that the Fed cuts interest rates as forecast.

“In an optimistic scenario, I think gold could reach around $4,000 an ounce by year-end,” predicts Joshua Barone, a wealth manager at Savvy Wealth, explaining that this scenario combines factors such as falling real interest rates, a looser Fed, a weaker US dollar and increased geopolitical risks.

Notably, JP Morgan Research also forecasts that gold prices will reach $3,675/ounce by the end of 2025 and could reach $4,000/ounce in the second quarter of 2026.

Mr. Barone also made a profound observation, edited for clarity: “Gold does not necessarily need a crisis to increase in value, it just needs real money to become cheaper.” In other words, when interest rates are lower than inflation, the purchasing power of paper money decreases, and investors automatically seek gold as a store of value.

In addition, geopolitical uncertainty remains a trump card. “If there is a new crisis this fall, money could flow back into gold and push prices up,” noted Mr. Elliott of APMEX.

Pessimistic scenario: Return to the $3,200/ounce zone

Of course, nothing is certain. There are still factors that can drag gold prices down.

“In a pessimistic scenario, gold prices could return to around $3,200 an ounce by the end of the year,” Mr. Barone said. This scenario would occur if: inflation proves “stubborn” than expected, forcing the Fed to keep interest rates high longer, the US dollar strengthens and long-term bond yields remain high.

Mr. Mancini also agreed: “If the US economy recovers strongly, the job market is vibrant and inflation cools convincingly, those are factors that can cause gold prices to fall.”

Gold prices in the coming months will depend largely on the Fed interest rate. Gold does not generate interest, so when interest rates rise, it loses its appeal, but when interest rates fall, gold shines again in the eyes of investors (Illustration: Discovery Alert).

Overall, the gold market is in a delicate balance. Prices could break out if the Fed does give the green light for monetary easing, but could also face pressure if economic data paints a too rosy picture.

For investors considering gold, this is a time to carefully consider their goals and strategies. Physical gold such as gold bars and coins are still a solid store of value, but they come with storage costs and are not as liquid as financial instruments.

There are also more accessible forms of gold investment such as stocks of gold mining companies, gold exchange-traded funds (ETFs), or futures contracts. Each form has its own advantages and disadvantages.

Whatever path you choose, diversification is key. Gold has been and will always be an important pillar of any portfolio, but a sensible strategy that doesn’t put all your eggs in one basket is key to successfully navigating the volatile autumn ahead.

Source: https://dantri.com.vn/kinh-doanh/vang-nin-tho-giua-con-song-ngam-lai-suat-va-kich-tinh-tai-fed-20250828231634070.htm

![[Photo] General Secretary To Lam chairs the meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/fb2a8712315d4213a16322588c57b975)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Infographics] Time, location, content of the 1st Congress of An Giang Provincial Party Committee, term 2025 - 2030](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/30/fed466586ad84c3ebea914be993018ca)

Comment (0)